Property Investment Locations Across England

LAT Property Investments providing exciting property investment opportunities in English cities with investment entry levels from £20,000+

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

Hot Property Investment Locations in England

Location determines property investment success as much as any other single factor. The identical property strategy that delivers exceptional returns in Nottingham might struggle in Bristol, whilst approaches that work brilliantly in Manchester prove unsuitable for Leicester. Understanding where to invest matters enormously.

We operate across England with particular depth in Midlands and Northern regions where property prices remain accessible whilst delivering solid yields and genuine growth potential. Our location recommendations aren't based on generic national rankings or theoretical predictions—they come from active sourcing experience, established local relationships, and real understanding of what actually lets and appreciates in each market.

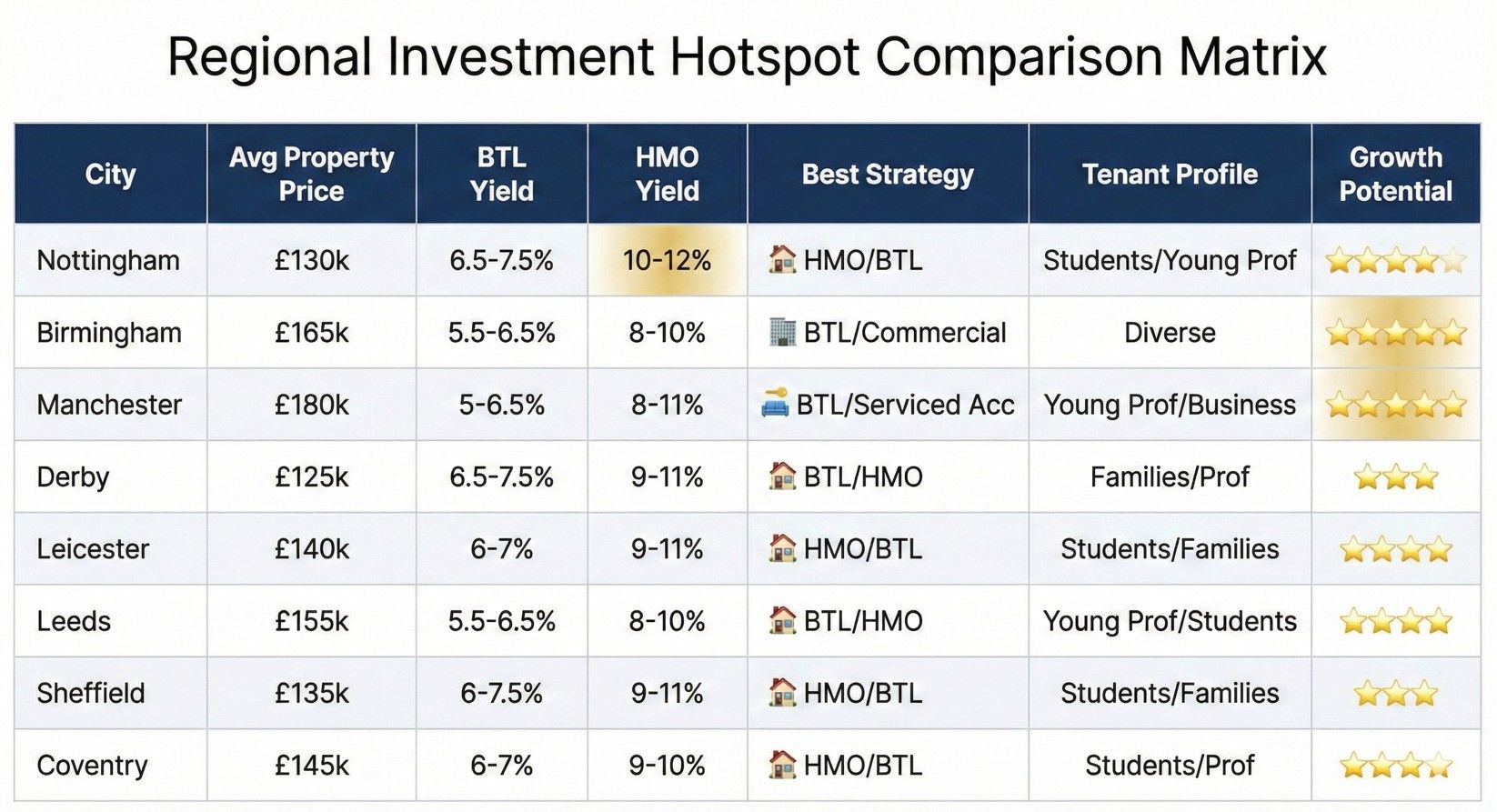

Different cities serve different investment strategies and investor profiles. University cities like Nottingham and Sheffield excel for HMO investments but require understanding student market dynamics. Regional business centres like Birmingham and Manchester offer diverse tenant demographics supporting various strategies. Commuter towns surrounding major employment hubs provide stable buy-to-let demand with lower volatility. We identify these opportunities through our property sourcing network, providing access to locations and properties that deliver optimal combinations of yield and growth potential.

This comprehensive guide examines England's strongest property investment locations, explaining what makes each market attractive, which strategies work best, and crucially, what risks or limitations each area presents. You'll understand not just where to invest, but why specific locations align with particular objectives and circumstances.

What Makes a Strong Property Investment Location

Identifying genuinely strong investment locations requires examining multiple factors simultaneously—attractive property prices alone don't create viable markets if rental demand proves weak, and strong tenant demand means little if property costs eliminate acceptable yields. We assess locations systematically across several critical dimensions.

Rental Yield Potential

Gross rental yield—annual rent as percentage of property price plus costs—provides the fundamental metric determining whether locations support viable investment. We target areas where standard buy-to-let properties achieve minimum 5.5-6% gross yields, with HMO opportunities reaching 9-10% or higher.

However, gross yields tell incomplete stories. We calculate net yields after accounting for mortgage interest, maintenance, insurance, management fees, and realistic void periods. Locations offering 7% gross yields but requiring expensive ongoing maintenance or experiencing frequent voids sometimes deliver worse net returns than areas with 6% gross yields but minimal operational issues.

Property price to rent ratios reveal yield sustainability. Areas where average property prices sit at 15-20 times annual rent generally support healthy investment returns. Ratios exceeding 25 times indicate overpriced markets where rental income struggles to justify purchase costs, whilst ratios below 12 times sometimes signal declining areas with weakening fundamentals despite superficially attractive yields.

Employment and Economic Fundamentals

Consistent rental demand stems from stable, diverse employment. We prioritise cities with multiple employment sectors—professional services, healthcare, education, technology, public sector—providing resilience when individual industries face difficulties. Cities like Leicester'sdiverse economy or Leeds' professional services concentration exemplify this economic diversity, creating resilient rental markets through varied employment bases. Cities dependent on single major employers or declining manufacturing sectors carry concentration risks affecting tenant stability.

We examine employment growth trends and planned economic developments. Areas attracting new employers, particularly in growing sectors, demonstrate strengthening fundamentals supporting rental demand and property values. Conversely, regions experiencing employment contraction or major employer departures face weakening tenant markets regardless of current yield attractions.

Average earnings relative to property prices and rents matter considerably. Areas where typical local salaries comfortably cover market rents indicate sustainable tenant bases. Markets where rents consume excessive portions of local wages often experience higher tenant turnover and arrears rates as people struggle affording accommodation.

Infrastructure and Connectivity

Transport infrastructure significantly affects location viability. Cities with strong rail connections to major employment centres attract commuters willing to pay premium rents for convenient access. Direct train services to London, Manchester, or Birmingham expand tenant pools beyond purely local employment bases.

Road infrastructure—proximity to motorway networks, quality of local road systems—influences both tenant appeal and broader economic prospects. Well-connected cities attract businesses and residents; poorly connected areas struggle competing for both regardless of other advantages.

Planned infrastructure improvements can transform location prospects. HS2 developments, new motorway junctions, or improved rail services strengthen affected areas' investment fundamentals. We monitor major infrastructure projects identifying locations likely benefiting from improved connectivity before markets fully price in these advantages.

Education and Demographics

University cities offer distinct advantages and challenges. Student populations provide consistent HMO demand, but require understanding academic calendars, summer void management, and occasional local authority restrictions on HMO concentrations. Cities like Nottingham, Sheffield, and Leicester combine strong universities with diverse non-student populations, providing investment flexibility across multiple strategies.

School quality ratings significantly affect family rental demand and property values in specific neighborhoods. Areas with outstanding-rated primary schools command rental premiums and attract stable, long-term family tenants. We examine Ofsted ratings when assessing different neighborhoods within broader cities, identifying pockets of stronger demand within otherwise moderate markets.

Demographic trends—population growth, age distributions, household formations—indicate future demand patterns. Cities attracting young professionals or experiencing population growth demonstrate strengthening fundamentals; those losing residents or aging populations signal potential demand weakening requiring careful strategy selection.

Housing Supply Dynamics

New housing development levels relative to population growth determine supply-demand balance. Cities with substantial housing construction occasionally face oversupply risks, particularly in specific property types like city center apartments. We monitor planning permissions and development pipelines identifying potential oversupply situations before they materialize.

Conversely, constrained supply due to limited development land or restrictive planning policies can support rental demand and property values. However, chronic undersupply sometimes stems from weak economic fundamentals rather than planning restrictions—areas nobody wants to build in often reflect genuine lack of demand.

We examine specific property type availability within broader markets. Some cities have abundant family houses but limited quality apartments; others show opposite patterns. Identifying undersupplied property types within generally balanced markets reveals opportunities for strategies targeting specific tenant demographics.

Regulatory Environment

Local authority approaches to landlord regulation vary considerably across England. Some councils implement strict HMO licensing requiring expensive compliance, whilst others take lighter-touch approaches. Article 4 directions restricting HMO concentrations in certain areas fundamentally affect strategy viability in affected neighborhoods.

We monitor council licensing schemes, planning policies, and selective licensing consultations, understanding how local regulation affects different investment strategies. This intelligence prevents recommending strategies incompatible with local regulatory environments or identifies locations where regulatory changes might impact existing investments.

Planning policies around permitted development, extensions, or conversions influence property improvement potential. Areas with restrictive planning prove challenging for strategies requiring property modifications, whilst flexible planning environments support value-add approaches through strategic improvements.

Capital Growth Prospects

Historical price growth provides context but doesn't guarantee future performance. We examine factors driving previous appreciation—was growth driven by genuine economic improvement, infrastructure investment, or simply loose lending inflating all markets temporarily? Understanding growth drivers helps assess sustainability.

Current development and regeneration projects indicate potential appreciation. Major city center redevelopment, new business districts, or significant public investment often precede property value increases as areas become more desirable. We identify locations in early regeneration stages where current prices haven't fully reflected improvement trajectories.

Relative affordability compared to similar cities suggests appreciation potential. Cities offering comparable employment, infrastructure, and amenities to more expensive markets sometimes represent value opportunities as investors and residents recognize relative affordability, driving demand that supports price growth.

Local Market Knowledge

Statistical analysis provides foundations, but genuine market understanding requires local relationships and on-ground intelligence. We maintain contact with estate agents, letting agents, and property managers across our core markets, gaining insights into subtle market dynamics that data alone doesn't reveal.

Which neighborhoods within cities are strengthening or weakening? Where are employers expanding or contracting? What planning applications might affect specific areas? Are there local issues—crime hotspots, antisocial behavior, proposed developments—affecting particular streets or postcodes? This granular intelligence prevents expensive mistakes where citywide statistics suggest opportunities but neighborhood realities present problems.

We physically visit and reassess our core markets regularly, observing changes that emerge between data updates. Property investment markets evolve continuously, and maintaining current knowledge requires ongoing attention rather than relying on historical analysis that may no longer reflect present conditions.

Where We Focus Our Expertise

Our nationwide coverage concentrates on regions delivering optimal combinations of affordability, yields, and growth potential. These aren't arbitrary choices—they represent markets where years of active sourcing have proven consistent investment viability.

The Midlands Hub

The Midlands offers perhaps England's best balance of accessible property prices and strong returns. Nottingham, Derby, Leicester, Birmingham, and Coventry form interconnected markets sharing central UK location advantages whilst maintaining distinct characteristics.

Nottingham excels for HMO investment with two universities generating consistent student demand alongside growing professional sectors. Derby provides affordable buy-to-let opportunities with stable family tenant demographics. Leicester combines strong multicultural communities with university populations supporting diverse strategies. Birmingham, as the UK's second city, offers everything from city center apartments through suburban family homes. Coventry benefits from university presence and improving transport infrastructure.

Property prices across Midlands cities typically range £100,000-£180,000 for standard investment properties, requiring deposits of £25,000-£45,000. Gross yields consistently reach 6-8% for buy-to-let, extending to 10-12% for well-selected HMO conversions. Capital growth prospects remain solid as infrastructure investment and economic development continue strengthening regional fundamentals. Our core Midlands markets include Nottingham's established student HMO sector, Derby's beginner-friendly affordability, Leicester's balanced opportunities, Birmingham as the region's growth anchor, and Coventry's regeneration momentum. Each offers distinct advantages depending on your investment priorities.

Manchester and the North West

Manchester represents the North West's investment powerhouse, combining major employment sectors, excellent connectivity, and ongoing regeneration supporting both rental demand and capital appreciation. The city attracts young professionals, students, and international workers creating diverse tenant populations.

City center apartments suit serviced accommodation or professional lets. Suburban areas like Salford and surrounding towns provide traditional buy-to-let opportunities at lower price points. The variety within compact geography allows portfolio diversification without spreading investments across distant regions.

Property prices in Manchester typically start £140,000-£200,000 for investment-grade properties. Yields range 5-7% for standard lets, potentially reaching 8-11% for HMO or serviced accommodation strategies. Growth prospects remain strong as MediaCity, airport expansion, and HS2 connections continue attracting businesses and residents. Manchester represents Northern England's economic powerhouse, offering diverse investment strategies from city center apartments to suburban buy-to-let across its expanding metropolitan area.

Yorkshire Markets

Leeds and Sheffield anchor Yorkshire's investment opportunities. Leeds combines strong financial and professional services sectors with universities, supporting both young professional and student tenant demand. Sheffield offers more affordable entry points with two universities driving HMO markets alongside family housing demand.

Property prices typically range £100,000-£160,000, providing accessible entry for first-time investors. Yields generally reach 6-7.5% for buy-to-let, extending to 9-11% for HMO properties in appropriate locations. Both cities benefit from M1 corridor connectivity and ongoing city center regeneration. Yorkshire provides compelling investment alternatives through Leeds' professional tenant markets and Sheffield's affordability-focused opportunities, creating regional portfolio diversification within manageable geographic scope.

Why These Regions Work

These markets share critical characteristics: accessible property prices allowing viable investment at realistic deposit levels, diverse employment supporting tenant demand resilience, strong transport infrastructure connecting to broader UK economy, and ongoing development improving long-term fundamentals.

We've deliberately concentrated expertise in regions demonstrating consistent performance rather than chasing speculative emerging markets or attempting superficial nationwide coverage. This regional focus allows genuine market knowledge, established relationships, and confidence recommending specific areas based on extensive sourcing experience.

Matching Locations to Your Strategy

Different investment objectives require different location characteristics. Aligning location selection with your specific strategy and circumstances determines success far more than simply choosing cities with highest headline yields or growth rates.

For Maximum Rental Yield

Investors prioritizing immediate cash flow should focus on Midlands cities—Nottingham, Derby, Leicester—where property prices remain modest whilst rental demand stays strong. HMO strategies in university neighborhoods consistently deliver 10-12% gross yields. Standard buy-to-let in commuter areas achieves 6.5-7.5%, providing solid income without requiring intensive management.

For Capital Growth Priority

Birmingham and Manchester offer strongest appreciation prospects, benefiting from major infrastructure investment, employment growth, and ongoing regeneration. Accept lower initial yields (5-6.5%) in exchange for property value increases over 5-10 year horizons. Suits investors with longer time horizons who can absorb modest current returns whilst building equity.

For Balanced Approaches

Leicester and Leeds provide middle ground—reasonable yields (6-7%) alongside solid growth potential. These cities combine affordable entry points with improving economic fundamentals, serving investors wanting both income and appreciation without accepting extreme positions on either dimension.

For First-Time Investors

Derby and Sheffield offer accessible entry prices (£100,000-£140,000 typical), straightforward buy-to-let opportunities, and stable tenant markets. Lower complexity and modest management requirements suit investors building confidence before exploring more sophisticated strategies or expensive markets.

For Portfolio Diversification

Established investors building substantial portfolios benefit from geographic spread across our core regions. Properties in Nottingham, Birmingham, and Manchester provide exposure to different economic drivers and tenant demographics, reducing concentration risks whilst maintaining manageable geographic scope for oversight.

Our consultation process identifies which locations genuinely align with your circumstances rather than promoting single markets regardless of suitability. Strategy, budget, risk tolerance, and practical constraints all influence optimal location selection. For maximum current yields, consider Nottingham's HMO sector or Sheffield's budget-friendly properties. Capital growth priorities align with Birmingham's second city momentum or Manchester's infrastructure investment. First-time investors benefit from Derby's straightforward buy-to-let market, while experienced portfolio builders find Leicester's balanced characteristics ideal for diversification.

Explore Investment Opportunities in Your Target Location

Understanding which UK regions offer strongest investment fundamentals represents crucial first steps, but successful investing requires moving from theory to action with properties specifically matching your criteria.

We provide detailed analysis for individual city pages accessible below, examining specific neighborhoods, property types, and investment opportunities in each core market. Whether you're drawn to Nottingham's HMO potential, Birmingham's growth prospects, or Derby's affordability, you'll find comprehensive local intelligence guiding your investment decisions.

Not certain which location suits your circumstances? Our consultation service discusses your objectives and recommends specific cities and neighborhoods aligned with your strategy, budget, and return requirements.

Explore Individual City Investment Guides:

Ready to Invest in the Right Location?

Speak with our team about investment opportunities across England's strongest property markets.

Location Selection Questions Answered

Which UK city offers the best property investment returns?

No single city universally delivers "best" returns. This depends on your strategy. Student HMO investments in Nottingham deliver 10-12% gross yields, while Birmingham provides balanced growth and income at 5.5-7% yields with stronger appreciation.

Nottingham and Derby typically offer highest rental yields (6.5-8% buy-to-let, 10-12% HMO) due to affordable property prices and strong tenant demand. Birmingham and Manchester provide strongest capital growth prospects but lower initial yields (5-6.5%). Leicester and Leeds offer balanced combinations of reasonable yields and growth potential. The "best" city is whichever aligns with your specific objectives, available capital, and risk tolerance.

Should I invest in one city or spread across multiple locations?

For your first 1-3 properties, concentrating in a single well-understood location makes practical sense. You'll develop local market knowledge, establish relationships with agents and contractors, and simplify management logistics. Once you've built experience and own 4+ properties, geographic diversification across 2-3 cities reduces concentration risk—if one local market weakens, others may remain strong. We typically recommend spreading portfolios across our core Midlands and Northern regions rather than concentrating everything in a single city's economy.

Do you invest in London or the South East?

We occasionally source London and South East opportunities for specific clients—typically high-net-worth investors or international buyers for whom London represents their primary UK connection. However, we don't routinely recommend these markets for investors prioritizing rental income and cash flow. Property prices of £400,000-£600,000+ in London generate similar rental income to £150,000 properties in Nottingham, meaning yields typically sit at 3-4% versus 6-8% regionally. London investment cases rest primarily on capital appreciation rather than income generation, requiring substantially larger capital and longer time horizons than most investors possess.

How do you identify up-and-coming areas before they become expensive?

We monitor several indicators suggesting strengthening markets: major infrastructure investment announcements (HS2 stations, new transport links), significant employer relocations or expansions, council regeneration projects receiving substantial funding, and planning permissions for quality residential or commercial developments. Areas receiving multiple simultaneous investments often experience property value increases as improvements materialize. However, we're cautious about purely speculative "next big thing" predictions—we focus on locations demonstrating actual improvement rather than theoretical potential that may never materialize.

What about Brexit and immigration impacts on different cities?

Brexit has affected UK property markets less dramatically than many predictions suggested. Immigration patterns have shifted—fewer EU workers, more international students and skilled workers from broader origins—but overall tenant demand in our core cities remains strong. University cities like Nottingham, Leicester, and Sheffield continue attracting substantial international student populations. Major employment centers like Birmingham and Manchester draw skilled workers regardless of immigration policy changes. Cities heavily dependent on specific EU-related industries faced some challenges, but our core markets' diverse economic bases provided resilience.

Are certain cities better for international investors?

All our core markets suit international investors with proper management support. However, some cities offer specific advantages. Birmingham and Manchester attract international recognition and direct flight connections facilitating occasional visits. University cities like Nottingham and Leicester have established international communities potentially offering cultural familiarity. Derby and Sheffield provide exceptional affordability allowing international investors to build portfolios faster with available capital. The management structure matters more than location—with comprehensive property management, any of our recommended cities work effectively for overseas investors.

How often do property investment location rankings change?

Underlying fundamentals—employment diversity, transport infrastructure, demographic trends - evolve gradually over years or decades. Short-term ranking fluctuations often reflect temporary factors or media attention rather than genuine fundamental changes. Cities appearing in "hot property investment" lists one year frequently prove overpriced by the time articles publish, as investors pile into already-discovered opportunities. We focus on locations with solid long-term fundamentals rather than chasing media-driven trends. Our core Midlands and Northern city recommendations have remained consistent for years because underlying strengths persist despite market cycles.

Should I focus on city centers or suburban areas?

This depends entirely on your strategy and target tenant demographic. City center apartments suit young professionals, students, or serviced accommodation strategies but typically command premium purchase prices and may face future oversupply from new development. Suburban family homes offer stable long-term tenancies, lower purchase costs, and minimal management but generate lower gross yields. HMO strategies often work best in areas between city centers and outer suburbs - close enough to universities or employment centers for tenant appeal whilst avoiding premium city center pricing. We identify optimal neighborhoods within each city based on your specific strategy during consultation.