Property Investment in Nottingham

LAT Property Investments providing exciting property investment opportunities in NOTTINGHAMSHIRE with investment entry levels from £20,000+

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

NOttingham Property Investment

Nottingham ranks among England's strongest property investment locations for HMO strategies, combining accessible pricing with proven student demand, exceptional rental yields and diverse tenant demographics. The city's dual university presence, growing professional sectors, and central UK location create multiple viable investment strategies within a compact, manageable market.

Nottingham sits at the heart of the East Midlands, within 30 minutes of Derby's more affordable buy-to-let opportunities and Leicester's balanced markets, allowing investors to build diversified regional portfolios across complementary cities.

Property prices averaging £120,000-£150,000 for investment-grade houses deliver gross rental yields of 6.5-7.5% for standard buy-to-let, extending to 10-12% for well-positioned HMO conversions. These returns significantly exceed national averages whilst requiring deposits manageable for first-time investors—typically £25,000-£40,000 depending on property type and strategy.

Beyond immediate yields, Nottingham demonstrates solid fundamentals supporting long-term investment viability. Two universities enrolling over 60,000 students provide consistent accommodation demand. Professional sectors—finance, technology, public administration, healthcare—employ diverse workforces supporting family and young professional rental markets. Transport infrastructure including direct rail services to London, Birmingham, and other major cities strengthens commuter appeal.

The city isn't without considerations. Student market concentration in certain areas requires understanding academic calendars and managing summer voids. Some neighborhoods face challenges around deprivation or antisocial behavior requiring careful area selection. Competition for quality investment properties has intensified as investors increasingly recognize Nottingham's advantages.

This comprehensive guide examines where Nottingham investment works best, which strategies suit different areas, and what realistic returns and considerations investors should understand before committing capital.

Best NOTTINGHAM Neighborhoods for Property Investment

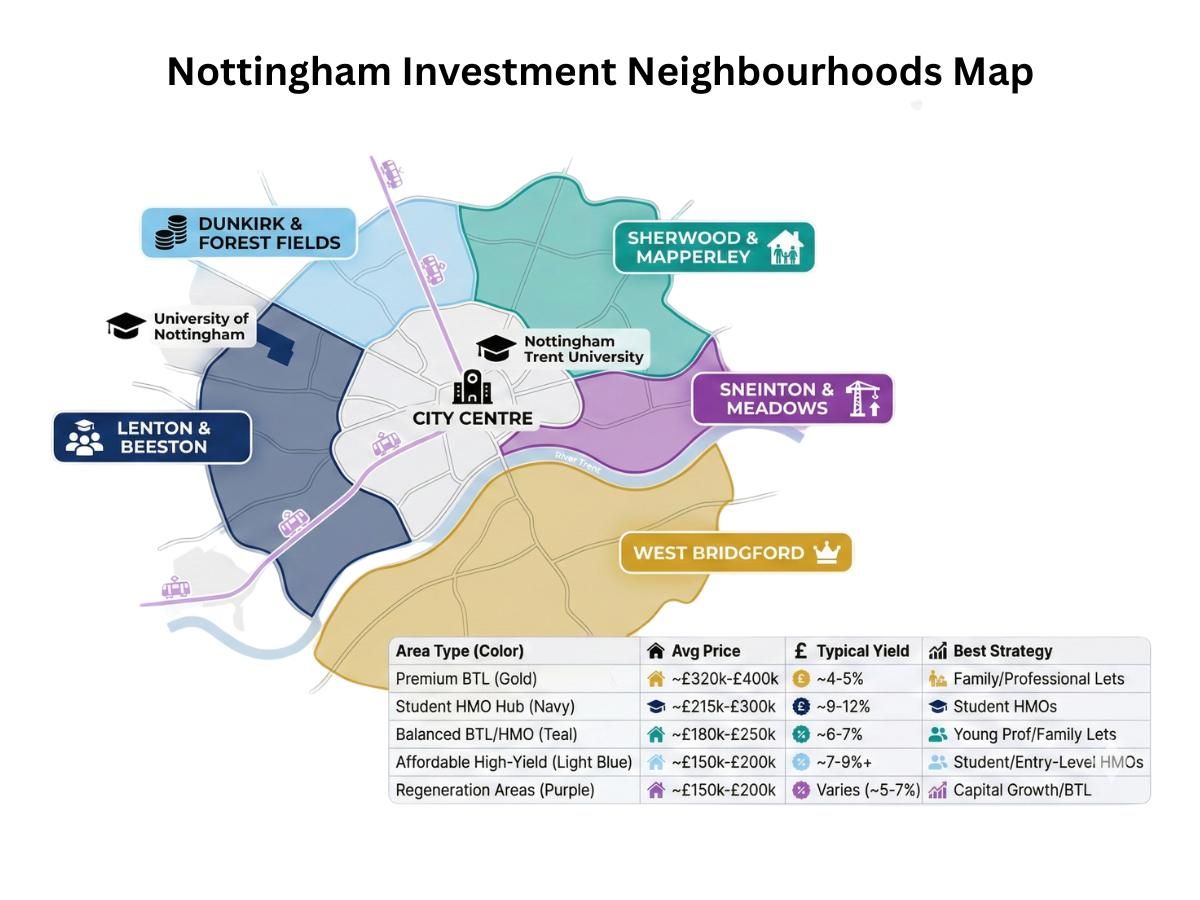

Nottingham's investment landscape divides into distinct neighborhoods, each suited to particular strategies and tenant demographics. Understanding these geographical nuances prevents costly mistakes where citywide statistics suggest opportunities but specific area realities present challenges.

Lenton and Beeston (Student HMO Hub)

Lenton sits adjacent to University of Nottingham's main campus, making it Nottingham's premier student accommodation area. Victorian terraced houses dominate, many already operating as HMOs. Properties typically cost £140,000-£180,000, generating 10-12% gross yields when fully tenanted with 5-6 student occupants.

The area offers established HMO infrastructure—existing licenses, proven student demand, familiar layouts—reducing conversion uncertainty. However, intense HMO concentration means Article 4 restrictions now limit further conversions in some streets. Competition for tenants intensifies when multiple properties become available simultaneously. While Lenton offers concentrated student HMO opportunities, investors seeking simpler strategies might consider Derby's straightforward buy-to-let market just 15 miles south.

Beeston, slightly south, provides similar student appeal with marginally lower property prices (£130,000-£160,000) and less saturated HMO markets. The area benefits from excellent transport links including direct tram services to both universities and city center.

Dunkirk and Forest Fields (Affordable HMO/BTL)

These areas east of city center offer Nottingham's most accessible entry prices—£90,000-£120,000 for terrace houses—delivering gross yields potentially exceeding 8-9% for buy-to-let, higher for HMO conversions. Nottingham Trent University's proximity provides student demand alongside young professionals and families.

Properties require careful selection. Some streets are well-maintained with stable tenant populations; others face antisocial behavior issues or property condition problems. Thorough area research and property-specific due diligence prove essential. These areas suit experienced investors comfortable with higher-yield, higher-management strategies rather than first-time investors seeking straightforward passive income.

West Bridgford (Premium Buy-to-Let)

West Bridgford, south of River Trent, represents Nottingham's most affluent suburb. Properties command premium prices—£180,000-£250,000 for investment-suitable houses—but attract stable professional tenants and families prioritizing excellent schools and neighborhood quality.

Gross yields sit lower (5-6%) reflecting higher property prices, but tenant quality, extended tenancy durations, and minimal management requirements often justify the yield sacrifice. This area suits investors prioritizing stability and capital preservation over maximum income generation.

Sherwood and Mapperley (Balanced Opportunities)

These northern suburbs offer middle-ground positioning—decent yields (6-7%), manageable property prices (£130,000-£170,000), and mixed tenant demographics including young professionals, small families, and some students. Properties typically require less intensive management than budget areas whilst avoiding West Bridgford's premium pricing.

The areas benefit from good local amenities, reasonable transport links, and neighborhoods generally lacking significant antisocial behavior issues. They suit first-time investors seeking straightforward buy-to-let opportunities or experienced investors wanting less intensive alternatives to pure student HMO strategies.

Sneinton and The Meadows (Regeneration Watch)

These areas east and south of city center have historically faced deprivation challenges but show improvement signs through regeneration investment. Properties remain very affordable (£80,000-£110,000), potentially delivering exceptional yields for investors accepting higher management requirements and some area challenges.

These represent higher-risk, potentially higher-reward opportunities. Regeneration efforts might transform areas over coming years, delivering both strong yields and capital appreciation. Alternatively, fundamental challenges might persist despite investment. Only experienced investors with appropriate risk tolerance and local knowledge should consider these markets.

Which Strategy Works Best in Nottingham

Nottingham supports diverse investment approaches, though certain strategies align particularly well with the city's characteristics and tenant demographics.

Student HMO Investment

Nottingham excels for student HMO strategies, with established markets, proven demand, and property stock well-suited to multi-let conversion. Properties in Lenton, Beeston, and areas near Nottingham Trent deliver consistent 10-12% gross yields when properly managed.

Success requires understanding the student letting cycle—marketing begins January-March for September tenancies, with summer representing the critical void period requiring either summer lets or accepting 10-11 month income years. Factor 1-2 months annual void into projections rather than assuming continuous 12-month occupancy.

Council licensing requirements have tightened considerably. Mandatory HMO licenses apply to properties with five or more occupants, whilst additional and selective licensing schemes cover other areas. Ensure any HMO purchase either holds current licenses or demonstrates clear licensability before committing.

HMO yields of 10-12% significantly exceed Leicester's balanced 6-7% buy-to-let returns, though require more intensive management.

Professional Buy-to-Let

Areas like West Bridgford, Sherwood, and parts of Mapperley suit traditional buy-to-let targeting young professionals or small families. Properties achieve 5.5-7% gross yields with significantly lower management intensity than student HMOs and longer average tenancy durations reducing turnover costs.

Professional tenants typically seek 12-month ASTs with potential for multi-year stays, providing income stability that student lets rarely match. Void periods between tenancies average 2-4 weeks rather than the 6-8 weeks common in student markets.

Serviced Accommodation

Nottingham's business visitors and tourism generate limited serviced accommodation demand compared to Manchester or Birmingham. City center locations near train stations occasionally work, but overall market depth remains modest. This strategy suits investors with existing Nottingham portfolios seeking diversification rather than being primary approach recommendations.

Mixed Portfolio Approach

Experienced investors often build Nottingham portfolios combining student HMOs delivering maximum yields with professional buy-to-let properties providing income stability. This diversification balances the student market's summer void challenges against professional lets' lower yields, creating more resilient overall returns.

Realistic Nottingham property Investment Returns

Typical Financial Performance

Standard buy-to-let properties in decent Nottingham areas—Sherwood, Mapperley, parts of Beeston—typically achieve:

- Purchase price: £130,000-£160,000

- Monthly rent: £750-£950

- Gross yield: 6-7%

- Net yield after costs: 3.5-4.5%

Student HMO properties in Lenton or Beeston deliver:

- Purchase price: £140,000-£180,000

- Monthly rent: £1,400-£1,800 (5-6 rooms at £280-£300 each)

- Gross yield: 10-12%

- Net yield after costs: 6-8%

These projections assume 75% loan-to-value mortgages at current interest rates, standard management fees, and realistic maintenance reserves.

Key Considerations

Nottingham's affordability creates intense investor competition. Quality properties in desirable areas often receive multiple offers within days of listing. Moving decisively when suitable opportunities arise proves essential.

Student market concentration means economic changes affecting universities—international student number restrictions, funding changes—would significantly impact certain neighborhoods. Portfolio diversification across student and non-student areas provides resilience.

Some areas face persistent challenges around antisocial behavior, property condition, or declining demographics. Thorough due diligence and area-specific knowledge prevent investing in superficially attractive high-yield properties in fundamentally problematic locations.

Nottingham's property Investment Strengths

We've sourced hundreds of Nottingham properties over many years, developing genuine local expertise beyond statistical analysis. The city consistently delivers for investors who select appropriate areas and strategies matching their circumstances.

Nottingham's affordability allows building substantial portfolios with realistic capital. Investors can acquire 3-4 Nottingham properties for the cost of single London investments, providing both diversification and superior immediate income generation.

The city's economic fundamentals continue strengthening—major employers expanding, transport infrastructure improving, city center regeneration progressing. These developments support both current rental demand and long-term capital preservation. Nottingham's established HMO infrastructure mirrors Sheffield's student accommodation market, though Nottingham typically commands slightly higher rents due to stronger university prestige.

Most importantly, Nottingham demonstrates genuine tenant demand depth. Properties don't sit empty between tenancies when priced appropriately and maintained reasonably. This fundamental demand sustainability matters more than marginal yield differences when evaluating long-term investment viability.

Invest in Nottingham Property

Whether you're attracted to Nottingham's HMO potential, seeking affordable buy-to-let opportunities, or building a diversified East Midlands portfolio, we provide comprehensive local support from property sourcing through ongoing management. Our property deal sourcing service identifies optimal Nottingham HMO opportunities before they reach major portals, screening for Article 4 compliance and prime student locations.

Our established Nottingham relationships—estate agents, letting agents, HMO licensing specialists, refurbishment contractors—deliver genuine advantages identifying opportunities and navigating local requirements efficiently.

FAQs ABOUT Nottingham property investment

Is Nottingham better for HMO or buy-to-let investment?

Nottingham excels for both strategies in different areas. HMO investments in Lenton, Beeston, or near Nottingham Trent consistently deliver 10-12% gross yields but require accepting student market dynamics including summer voids and higher management intensity. Buy-to-let in areas like Sherwood or West Bridgford generates lower yields (5.5-7%) with significantly less management and more stable tenancies. Your optimal strategy depends on available capital, risk tolerance, and whether you prioritize maximum income or management ease. Many experienced investors maintain both property types within Nottingham portfolios for diversification.

How do I handle summer voids with student properties?

Student HMO investors manage summer voids through several approaches: explicitly account for 10-11 month occupancy in financial projections rather than assuming full 12-month income; negotiate tenancy agreements where students pay summer months even if not occupying (increasingly difficult); pursue summer sublets to conference attendees or short-term workers (requires effort and carries risks); or simply accept the void period as inherent to student investment reflected in higher academic-year yields. Properties in strongest locations near University of Nottingham sometimes attract professional summer tenants, though this remains exceptional rather than reliable.

What are Nottingham's HMO licensing requirements?

Nottingham City Council operates mandatory HMO licensing for properties housing five or more people from two or more households, additional licensing schemes in specific wards, and selective licensing in certain areas. Requirements include meeting minimum room sizes (typically 6.51 square meters for single occupancy), providing adequate bathroom and kitchen facilities, installing fire safety equipment to specific standards, and ensuring property maintenance meets acceptable standards. License applications cost several hundred pounds and require detailed property information. Always verify any HMO purchase either holds current valid licenses or conclusively demonstrates licensability before committing—unlicensed HMO operation carries substantial penalties.Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.

Which areas should I avoid in Nottingham?

Rather than blanket area avoidance, focus on street-level selection. Even historically challenging areas contain well-maintained streets with stable tenant demand, whilst better neighborhoods include problematic pockets. St Ann's, parts of The Meadows, and some Sneinton streets face persistent challenges suitable only for very experienced investors accepting higher management demands. Conversely, these areas also contain regeneration success stories delivering exceptional returns. Work with advisors possessing genuine local knowledge conducting property-specific due diligence rather than relying on postcode-level generalizations. Our sourcing service explicitly screens for area-specific issues before presenting Nottingham opportunities.