Your Future Property Investments Are Accessible Today

LAT Property Investments providing exciting UK property investment opportunities with investment entry levels of £30,000 upwards

Sourcing Property Opportunities Across England

Investment from £30,000 with 10% returns

Working with Experienced Investment Professionals and Novices

Expert Property Investment Services Across England

Finding profitable property investments shouldn't feel like navigating a minefield. Whether you're taking your first steps into buy-to-let or expanding an established portfolio, we provide the end-to-end support that turns property investment from overwhelming to achievable.

At LAT Property Investments, we combine thorough market analysis with hands-on experience to source, renovate, and manage properties that deliver genuine returns. Our approach focuses on education alongside execution - we don't just find you deals, we ensure you understand exactly why each opportunity makes financial sense for your specific goals.

From identifying below-market-value properties to managing your portfolio's day-to-day operations, we handle the complexities whilst keeping you informed and in control. Our nationwide coverage across England means we're not limited to a single postcode lottery - we go wherever the best opportunities exist for your investment criteria.

Our Property Services

Property Procurement

Targeted Property Acquisition

Deal Sourcing

High-Quality Investment Opportunities

Property Renovation

End-to-End Asset Management

Why Choose LAT Property Investments

Comprehensive Property Investment Services

Property investment success rarely comes from a single transaction—it's built through strategic planning, careful execution, and ongoing management. We've structured our services to support investors at every stage, whether you're purchasing your first buy-to-let or scaling a multi-property portfolio.

Property Deal Sourcing

The foundation of profitable property investment lies in finding the right opportunities before they hit the open market. We maintain relationships with estate agents, developers, and property networks across England, giving us access to below-market-value deals that never appear on Rightmove or Zoopla.

Our sourcing process goes beyond simply finding cheap properties. We analyse rental yield potential, capital growth prospects, and local market dynamics to identify investments that align with your financial goals. Each opportunity we present includes detailed comparables, area analysis, and projected returns—the information you need to make confident decisions rather than emotional ones.

Whether you're targeting high-yield HMOs in Manchester, capital appreciation opportunities in Birmingham, or stable buy-to-let investments in the Midlands, we source deals that match your criteria rather than trying to convince you that whatever's available suits your needs.

Property Refurbishment and Renovation Management

A property's purchase price is only part of the equation. The difference between mediocre and exceptional returns often comes down to how effectively you improve and position the asset. Our refurbishment service transforms tired properties into desirable homes that command premium rents and attract quality tenants.

We handle everything from initial contractor quotations through to final inspections, managing tradespeople who understand investment timelines and budget constraints. Our experience means we know which improvements deliver genuine rental value and which are simply expensive cosmetic touches that don't impact your bottom line.

For HMO conversions, we navigate the planning permissions, building regulations, and licensing requirements that can overwhelm investors attempting their first multi-let property. We've managed enough conversions to know where councils raise objections and how to structure applications for approval.

The goal isn't creating show homes - it's creating properties that achieve strong rental yields whilst requiring minimal ongoing maintenance. That balance comes from years of understanding what tenants actually value versus what property programmes on television suggest they want.

Portfolio Management Services

Finding and improving properties is the exciting part. Managing them day-to-day is where many investors lose enthusiasm and, consequently, profitability. Our portfolio management service handles the operational details that determine whether your investment generates consistent income or constant headaches.

Tenant sourcing and vetting sits at the heart of successful lettings. We don't simply accept the first applicant who can afford the rent - we conduct thorough referencing, verify employment and income, and assess whether prospective tenants will respect the property. The few extra days finding the right tenant saves months of potential issues later.

Once tenants are in place, we manage everything from routine maintenance requests to deposit negotiations at tenancy end. We handle compliance requirements including gas safety certificates, electrical inspections, and Energy Performance Certificates, ensuring you meet legal obligations without having to track renewal dates yourself.

For investors building portfolios, we provide regular financial reporting that goes beyond basic rent collection statements. You'll understand exactly how each property performs, where costs are trending, and which assets might benefit from refinancing or strategic improvements.

Investment Strategy Consultation

Every investor's circumstances differ—available capital, risk tolerance, time commitment, and return expectations all influence which strategies make sense. We don't push a single investment approach because we recognise that what works brilliantly for a cash-rich, time-poor professional won't suit someone looking to build wealth through sweat equity.

Our consultation process begins by understanding your current position and investment objectives. Are you seeking immediate cash flow to replace employment income? Building long-term wealth through capital appreciation? Creating a pension alternative? The strategy that serves each goal differs significantly.

We'll walk you through the realistic returns, capital requirements, and time commitments associated with different approaches - from traditional buy-to-let through to more sophisticated strategies like serviced accommodation or commercial property investment. This isn't about overwhelming you with options; it's about identifying the two or three strategies that genuinely align with your situation.

For international investors, we address the specific considerations around UK property ownership, including financing options for non-residents, tax implications, and the practical realities of managing UK assets from overseas. We've worked with investors from across Europe, Asia, and the Middle East who value having a UK-based partner managing their interests.

Investor Education and Training

The property investment industry contains enough misinformation and oversimplified strategies to fill several libraries. We've watched countless investors make expensive mistakes because they relied on free YouTube content or attended high-pressure seminars selling unrealistic expectations.

Our educational approach focuses on practical knowledge rather than motivational content. We explain how mortgage products actually work, what void periods realistically cost, and why some "high-yield" opportunities carry risks that outweigh their returns. Understanding these realities prevents costly errors and builds genuine confidence.

For investors wanting to become more hands-on, we offer guidance on topics like refurbishment project management, dealing with difficult tenants, and understanding when to hold versus when to sell. The goal isn't creating dependency—it's ensuring you can make informed decisions whether we're involved or not.

We also provide ongoing market insights and strategy updates as economic conditions, lending criteria, and tax legislation evolve. Property investment isn't a set-and-forget activity, and staying informed about regulatory changes or emerging opportunities protects your portfolio's performance.

Property Investment Strategies for Every Goal

Property investment isn't a one-size-fits-all endeavour. The strategy that delivers exceptional returns for one investor might prove completely unsuitable for another, depending on available capital, risk appetite, and how hands-on you want to be. We work across the full spectrum of investment approaches, matching strategies to investor circumstances rather than forcing square pegs into round holes.

Buy-to-Let Investment

Traditional buy-to-let remains the foundation of most UK property portfolios for good reason - it's straightforward, relatively low-risk, and generates predictable monthly income. You purchase a property, let it to a single household, and collect rent that covers your mortgage whilst building equity through capital appreciation.

The simplicity appeals to first-time investors who want to understand exactly what they're getting into before exploring more complex strategies. Recent tax changes and stricter lending criteria have made buy-to-let less attractive than a decade ago, but it still delivers solid returns when you purchase well and avoid overpaying in competitive markets.

We focus on areas where rental demand remains strong - university cities, commuter towns with good transport links, and regional centres with diverse employment sectors. The properties we source typically appeal to young professionals or small families, tenant demographics that tend to stay longer and treat properties respectably.

Success in buy-to-let comes down to two factors: purchasing at the right price and selecting properties that require minimal management. A slightly lower initial yield on a property that attracts stable tenants often outperforms a higher yield that comes with constant maintenance issues and tenant turnover.

HMO (House in Multiple Occupation) Investment

HMOs—properties rented to three or more tenants forming separate households - consistently deliver the highest rental yields of any residential strategy. By converting a single dwelling into multiple lettable rooms, you multiply the income stream whilst the mortgage remains based on the original property's value.

A three-bedroom house generating £800 monthly as a standard let might produce £1,400-£1,800 as an HMO, depending on the local market. That difference transforms marginal investments into highly profitable ones, which explains why experienced investors often transition from buy-to-let into HMOs as they gain confidence.

The trade-off comes in increased management complexity and stricter regulatory requirements. Most HMOs require licensing from the local council, and you'll need to meet specific standards around fire safety, room sizes, and kitchen facilities. Tenant turnover runs higher than single-let properties - students move annually, young professionals relocate for work - meaning more frequent void periods and re-letting costs.

We handle HMO conversions from planning through to first tenancies, ensuring properties meet all regulatory requirements whilst maximising lettable space. Our refurbishment teams understand exactly what councils inspect and how to create layouts that satisfy regulations without unnecessary expenditure. For investors wanting HMO returns without the hands-on management, our portfolio management service handles the day-to-day tenant coordination that makes this strategy genuinely passive.

Serviced Accommodation

Serviced accommodation sits somewhere between traditional lettings and hotel operations - you furnish properties to high standards and let them on short-term bases through platforms like Booking.com or Airbnb. Returns can significantly exceed long-term lets, particularly in tourist destinations or business travel hubs, with some investors achieving 15-20% annual yields.

The strategy demands more active management than buy-to-let. You're handling guest communications, coordinating cleaning between bookings, maintaining inventory, and ensuring the property remains competitively positioned against local alternatives. Occupancy rates fluctuate seasonally, and you'll need sufficient capital reserves to cover quieter periods.

Local planning restrictions increasingly limit serviced accommodation, with some councils requiring specific permission for short-term letting. We stay current with regional regulations and can advise whether your target area welcomes or restricts this approach. The locations where serviced accommodation thrives: city centres, coastal areas, near major attractions - often carry premium purchase prices, so the strategy typically suits investors with larger capital deposits.

When circumstances align, serviced accommodation delivers exceptional returns and builds valuable business skills in hospitality and marketing. It's not a passive investment, but for investors willing to stay involved, the financial rewards justify the additional effort.

Rent-to-Rent Strategies

Rent-to-rent offers a route into property investment without purchasing properties at all. You lease properties from landlords on standard Assured Shorthold Tenancies, then sublet them - typically as HMOs or serviced accommodation, at higher rates. The profit comes from the difference between what you pay the landlord and what you collect from your tenants.

This strategy appeals to investors with limited capital since you're not covering deposits and stamp duty associated with purchases. The flip side is you're building someone else's equity rather than your own, and you remain vulnerable to the head landlord deciding not to renew your lease when it expires.

Rent-to-rent works best when you can genuinely add value - converting an under-utilised property into an HMO or serviced accommodation that achieves returns the owner couldn't manage themselves. Simply taking a standard property and subletting it marginally higher rarely generates meaningful profit once you account for management time and void risks.

We assist investors structuring compliant rent-to-rent agreements, ensuring both parties understand obligations and returns. Many landlords welcome professional rent-to-rent operators who guarantee income and maintain their properties, but the arrangement requires transparency and trust that only comes through proper documentation and realistic projections.

Commercial Property Investment

Commercial property - retail units, offices, industrial units, and mixed-use buildings - operates quite differently from residential investment. Leases typically run 5-10 years rather than six or twelve months, tenants handle most maintenance and repair costs, and rental agreements offer more flexibility around rent reviews and lease terms.

The longer lease periods provide income stability that residential landlords rarely achieve. A well-tenanted commercial property can run for years requiring minimal landlord involvement beyond annual rent collection. That passive nature appeals to investors who want property exposure without management burden.

Commercial investment carries different risks. Economic downturns hit business tenants harder than residential occupiers - shops close, offices downsize, and void periods can extend many months. Financing commercial property also proves more complex, with lenders requiring larger deposits and offering less competitive interest rates than residential mortgages.

For investors with £100,000+ deposits willing to research local commercial markets, the strategy offers diversification away from residential property's increasingly complex regulatory landscape. We source commercial opportunities in areas with strong business fundamentals—retail units on established high streets, office space near transport hubs, industrial units in growing logistics corridors.

Social Housing and LHA Properties

Local Housing Allowance properties - homes let to tenants whose rent is partially or fully covered by housing benefit - offer remarkably stable income streams. Government-backed rent arrives reliably regardless of economic conditions, and void periods tend to be minimal given the shortage of quality properties accepting benefit claimants.

The strategy faces unjustified stigma, with many investors assuming benefit tenants automatically cause problems. Our experience contradicts this - tenants receiving housing support often prove more stable and appreciative of well-maintained properties than market-rate renters who view landlords as adversaries.

Success with LHA investment requires purchasing properties that meet council standards and understanding which areas offer the best balance between allowance rates and property prices. Some regions provide generous housing allowance that makes this strategy extremely profitable; others offer rates so low that financial viability becomes marginal.

We work with investors targeting stable, government-supported income who want to avoid the volatility that comes with market-rate residential lettings. The approach particularly suits risk-averse investors or those approaching retirement who prioritise income reliability over maximum yields.

Property Lease Options

Lease options represent an advanced strategy where you secure the right to purchase a property at a predetermined price within a specific timeframe, whilst controlling the property immediately. You can live in it, let it, refurbish it, or even sell your option to another buyer - all without actually owning the property until you exercise your option.

This creates possibilities for capital-light investing and creative deal structures, particularly with distressed sellers or landlords tired of managing their properties. The strategy requires sophisticated negotiation skills and thorough legal documentation to protect all parties.

Lease options aren't suitable for most investors starting out - the structures are complex, finding willing sellers takes persistence, and financing can prove challenging since traditional lenders don't recognise options as owned assets. For experienced investors who understand the mechanics and legal requirements, options unlock opportunities that conventional purchases couldn't achieve.

We occasionally use lease option structures when sourcing deals for sophisticated investors, though we're selective about circumstances. The strategy works best when everyone benefits clearly - a seller who wants to delay tax implications, a buyer who needs time to arrange financing, or a situation where the property requires substantial work before it becomes mortgageable.

The LAT Property Investments Difference

The UK property investment market contains no shortage of companies promising exceptional returns and hassle-free wealth building. We've watched investors lose substantial capital following advice from operators who prioritised their own commission over client outcomes, which is why we've structured our approach differently from the outset.

End-to-End Service Integration

Most property investment companies specialise in one narrow area - they either source deals, or manage properties, or handle refurbishments, but rarely all three cohesively. This fragmented approach leaves investors coordinating between multiple providers, each blaming the others when issues arise.

We deliberately built our service to cover the complete investment journey because we've experienced firsthand how disconnected services create problems. When the company sourcing your deal doesn't understand refurbishment costs, they'll recommend properties that look attractive on paper but become financial sinkholes once you start renovation work. When your property manager wasn't involved in the initial purchase decision, they inherit assets they'd never have recommended acquiring.

Our integrated approach means the same team assessing whether a property makes financial sense will later manage its refurbishment and ongoing lettings. This accountability eliminates the finger-pointing that happens when things go wrong and ensures every decision considers long-term management implications rather than just initial purchase appeal.

If we wouldn't invest our own money in an opportunity, we won't recommend you invest yours. That simple principle guides every deal we present and every strategy we suggest.

Transparent, Education-First Philosophy

Property investment education in the UK often comes wrapped in high-pressure sales environments - weekend seminars where motivational speakers promise six-figure incomes if you'll just sign up for their £10,000 mentorship programme. We find this approach both ethically questionable and practically counterproductive.

Informed investors make better decisions, ask smarter questions, and build more successful portfolios than those who blindly follow someone else's system. We'd rather spend time explaining why a particular deal works and what risks it carries than pressure you into purchasing before you've had chance to consider properly.

This means sometimes talking investors out of strategies that don't suit their circumstances, even when those strategies might generate higher fees for us. We've genuinely advised clients that their first property purchase should be a straightforward buy-to-let rather than the HMO they'd set their heart on, simply because we recognised they weren't ready for the additional complexity.

Our consultation process includes detailed financial projections showing realistic scenarios - not just best-case returns where everything goes perfectly, but what happens if void periods run longer, refurbishment costs exceed estimates, or rental demand softens. Understanding downside risks matters as much as appreciating upside potential.

You'll never feel pressured to move faster than feels comfortable, and we're happy to walk through the same calculations multiple times until you're genuinely confident in your decision. Property investment involves too much capital and too many long-term implications to rush.

Nationwide Market Access

Operating across England rather than concentrating on a single region fundamentally changes how we source opportunities. We're not limited to whatever happens to be available in one postcode area, hoping it somehow aligns with your investment criteria.

Different UK markets offer different advantages depending on your strategy. Student cities like Nottingham, Sheffield, and Leicester deliver strong HMO returns. Commuter towns surrounding major employment centres provide stable buy-to-let income. Regional cities undergoing regeneration offer capital growth potential. Rather than trying to convince you that our local patch suits every investment approach, we match locations to strategies.

This geographic flexibility proves particularly valuable for international investors who aren't emotionally attached to specific UK regions. When your priority is financial returns rather than proximity to family or nostalgic connections to certain cities, selecting purely on investment fundamentals becomes straightforward.

We maintain relationships with estate agents, property networks, and developers across multiple regions, giving us visibility of off-market opportunities that never appear on property portals. These connections take years to develop and provide genuine competitive advantage - you're not competing with every investor refreshing Rightmove hoping for a bargain.

Our nationwide approach also allows portfolio diversification across different markets and economic bases. Concentrating all your properties in one city exposes you completely to that area's economic fortunes. Spreading investments across multiple regions provides natural resilience if one market softens whilst others remain strong.

Realistic Expectations and Honest Communication

We've never promised anyone they'll become a property millionaire within twelve months, and we're immediately suspicious of any operator making such claims. Property investment builds wealth reliably over years and decades, not overnight.

Our projections are based on what we've actually achieved with existing properties, not theoretical calculations that assume perfect conditions. When we quote rental yields, they factor in void periods, maintenance costs, and letting fees rather than presenting gross rental income as if it all reaches your bank account untouched.

This realism might make our initial proposals appear less exciting than competitors promising extraordinary returns, but we'd rather under-promise and over-deliver than set expectations we can't meet. Investors who understand genuine, achievable returns tend to remain satisfied and continue growing their portfolios. Those sold unrealistic dreams become disillusioned quickly.

We'll tell you when a property you've found doesn't make financial sense, even if you've fallen in love with it. We'll explain when market conditions suggest waiting rather than rushing into purchases. And we'll be honest when strategies you're considering don't align with your stated goals or available capital.

This directness might occasionally feel blunt, but it comes from genuine concern for your financial outcomes rather than prioritising short-term fee generation. Property investment carries enough legitimate risks without adding avoidable mistakes caused by poor advice or misaligned strategies.

Experience Across Multiple Market Cycles

Property investment looks straightforward during periods of rising prices and strong rental demand - almost any purchase generates positive returns when the market lifts all boats. Our team's experience spans various economic conditions, including periods when property markets softened, lending criteria tightened, and rental yields compressed.

This experience through different cycles informs how we assess opportunities and structure investments. We've seen which property types and locations demonstrate resilience during downturns, and which previously "hot" markets collapsed when economic conditions changed. Understanding these patterns helps identify genuinely sound investments versus those only succeeding due to temporarily favourable conditions.

We've also navigated multiple changes to property investment taxation and regulation - from wear-and-tear allowance removal through to stricter HMO licensing requirements. Regulatory changes often catch investors by surprise, but we monitor legislative developments and adapt strategies proactively rather than reactively scrambling when new rules take effect.

This institutional knowledge proves particularly valuable when markets feel uncertain. Anyone can source deals during boom periods; maintaining profitability through various conditions requires experience and adaptability that only comes from years operating in this sector.

Support for International Investors

UK property investment attracts substantial international interest, particularly from European, Middle Eastern, and Asian investors seeking stable markets and strong tenant demand. However, investing remotely carries unique challenges around financing, tax implications, and practical property management.

We work extensively with international investors who value having UK-based partners managing their interests. The time zone differences, language considerations, and unfamiliarity with UK systems that deter many property companies don't concern us - we've structured our processes specifically to accommodate remote investors.

Financing UK property as a non-resident involves different lending criteria and typically requires larger deposits than UK residents face. We maintain relationships with specialist lenders who understand international investor circumstances and can provide mortgage products when high-street banks decline applications.

Tax implications for international property ownership vary dramatically depending on your country of residence and whether bilateral tax treaties exist between your nation and the UK. Whilst we're not tax advisors ourselves, we work alongside accountants and solicitors who specialise in international property taxation, ensuring you understand your obligations before committing capital.

The practical realities of managing UK properties from overseas - dealing with tenant emergencies at unsociable hours, coordinating maintenance from thousands of miles away, ensuring compliance with regulations you might not fully understand - make having reliable UK partners essential. Our management service provides this peace of mind, handling day-to-day operations whilst keeping you informed about significant decisions or issues requiring your attention.

Property Investors We Work With

We support investors at various stages of their property journey, from complete beginners evaluating whether property investment suits them through to experienced portfolio holders seeking additional opportunities or management support. Whilst each investor's circumstances differ, certain profiles represent our typical clients.

First-Time Property Investors

Taking your first steps into property investment feels significantly more daunting than buying your own home. You're making decisions based on financial projections rather than emotional preferences, analysing rental yields and capital growth potential instead of choosing kitchen colours you personally like.

First-time investors typically arrive with substantial research already completed - you've read books, watched online content, perhaps attended introductory seminars - but theory only takes you so far. The gap between understanding property investment conceptually and actually committing £30,000-£50,000 to your first purchase feels enormous.

We work with first-time investors by translating theoretical knowledge into practical decisions. What looks excellent on paper sometimes reveals problems during property viewings. Rental yield calculations depend on accurate cost assumptions, and inexperienced investors often underestimate refurbishment expenses or ongoing maintenance requirements.

Our approach focuses on straightforward, lower-risk strategies for your first investment - typically traditional buy-to-let properties in areas with strong rental demand and stable tenant demographics. Building confidence through a successful first investment matters more than maximising initial returns. Once you've experienced the complete cycle from purchase through tenancy to steady rental income, you'll feel genuinely prepared to explore more sophisticated strategies.

We encourage first-time investors to ask every question, however basic it might seem. Property investment contains plenty of industry jargon and assumed knowledge that confuses newcomers but which professionals forget isn't universally understood. No question is too simple, and we'd rather spend time ensuring you truly understand each element than rush you toward decisions you're not entirely comfortable making.

Portfolio-Building Investors

Once you've successfully completed your first property investment and experienced how the process actually works, the natural next step involves expanding your portfolio. You're no longer learning fundamentals - you understand mortgage products, know what rental yields look like in practice, and recognise which property features tenants actually value.

Portfolio-building investors typically seek efficiency and systems that allow scaling without proportionally increasing time commitment. Managing one property remains relatively straightforward; managing five or ten requires proper processes for tracking finances, coordinating maintenance across multiple properties, and ensuring compliance documentation stays current.

We support portfolio growth by identifying opportunities that complement your existing holdings rather than simply adding more of the same. Diversification across property types, locations, and strategies provides resilience - if student HMO markets soften, your buy-to-let properties in commuter towns continue performing steadily.

Our portfolio management service becomes particularly valuable at this stage. Investors successfully managing one or two properties often struggle once portfolios expand to five or more. The time demands multiply, tenant issues can arise simultaneously across different properties, and maintaining consistent standards becomes challenging.

For investors specifically focused on building substantial portfolios - ten, twenty, or more properties, we help structure purchasing strategies that maximise mortgage capacity whilst managing risk exposure. Lender appetite for financing additional properties varies considerably, and approaching this strategically matters more than simply applying randomly hoping for approval.

Cash-Rich, Time-Poor Professionals

Many successful professionals recognise property investment's wealth-building potential but lack time to actively manage the process. You're working demanding roles, travelling frequently, or running businesses that consume your attention - researching property markets, viewing potential investments, and coordinating refurbishments simply isn't feasible.

This profile often includes medical consultants, senior corporate executives, business owners, and international professionals who want property exposure without it becoming another project requiring their direct involvement. The capital exists, the understanding of investment fundamentals is solid, but time represents the limiting constraint.

We provide completely managed property investment for time-poor investors. You'll remain informed and approve major decisions, but the day-to-day execution happens without requiring your constant attention. We source opportunities matching your criteria, conduct viewings and due diligence, coordinate refurbishments, arrange tenancies, and manage ongoing operations.

This full-service approach costs more than doing everything yourself, but for professionals whose time generates substantial income elsewhere, the mathematics makes perfect sense. Spending your weekends viewing properties and meeting contractors doesn't represent optimal use of time when you could be focusing on your primary career or business.

The key requirement for this arrangement working successfully is trust, which only develops through transparent communication and consistent delivery. We provide regular updates on portfolio performance, flag issues requiring your attention promptly, and explain the reasoning behind recommendations rather than just presenting conclusions.

International and Expat Investors

UK property investment appeals strongly to international investors seeking stable markets, robust tenant demand, and transparent legal frameworks. Whether you're based in Dubai, Singapore, Germany, or elsewhere, UK property offers advantages that many domestic markets don't provide.

International investors face specific challenges that UK-based investors never encounter. Securing mortgage financing as a non-resident requires working with specialist lenders who understand your circumstances. Tax implications vary dramatically depending on your country of residence and whether tax treaties exist between your nation and the UK. Managing properties remotely - dealing with tenant issues, coordinating maintenance, ensuring regulatory compliance - proves difficult without reliable UK-based partners.

We work extensively with international investors, providing the local presence and market knowledge you need whilst keeping you fully informed about your investments. Our communication accommodates different time zones, and we're comfortable working via video calls, email, and messaging platforms that suit international coordination.

For investors purchasing UK property whilst living abroad, we guide you through the complete process including connecting you with solicitors experienced in international transactions, mortgage brokers specialising in non-resident financing, and accountants who understand cross-border tax implications.

The practical reality is that successful international property investment requires delegating operational control to trustworthy UK partners. You can't handle a boiler breakdown at 10pm from a different continent, nor can you easily coordinate contractor quotes or conduct property inspections remotely. Our management service provides this essential local presence, handling day-to-day operations whilst consulting you on significant decisions.

Investors Seeking Passive Income

Some investors approach property primarily as an income-generation strategy rather than capital growth opportunity. You might be approaching retirement and want assets producing reliable monthly income, or you're building alternative income streams to reduce dependence on employment.

Passive income investors prioritise stability and predictability over maximum yields. A property generating 6% annual return with minimal management requirements often serves you better than an 8% yield that demands constant attention and carries higher void risks.

We structure portfolios specifically for passive income objectives, focusing on property types and tenant demographics that deliver consistent returns. This typically means avoiding strategies like serviced accommodation or rent-to-rent that require active involvement, instead concentrating on traditional buy-to-let or social housing properties with longer tenancy periods.

Our portfolio management service aligns particularly well with passive income goals - you receive monthly rental income without handling tenant communications, maintenance coordination, or compliance administration. The investment genuinely becomes passive rather than theoretically passive but practically demanding significant ongoing attention.

For investors approaching retirement, we also consider how property holdings integrate with pension planning and estate considerations. Property investment offers advantages over traditional pension schemes in certain circumstances, but the structures and timing matter considerably. We work alongside financial advisors and tax specialists to ensure your property strategy complements broader financial planning rather than creating complications.

Investors Requiring Specialist Strategies

Occasionally we work with investors pursuing specific outcomes that demand tailored approaches. This might include investors with unusual capital situations - perhaps substantial equity in existing properties but limited cash for deposits - who need creative structuring using refinancing or joint ventures.

Other specialist situations include investors targeting specific tenant demographics for personal or ethical reasons, such as providing quality housing for families receiving housing benefit, or investors with particular geographic requirements due to existing local knowledge or family connections to certain areas.

We're comfortable working with unconventional circumstances when the fundamentals make sense. Property investment allows considerable flexibility in structuring arrangements, and solutions exist for most situations if you're willing to explore options beyond standard approaches.

The key distinction here is between genuinely specialist requirements and simply wanting to overcomplicate matters unnecessarily. Some investors believe they need exotic strategies when straightforward approaches would serve them better. We'll be honest about whether your specialist requirements genuinely add value or whether they're creating unnecessary complexity.

Nationwide Property Investment Across England

Operating across England rather than limiting ourselves to a single region fundamentally changes the opportunities we can offer. We're not constrained by hoping suitable properties happen to become available in one specific postcode area—we go wherever the strongest investment fundamentals exist for your particular strategy and budget.

Strategic Market Selection

Different UK property markets serve different investment objectives. University cities deliver consistent rental demand but face seasonal void periods when students move home during summer. Commuter towns surrounding major employment centres provide stable, year-round tenancies but typically offer lower gross yields. Regional cities undergoing regeneration present capital growth potential alongside current income generation.

Rather than claiming every location suits every strategy, we match markets to investor goals. If you're prioritising immediate cash flow, we'll focus on areas where rental yields justify the investment even without significant capital appreciation. For investors with longer time horizons who can absorb lower initial yields, we identify locations where substantial infrastructure investment or economic development suggests strong future price growth.

This geographic flexibility proves particularly valuable when market conditions shift. Property investment operates in cycles—areas that delivered exceptional returns during one period sometimes soften whilst previously overlooked locations strengthen. Having nationwide coverage means we can adapt recommendations to current conditions rather than perpetually promoting the same markets regardless of changing fundamentals.

Core Investment Regions

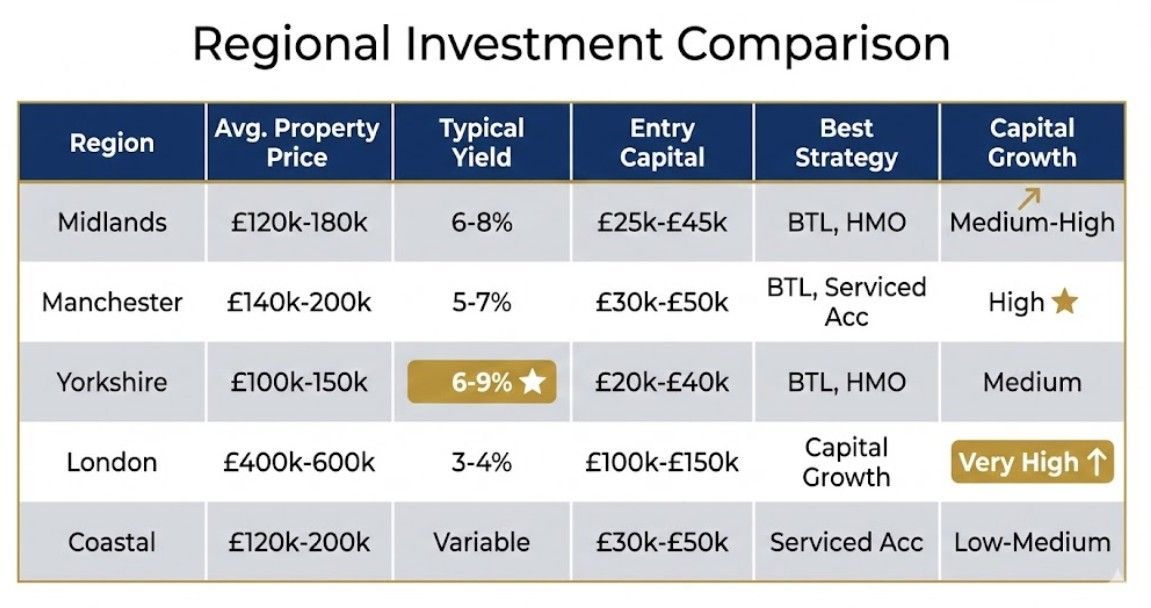

Whilst we operate across England, certain regions consistently deliver strong investment opportunities across multiple strategies. The Midlands - encompassing cities like Nottingham, Derby, Leicester, Birmingham, and Coventry - offers perhaps the best balance of affordable property prices, strong rental yields, and improving infrastructure that we've found anywhere in England.

These cities benefit from their central UK location, making them accessible to businesses seeking logistics or distribution centres. They've received substantial transport investment, with HS2 developments improving connectivity to London and other major cities. Employment sectors have diversified beyond traditional manufacturing into technology, financial services, and professional sectors, creating stable tenant demographics.

Property prices in Midlands cities remain considerably below London and the South East, meaning capital requirements for investors stay manageable whilst rental yields often exceed 6-7% for standard buy-to-let properties. HMO conversions in the right areas can achieve 10-12% yields, and the student populations in cities like Nottingham and Leicester provide consistent demand for quality multi-let properties.

Manchester and the wider North West represent another core focus area. The city has undergone remarkable transformation over recent decades, attracting major employers, substantial residential development, and infrastructure investment. Media City, the Northern Quarter's tech sector, and ongoing city centre regeneration create diverse employment that supports strong rental demand.

Manchester's property market offers interesting dynamics - city centre apartments appeal to young professionals and provide strong serviced accommodation potential, whilst suburban areas and surrounding towns like Salford, Stockport, and Bolton deliver traditional buy-to-let opportunities at lower price points. The variety within relatively compact geography allows portfolio diversification without spreading investments across distant regions.

Regional City Opportunities

Beyond our core Midlands and North West focus, we identify opportunities in regional cities demonstrating strong investment fundamentals. Sheffield benefits from its two universities and affordable property prices, though recent oversupply of student accommodation requires careful market analysis. Leeds combines strong professional employment sectors with diverse residential areas suitable for various investment strategies.

Cities in the East Midlands and Yorkshire often fly under the radar of investors focusing exclusively on London or Manchester, yet they frequently offer superior yields and lower competition for quality properties. The key lies in understanding which specific areas within these cities attract stable tenants versus which neighborhoods face declining demand or oversupply issues.

Coastal locations occasionally present compelling opportunities, particularly for serviced accommodation strategies. Towns like Scarborough, Whitby, or areas of the South Coast see strong tourist demand during peak seasons. However, these markets require sophisticated understanding of occupancy patterns and off-season income generation to ensure annual returns justify the investment.

We approach coastal and tourist-dependent markets more cautiously than employment-driven cities. Economic downturns hit discretionary tourism spending quickly, and regulatory changes increasingly restrict short-term letting in some areas. When circumstances align - strong year-round appeal, limited planning restrictions, properties at sensible prices - coastal investments can deliver exceptional returns. More often, employment-centred cities provide better risk-adjusted outcomes.

London and the South East

London property investment operates quite differently from regional markets, with substantially higher purchase prices creating different financial dynamics. A property requiring £400,000-£500,000 in London might generate similar rental income to a £150,000 property in Nottingham, meaning yields often sit in the 3-4% range compared to 6-8% regionally.

The London investment case rests primarily on capital appreciation rather than immediate income generation. Historically, London property values have grown consistently over long periods, and the city's position as a global financial centre suggests this will likely continue. For investors with substantial capital who can accept lower current yields in exchange for potential long-term value growth, London makes sense.

However, most investors we work with prioritise cash flow and income generation over speculative capital growth. Regional markets deliver this more reliably and with significantly lower capital barriers to entry. You can build a three-property portfolio in the Midlands for less than a single London investment, providing both diversification and superior income from day one.

We occasionally source London opportunities for specific clients - typically high-net-worth investors or international buyers for whom London represents their primary UK connection. But for investors focused on building income-generating portfolios, regional markets offer substantially better fundamentals.

The South East beyond London - areas like Reading, Guildford, or Cambridge - suffers from similar dynamics. Property prices reflect proximity to London and Southern employment centres, but rental demand, whilst strong, doesn't justify the premium purchase prices from a pure yield perspective. These markets work for capital growth strategies or investors specifically wanting Southern locations, but they rarely represent our primary recommendations.

Market Research and Local Intelligence

Operating nationwide requires maintaining current knowledge about multiple property markets simultaneously. We don't rely on generalised assumptions about regions - we track actual rental demand, monitor new housing development that might create oversupply, follow employment sector changes that affect tenant demographics, and maintain relationships with local letting agents who understand their markets intimately.

This research infrastructure means our market recommendations reflect current conditions rather than outdated perceptions. Cities that offered excellent opportunities five years ago sometimes face changed circumstances - oversupply of certain property types, declining employment sectors, or regulatory changes that affect investment viability. Equally, previously overlooked areas can emerge as strong markets due to infrastructure improvements or economic development.

We conduct detailed area analysis before recommending any specific location, examining factors like transport links, school quality ratings, crime statistics, planned developments, and historical rental void rates. Two neighborhoods within the same city can demonstrate dramatically different investment fundamentals, and identifying these distinctions prevents costly mistakes.

For investors unfamiliar with UK geography, we provide context about regions we recommend - typical journey times to major cities, the character of different areas, and which tenant demographics each location attracts. Understanding not just the financial projections but the actual lived experience of areas helps investors feel confident about markets they've never personally visited.

International Investor Considerations

International investors often approach UK geography differently from domestic buyers. You're not constrained by proximity to family, work locations, or emotional connections to specific regions. This freedom allows purely financial decision-making based on which markets offer optimal returns for your investment criteria.

We work with international investors to identify markets providing the best combination of yield, capital growth potential, and practical management considerations. Some regions offer marginally higher returns but prove more challenging to manage remotely due to tenant demographics or property types requiring frequent attention. Balancing maximum returns with practical operational realities matters when you're managing from overseas.

For investors planning occasional UK visits, we can factor accessibility into location selection - properties within reasonable distance of major airports or transport hubs allow easier inspection visits. However, with comprehensive management services in place, many international investors never physically visit their UK properties, relying on our regular updates and professional oversight.

Different nationalities often show preferences for specific UK regions based on existing diaspora communities, previous experience, or simply name recognition of certain cities. We're happy to accommodate these preferences whilst ensuring investment fundamentals remain sound. Emotional comfort with locations matters, particularly for first-time international property investors, even when purely financial analysis might suggest different markets.

Our Property Investment Process

Property investment involves substantial capital and long-term commitment, which is why we've developed a structured process that ensures you understand exactly what you're investing in before making decisions. Rushed choices based on incomplete information create most of the problems investors face - we'd rather move methodically and get everything right than pressure you into premature commitments.

Initial Consultation and Goal Setting

Every successful investment strategy begins with understanding your specific circumstances, objectives, and constraints. We start with a comprehensive consultation that explores several key areas: your available capital for deposits and reserves, your income level and mortgage capacity, your risk tolerance, and critically, what you're actually trying to achieve through property investment.

These objectives vary considerably between investors. Some prioritise immediate monthly income to supplement or replace employment earnings. Others focus on long-term wealth building and accept lower current yields in exchange for capital appreciation potential. Many investors want portfolio growth - acquiring multiple properties over several years to create substantial assets. International investors might seek secure UK assets for wealth preservation alongside income generation.

Your time availability matters enormously when selecting appropriate strategies. Investors with demanding careers or business commitments need genuinely passive approaches, whilst those with flexible schedules might embrace more hands-on strategies that deliver higher returns in exchange for active involvement. There's no point recommending rent-to-rent or serviced accommodation if you travel constantly for work and can't respond to operational issues.

We'll discuss your existing financial position including any current property holdings, pension arrangements, and other investments. Property investment shouldn't exist in isolation - it needs to complement your broader financial picture rather than creating complications. For instance, investors approaching retirement might prioritise different strategies than those in their thirties building long-term wealth.

This initial consultation typically takes 60-90 minutes and can happen via video call for international or distant investors. We're not trying to sell you anything during this conversation - we're gathering information that allows us to provide genuinely relevant recommendations rather than generic advice that might not suit your circumstances at all.

Strategy Development and Market Analysis

Following our initial consultation, we develop a tailored investment strategy document that outlines recommended approaches based on your specific situation. This isn't a generic template - it's detailed analysis showing which property types, investment strategies, and geographic markets align with your goals and constraints.

The strategy document includes realistic financial projections showing expected returns under various scenarios. We model best-case outcomes where everything proceeds smoothly, but more importantly, we show what happens if void periods extend longer than average, if refurbishment costs overrun estimates, or if rental demand softens. Understanding downside scenarios prevents nasty surprises and ensures you're genuinely comfortable with the risks involved.

We identify specific markets and property types that suit your strategy, explaining the reasoning behind each recommendation. Why does Nottingham make more sense than Leeds for your circumstances? Why are we suggesting a three-bedroom semi-detached house rather than a two-bedroom apartment? These decisions involve multiple factors - current market conditions, tenant demand patterns, capital requirements, management complexity - and we explain our thinking transparently.

For investors pursuing multiple strategies or building portfolios, we provide a phased implementation plan. Perhaps you start with a straightforward buy-to-let to gain experience, then add an HMO once you understand property management realities, followed by exploring serviced accommodation or commercial property as your portfolio matures. This progression builds skills and confidence gradually rather than overwhelming you with complexity immediately.

The strategy document also addresses practical considerations like optimal financing structures, tax planning opportunities, and entity structures if you're building substantial portfolios. Whilst we're not tax advisors or mortgage brokers ourselves, we work alongside specialists in these areas and ensure your property strategy integrates properly with tax efficiency and financing optimization.

You'll have time to review this strategy document thoroughly, discuss it with family or professional advisors if appropriate, and ask whatever questions arise. We encourage you to challenge our recommendations if anything seems unclear or doesn't align with your thinking—better to address concerns during planning than discover misalignment after committing capital.

Property Sourcing and Due Diligence

Once your strategy is agreed, we begin actively sourcing properties matching your criteria. This involves monitoring our network of estate agents, developers, and property contacts across your target markets, identifying opportunities before they reach public portals or, occasionally, securing off-market deals through our established relationships.

We conduct initial screening on every potential property, filtering out unsuitable options before they reach you. This includes checking planning history for any restrictions or problems, reviewing local rental demand and comparable properties, assessing the property's condition and likely refurbishment requirements, and running preliminary financial projections to confirm the numbers work.

Properties passing our initial screening get presented to you with comprehensive analysis - detailed financial projections including all costs and realistic rental income, area analysis covering tenant demographics and local market conditions, comparable property data showing both purchase prices and rental values, refurbishment cost estimates if work is required, and specific concerns or risk factors we've identified.

We arrange property viewings for opportunities you want to pursue, conducting thorough inspections that go beyond what typical buyers notice. Our team includes people with building and refurbishment experience who can spot structural issues, damp problems, or outdated systems that might require expensive remediation. These problems don't necessarily mean rejecting a property - sometimes they create negotiating leverage - but you need to know about them before committing.

For international investors or those unable to attend viewings personally, we conduct detailed video walkthroughs, providing comprehensive photographic documentation and written reports covering every aspect of the property. Whilst we always recommend viewing properties yourself when possible, we ensure remote investors receive sufficient information to make confident decisions.

Due diligence extends beyond the physical property itself. We investigate local market dynamics - are there major developments planned nearby that might affect rental demand? Has the area experienced declining or improving prospects? What's the tenant demographic and how stable is it? Are there specific employment sectors driving rental demand that might face uncertainty?

We review title documents, checking for restrictive covenants, rights of way, or other legal complications that could affect property use or future resale. We examine local authority records for planning applications or enforcement actions. We verify that the property has necessary certificates - gas safety, electrical installation condition reports, Energy Performance Certificates - and identify any compliance issues requiring attention.

This thorough due diligence process occasionally results in us recommending against purchases you're keen on. A property might appear excellent superficially but reveal problems during deeper investigation. We'd rather occasionally disappoint you by rejecting marginal opportunities than allow you to proceed with investments carrying avoidable risks.

Purchase Coordination and Legal Process

Once you've decided to proceed with a specific property, we coordinate the entire purchase process, working alongside your solicitor and mortgage broker to ensure everything progresses efficiently. Property transactions involve numerous moving parts, and delays or miscommunications at any stage can jeopardise deals or create unnecessary complications.

We liaise with the selling agent to agree terms, negotiating on price where our due diligence has identified justification for reductions. If surveys reveal problems, we handle renegotiations or secure contributions toward remediation costs. Our ongoing relationships with agents across multiple markets mean we can often achieve better outcomes than buyers negotiating individually.

Your solicitor handles the legal conveyancing, but we stay involved throughout, ensuring they receive necessary information promptly and flagging any issues requiring attention. Property purchases can stall when solicitors await documentation or clarification - we keep processes moving by anticipating requirements and providing information proactively.

For investors using mortgage financing, we work with your broker to ensure applications proceed smoothly. Lenders sometimes request additional information or clarification about investment properties, particularly for less standard scenarios like HMO mortgages or portfolio refinancing. We've seen enough mortgage applications to know what lenders typically query and can help prepare responses that address their concerns efficiently.

If you're purchasing through a limited company structure, we coordinate with accountants and solicitors to ensure entity setup and documentation happens correctly. Many investors discover company property ownership after already holding properties personally, then face expensive reorganization. Planning ownership structures properly from the outset saves significant complications later.

Throughout the purchase process, we provide regular updates on progress, expected timelines, and any issues requiring your attention or decision. Property transactions rarely proceed perfectly smoothly - surveys identify problems, sellers become difficult, mortgage valuations come in low—and our experience managing these situations prevents minor issues becoming major obstacles.

Refurbishment and Property Preparation

For properties requiring work before letting, we project-manage the complete refurbishment process from initial contractor quotes through to final inspections. This service proves particularly valuable for investors purchasing properties needing modernization or those converting standard houses into HMOs.

We obtain multiple quotes from trusted contractors, presenting detailed breakdowns showing exactly what work is proposed and at what cost. The cheapest quote rarely represents the best value - we assess contractors on reliability, quality standards, and realistic timescales alongside pricing. Using contractors we've worked with previously eliminates much of the risk associated with refurbishment projects.

Project management involves coordinating multiple trades, ensuring work progresses in the correct sequence, and maintaining quality standards throughout. We conduct regular site visits during work, identifying any deviations from specifications and ensuring contractors remain on schedule. Problems caught early during refurbishment cost far less to remedy than discovering issues after contractors have been paid and moved on.

For HMO conversions, we manage the additional complexities around fire safety systems, sound insulation between rooms, kitchen and bathroom specifications meeting licensing standards, and planning permission or building regulation applications if required. These regulatory requirements vary between councils and getting them wrong can delay licensing or, worse, result in properties that can't legally be occupied as HMOs.

We provide regular photographic updates throughout refurbishment projects, allowing you to monitor progress even if you can't visit the property yourself. For international investors, this visibility proves essential - you can see exactly how your capital is being deployed and have confidence that work proceeds as planned.

Refurbishment cost control matters enormously to investment returns. We maintain detailed budgets, tracking actual expenditure against estimates and flagging potential overruns before they become significant. Unexpected issues do arise during property work - hidden damp, outdated wiring requiring complete replacement - and we discuss these promptly, explaining necessary remediation and revised cost implications.

The goal isn't creating show homes that win design awards - it's producing properties that attract quality tenants, command good rents, and require minimal ongoing maintenance. This balance between initial investment and long-term performance comes from understanding what tenants genuinely value versus expensive cosmetic touches that don't impact rental income.

Tenancy Setup and Ongoing Management

Once properties are ready for occupation, we handle tenant sourcing through comprehensive marketing across major property portals, our own website, and our network of local agents. We create professional property listings with high-quality photography and detailed descriptions that attract serious enquiries whilst filtering out unsuitable applicants.

Prospective tenant vetting involves far more than accepting whoever applies first. We conduct thorough referencing including employment verification, previous landlord references, credit checks, and affordability assessments. We look for warning signs - frequent address changes, poor rental payment history, employment gaps without reasonable explanation - that suggest potential problems.

For HMO properties, we consider how different tenants might coexist. Mixing incompatible tenant types - say, shift workers needing sleep during daytime with students who socialise late into the night - creates friction that damages tenant retention. Getting the tenant mix right from the outset prevents many management headaches later.

We prepare comprehensive tenancy agreements, conduct detailed property inventories, arrange deposit protection, and ensure all legal compliance requirements are met. The requirements have become increasingly complex - Right to Rent checks, prescribed information about deposits, How to Rent guides, gas and electrical safety certificates, Energy Performance Certificates - and missing any element can invalidate tenancy agreements or create legal liability.

Our ongoing management service handles everything from routine maintenance requests through to deposit negotiations at tenancy end. Tenants contact us directly for any issues, we coordinate repairs and maintenance through our contractor network, and we keep you informed about significant matters whilst handling day-to-day operations without requiring your constant involvement.

We conduct periodic property inspections, typically every 3-6 months, checking the property's condition and identifying any maintenance requirements before they become serious problems. These inspections also provide opportunities to maintain good landlord-tenant relationships and address any minor concerns before they escalate into formal complaints.

Rent collection happens automatically through standing orders or direct debits, with monthly statements showing exactly what you've received, what costs have been incurred, and the net income distributed to you. For portfolio holders with multiple properties, consolidated reporting allows you to understand overall portfolio performance rather than tracking each property individually.

When tenancies end, we coordinate checkout procedures, assess any damage beyond fair wear and tear, and negotiate deposit deductions if necessary. We re-market properties promptly to minimize void periods, conducting any necessary maintenance or improvements between tenancies.

Portfolio Review and Strategic Development

Property investment isn't static - markets change, regulations evolve, and your personal circumstances develop over time. We conduct regular portfolio reviews with established investors, typically annually or biannually, assessing how your investments are performing and whether adjustments would improve outcomes.

These reviews examine financial performance across your portfolio, identifying underperforming properties that might benefit from strategic improvements or potentially even sale and reinvestment. We look at whether current rental rates remain competitive or whether you're missing income opportunities. We assess whether your mortgage arrangements remain optimal or whether refinancing could improve cash flow or release equity for additional investments.

We discuss portfolio expansion opportunities - are market conditions favorable for adding properties? Has your financial position improved allowing larger or additional investments? Should you diversify into different property types or strategies to reduce concentration risk?

For investors building substantial portfolios, we address succession planning and exit strategies. How will your property holdings integrate with retirement planning or eventual estate distribution? Are there tax-efficient structures you should consider implementing? These longer-term considerations matter increasingly as portfolios grow and investment horizons extend.

Ready to Build Your Property Portfolio?

Whether you're taking your first steps into property investment or looking to expand an established portfolio, the right guidance makes the difference between struggling through avoidable mistakes and building wealth systematically. We've structured our services specifically to remove the uncertainty and complexity that stops many potential investors from ever getting started.

No-Obligation Initial Consultation

Every investor's circumstances differ, which is why we begin with a comprehensive consultation that explores your specific goals, available capital, risk tolerance, and time commitment. This conversation isn't a sales pitch—we're genuinely interested in understanding whether property investment suits you and, if so, which strategies align with your situation.

Some people discover during consultation that property investment doesn't actually serve their objectives as well as alternative approaches might. We'd rather have that honest conversation early than encourage unsuitable investments that ultimately disappoint. Our reputation depends on long-term client satisfaction, not maximising short-term deal volume.

The consultation typically lasts 60-90 minutes and can happen via video call if you're based internationally or prefer remote meetings. We'll discuss your current financial position, what you hope to achieve through property investment, and any specific concerns or questions you have about the process. By the end, you'll have clarity about whether property investment makes sense for you and what realistic next steps might look like.

There's absolutely no pressure to proceed beyond this initial conversation. Many investors benefit from consultation even if they ultimately decide to delay investing, pursue different strategies, or work with other providers. The insights you gain about property investment fundamentals, market conditions, and realistic return expectations remain valuable regardless.

Booking Your Consultation

Getting started takes a simple phone call or online enquiry. Our team responds to all enquiries within one working day, typically much sooner. We'll arrange a consultation time that suits your schedule, whether that's during standard business hours or early evening for those with demanding work commitments.

For international investors, we're comfortable working across time zones and can schedule calls that accommodate your location. We regularly consult with investors based in Dubai, Singapore, mainland Europe, and elsewhere—time differences don't prevent us from providing the same thorough service UK-based investors receive.

Before your consultation, we'll send a brief questionnaire covering basic information about your investment goals and circumstances. Completing this in advance allows us to prepare relevant examples and recommendations rather than spending consultation time gathering basic details. The questionnaire takes 5-10 minutes and helps ensure our conversation focuses on substantive strategy discussion.

What Happens After Consultation

Following your initial consultation, assuming property investment appears suitable and you want to proceed, we'll prepare a detailed strategy document tailored to your specific circumstances. This typically takes 1-2 weeks and includes comprehensive market analysis, financial projections, and recommended approaches.

You'll have time to review this document thoroughly, discuss it with family or professional advisors if appropriate, and raise any questions or concerns. We're happy to revise recommendations based on your feedback—the strategy document represents our initial thinking, not an immutable plan you must follow rigidly.

Once you're comfortable with the proposed strategy, we begin actively sourcing properties matching your criteria. This process duration varies considerably depending on market conditions and how specific your requirements are. Sometimes we identify suitable opportunities within weeks; other times finding the right property takes several months. We'll never pressure you to accept unsuitable properties simply to close deals quickly.

Throughout the sourcing and purchase process, you remain in complete control. We present opportunities with detailed analysis, but you make every significant decision about which properties to pursue, what price to offer, and whether to proceed following due diligence. Our role is providing information and guidance that allows you to make confident, informed choices.

Ongoing Support and Portfolio Growth

Our relationship doesn't end once your first property is purchased and tenanted. Property investment works best as a long-term wealth-building strategy rather than one-off transactions. We support investors throughout their property journey, whether that involves managing a single buy-to-let indefinitely or systematically building a portfolio over many years.

Many investors start cautiously with one property, gain confidence through experiencing the process firsthand, then proceed to add additional investments more quickly. This measured approach makes perfect sense—property investment involves substantial capital, and understanding how it actually works in practice before committing further reduces risk significantly.

We're equally comfortable working with investors who want to move more aggressively, acquiring multiple properties in relatively short timeframes. For investors with available capital and clear strategies, there's no reason to artificially slow the process. What matters is ensuring each investment receives proper due diligence and genuinely advances your overall objectives.

Portfolio reviews happen regularly for established investors, typically annually or when circumstances change significantly. These reviews assess performance across your holdings, identify optimization opportunities, and discuss whether portfolio expansion or adjustments make sense given current market conditions and your evolving goals.

International Investor Services

We've developed specific processes for international investors recognizing that managing UK property from overseas involves unique challenges. From your initial consultation through ongoing portfolio management, we structure our services to accommodate remote investing whilst ensuring you maintain full visibility and control.

Communication happens via whatever channels work best for your situation—video calls, email, WhatsApp, or other messaging platforms you prefer. We provide regular updates on portfolio performance, flag issues requiring your attention promptly, and ensure you're never surprised by problems that should have been communicated earlier.

Documentation and financial reporting is structured clearly for international requirements, making it straightforward to integrate UK property income with your broader financial affairs and tax obligations in your country of residence. We work alongside accountants and solicitors experienced in international property ownership who can advise on your specific circumstances.

Many international investors never physically visit their UK properties, relying entirely on our due diligence, refurbishment oversight, and ongoing management. Whilst we always recommend viewing properties yourself when practical, we ensure remote investors receive sufficient information and documentation to make confident decisions without requiring UK travel for every opportunity.

Fees and Investment Minimums

Our fee structure is transparent and designed to align our interests with yours—we succeed when your investments perform well, not simply by processing transactions. Initial consultation is provided at no cost and without obligation. Strategy development is included for investors proceeding with property sourcing.

Deal sourcing fees are charged only on completed purchases, typically structured as a percentage of property purchase price or as fixed fees depending on service level and property type. Management fees for ongoing portfolio oversight are charged monthly based on rental income, aligning our incentives with maintaining high occupancy and achieving strong rents.

We'll provide detailed fee schedules during your consultation, ensuring you understand exactly what costs are involved before committing to anything. Property investment involves numerous costs beyond our fees—stamp duty, legal fees, mortgage arrangement fees, refurbishment costs—and we'll explain the complete financial picture so you can budget appropriately.

Minimum investment levels depend on chosen strategies, but generally investors should have at least £25,000-£30,000 available for deposits and associated costs. Lower capital approaches like rent-to-rent exist, but we typically recommend building toward property ownership rather than relying indefinitely on strategies that don't build equity.

Take the First Step Today

Property investment consistently builds wealth for people who approach it systematically with proper guidance. The difference between successful investors and those who struggle rarely comes down to starting capital or market timing—it's about making informed decisions, avoiding common mistakes, and staying focused on long-term objectives rather than chasing unrealistic short-term gains.

We've helped hundreds of investors navigate this journey, from complete beginners purchasing their first buy-to-let through to sophisticated portfolio holders managing substantial property assets. The common factor among successful investors isn't exceptional market knowledge or perfect timing—it's taking that initial step to begin the process rather than perpetually researching without ever acting.

Your consultation will provide genuine clarity about whether property investment suits you and what realistic pathways exist for your circumstances. Even if you ultimately decide property investment isn't right for you currently, you'll benefit from understanding the fundamentals and knowing what options exist when your situation changes.

Contact LAT Property Investments

Schedule Your Free Consultation