Property Investment in Birmingham

LAT Property Investments providing exciting property investment opportunities in THE WEST MIDLANDS with investment entry levels from £20,000+

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

BIRMINGHAM Property Investment

Birmingham stands as the UK's second city and England's largest local authority, offering property investors exposure to genuinely major city fundamentals, sustained regeneration investment, and economic diversity that few markets outside London can match. For investors seeking balanced combinations of capital growth, rental yields, and major infrastructure connectivity, Birmingham consistently delivers compelling opportunities. Birmingham ranks among England's most significant property investment locations, offering major city infrastructure, diverse employment, and regeneration momentum that few UK cities can match.

The city's economic transformation mirrors Manchester's evolution whilst maintaining distinct characteristics. Birmingham anchors the West Midlands economy with over 1.1 million residents and employment spanning finance, professional services, healthcare, advanced manufacturing, and growing technology sectors. Major employers include HSBC UK headquarters, numerous financial institutions concentrated around Snow Hill and Colmore Row, the vast Queen Elizabeth Hospital complex, and Jaguar Land Rover's regional presence.

Property investment in Birmingham requires moderate capital—typical opportunities range £150,000-£220,000 depending on location and type, with deposits of £38,000-£55,000 making entry accessible for investors with reasonable capital reserves. These price points deliver gross rental yields of 5.5-7% for standard investments alongside capital appreciation historically averaging 4-6% annually, creating balanced return profiles combining income and growth.

Birmingham's geographic position at England's heart provides strategic advantages. The city sits at the motorway network's center—M5, M6, M40, and M42 all converge here, facilitating business logistics and commuter accessibility. HS2's eventual completion will reduce London journey times to under 50 minutes, fundamentally strengthening Birmingham's appeal to businesses seeking reduced operating costs whilst maintaining capital connectivity.

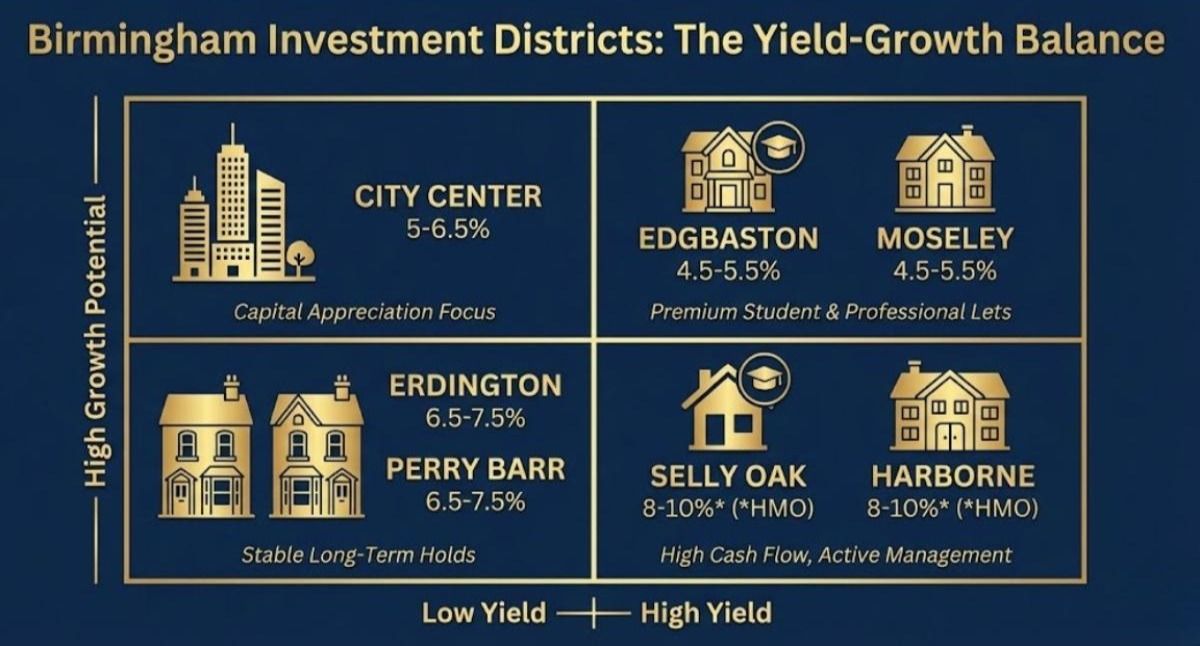

Investment diversity matches the city's scale. City center apartments serve young professionals in modern developments around Brindleyplace and the Mailbox. Suburban areas like Edgbaston, Harborne, and Moseley provide premium family rental markets. Student areas near University of Birmingham and Birmingham City University support HMO strategies. Outer districts like Erdington, Solihull, and Sutton Coldfield offer more affordable entry points with varying tenant demographics.

This guide examines Birmingham's investment landscape, identifying where different strategies work optimally and what realistic returns investors should expect across the city's diverse neighborhoods.

Key Birmingham Neighborhoods for Investment

Birmingham's substantial geographic spread creates distinct neighborhood characters, each suited to particular investment strategies and tenant demographics.

City Center and Jewellery Quarter

Birmingham city center offers modern apartments in developments around Brindleyplace, the Mailbox, and near New Street Station, typically priced £160,000-£250,000. Gross yields range 5-6.5% for standard lets to young professionals working in city center finance, professional services, or healthcare sectors.

The Jewellery Quarter blends historic character with modern residential conversions, attracting creative professionals and young couples seeking characterful apartments rather than generic new-builds. The area demonstrates stronger tenant retention than some purely modern city center developments, with tenants valuing unique properties and established neighborhood character.

Service charges and leasehold complications require thorough scrutiny—some developments impose £2,000-£3,000 annual charges significantly impacting net returns. City center investment suits investors comfortable navigating these complexities whilst accepting modest yields in exchange for capital growth exposure.

Selly Oak and Harborne (Student and University Areas)

Areas surrounding University of Birmingham provide established student accommodation markets. Selly Oak particularly concentrates student housing, with terraced properties suitable for HMO conversion typically costing £150,000-£200,000, delivering 8-10% gross yields when fully tenanted with 5-6 students.

Harborne sits adjacent but attracts more mixed demographics—students, young professionals, and some families—creating diversified tenant opportunities. Properties command slightly higher prices (£170,000-£220,000) but offer flexibility pursuing either student HMO or professional single-let strategies.

Birmingham City University's city center location creates additional student demand in areas like Digbeth and parts of the Jewellery Quarter, though these markets remain less established than traditional Selly Oak student concentrations. Digbeth's creative quarter development follows similar trajectories to Manchester's Northern Quarter transformation, attracting young professionals through cultural amenities and modern workspace conversions.

Edgbaston and Moseley (Premium Residential)

Edgbaston represents Birmingham's most prestigious residential area, with Victorian and Edwardian houses commanding £250,000-£400,000+ appealing to professional families prioritizing excellent schools and neighborhood quality. Gross yields moderate to 4.5-5.5%, but tenant stability, minimal management, and consistent capital appreciation often justify accepting lower immediate returns.

Moseley provides slightly more accessible premium market entry (£180,000-£280,000) whilst maintaining similar tenant appeal—professionals, families, creative sector workers valuing independent shops, restaurants, and community atmosphere. The area demonstrates strong rental demand and properties let rapidly with minimal void periods.

These neighborhoods suit investors prioritizing tenant quality and capital preservation over maximum yields, accepting modest rental returns in exchange for minimal management and strong long-term value protection.

Erdington and Perry Barr (North Birmingham)

Northern Birmingham areas offer more affordable entry points—£120,000-£170,000 for terraced and semi-detached properties—delivering gross yields of 6.5-7.5% to mixed tenant demographics including families, young professionals, and some benefit recipients.

These areas require more careful property and street-level selection. Some pockets demonstrate stable tenant demand and reasonable property conditions; others face persistent challenges around antisocial behavior or declining amenities. Thorough local knowledge prevents investing in superficially attractive high-yield properties in fundamentally problematic locations.

North Birmingham benefits from ongoing regeneration investment and improved transport infrastructure, including potential HS2 station impacts on Perry Barr. These developments may strengthen area fundamentals over coming years, though appreciation remains more uncertain than established premium neighborhoods.

Solihull and Sutton Coldfield (Affluent Suburbs)

Technically separate towns but functionally part of greater Birmingham, Solihull and Sutton Coldfield offer affluent suburban markets with excellent schools, substantial green spaces, and strong transport links. Properties typically cost £180,000-£300,000, delivering moderate gross yields (5-6%) to exceptionally stable family tenants.

These areas particularly suit investors seeking minimal management and tenant longevity. Average tenancy durations often exceed three years, and properties maintained to reasonable standards rarely experience void periods exceeding 2-3 weeks between occupancies.

The areas provide geographic diversification from central Birmingham whilst maintaining economic connectivity, reducing concentration risk for investors building substantial regional portfolios.

Why Birmingham Attracts Investment

Birmingham's investment case rests on several fundamental strengths distinguishing it from other regional cities and establishing sustained appeal beyond temporary market trends.

UK's Second City Status

Birmingham's scale provides genuine economic diversity. Unlike cities dependent on single sectors or major employers, Birmingham's economy spans finance, professional services, healthcare, education, manufacturing, and growing technology sectors. This diversity creates resilience - sector-specific downturns impact the city less severely than concentrated economies.

The city's population continues growing through both natural increase and migration, with young professionals relocating from other UK regions and substantial international migration. Population growth directly supports rental demand and long-term property value appreciation.

Infrastructure Investment

HS2 represents the most significant infrastructure project, despite ongoing political controversies and cost escalations. These investments compound Birmingham's accessibility advantages. HS2's arrival transforms Birmingham's national connectivity, with journey time improvements benefiting the entire West Midlands. Nearby Coventry's regeneration momentum partly stems from Birmingham's economic expansion and improved regional infrastructure.

When operational, journey times to London will reduce to approximately 45 minutes, fundamentally altering Birmingham's relationship with the capital. Businesses seeking London access without London costs will find Birmingham increasingly attractive, supporting both commercial and residential property demand.

Beyond HS2, ongoing transport improvements include Metro tram network expansion, New Street Station redevelopment completion, and continued motorway network enhancement.

Regeneration Momentum

City center regeneration continues transforming previously underutilized areas. Paradise development is creating substantial new commercial and residential space. Smithfield market redevelopment will deliver mixed-use regeneration in historically neglected areas. These projects demonstrate sustained investment confidence extending beyond immediate property speculation.

The Commonwealth Games 2022 legacy includes improved sports facilities, residential developments, and transport infrastructure particularly benefiting eastern Birmingham areas previously receiving limited investment attention.

Balanced Returns Profile

Birmingham typically delivers 5-6.5% gross yields on standard buy-to-lets, lower than Derby's 6.5-8% immediate returns but coupled with substantially stronger capital appreciation prospects over medium to long terms. Investors receive reasonable current yields (5.5-7%) alongside solid capital growth prospects (4-6% historically), avoiding the extreme trade-offs of choosing purely yield-focused or purely growth-focused markets.

This balance suits investors wanting both income and appreciation without accepting minimal current returns or sacrificing capital growth entirely for immediate cash flow.

Birmingham Investment Performance

Standard Buy-to-Let Returns

Typical Birmingham suburban property (£165,000 purchase in area like Erdington):

- Monthly rent: £850-£1,000

- Gross yield: 6-7%

- Net yield: 3.5-4.5%

- Capital growth: 4-6% annually (historical)

- Tenancy duration: 18-24 months average

Student HMO Performance

Selly Oak HMO property (£170,000, 5 rooms):

- Monthly rent: £1,400-£1,700 (£280-£340 per room)

- Gross yield: 9-10%

- Net yield: 6-7.5%

- Management intensity: High

- Void considerations: Summer months

Premium Buy-to-Let

Edgbaston family home (£280,000):

- Monthly rent: £1,400-£1,700

- Gross yield: 5-6%

- Net yield: 3-4%

- Tenant quality: Exceptional

- Tenancy duration: 24-36+ months

Market Considerations

Birmingham demonstrates consistent performance through economic cycles, though growth periods see stronger appreciation than more volatile markets subsequently correcting more sharply. This measured approach provides stability for long-term investors whilst potentially disappointing those seeking explosive short-term gains.

Competition for quality Birmingham properties remains substantial - the city's investment appeal is well-established rather than emerging opportunity. Decisive action when suitable properties appear proves essential, though this urgency shouldn't override thorough due diligence and proper financial analysis.

Birmingham's diverse neighborhoods support various investment approaches - student HMOs near universities, professional buy-to-lets in suburbs, city centre apartments for young professionals. This versatility resembles Leicester's varied investment opportunities whilst operating at considerably larger scale. Birmingham's sheer scale creates complexity - different neighborhoods function as distinct markets with varied tenant demographics and dynamics. Unlike Nottingham's relatively concentrated geography, Birmingham demands thorough area-specific research before committing capital.

Building PROPERTY Portfolios with Birmingham

Birmingham works effectively as either portfolio foundation or strategic addition to existing holdings, depending on investor circumstances and objectives.

As Portfolio Foundation

Birmingham's economic stability and diversity make it sensible anchor for multi-property portfolios. Starting with Birmingham establishes exposure to major city fundamentals whilst maintaining yields sufficient for portfolio growth through refinancing or savings accumulation.

The city's substantial size allows building entire portfolios within Birmingham boundaries, diversifying across different neighborhoods and strategies whilst maintaining geographic concentration simplifying management logistics.

As Strategic Addition

For investors with established Midlands holdings in Derby or Nottingham, Birmingham provides major city exposure and growth potential complementing more yield-focused regional properties. Geographic proximity allows managing multi-city Midlands portfolios efficiently without excessive travel.

Birmingham properties balance Nottingham's higher yields with Derby's simplicity, creating diversified risk profiles within coherent regional strategies.

Growth-Focused Positioning

Investors prioritizing capital appreciation over immediate income often weight portfolios toward Birmingham and Manchester, accepting moderate current yields in exchange for superior long-term value building. This approach suits investors with longer time horizons who can sustain modest current returns whilst building substantial equity.

Invest in Birmingham Property

Birmingham's investment opportunities span affordability levels, strategies, and neighborhoods, providing options for diverse investor circumstances and objectives. Birmingham's competitive market and neighborhood complexity make local expertise essential. Our established sourcing relationships identify optimal Birmingham opportunities across the city, matching areas to your investment criteria and risk tolerance

Whether you're attracted to city center growth, student market yields, or suburban stability, we provide comprehensive Birmingham analysis matching opportunities to your specific requirements.

FAQs ABOUT BIRMINGHAM property investment

How will HS2 affect Birmingham property investment?

HS2 completion will reduce London journey times to approximately 45 minutes, fundamentally strengthening Birmingham's appeal to businesses and residents seeking capital connectivity without London costs. Areas near proposed HS2 stations—particularly Curzon Street and surrounding neighborhoods—may experience enhanced appreciation as infrastructure materializes, though some value anticipation already occurred during announcement phases. However, HS2 timelines remain uncertain with ongoing political debates and cost concerns potentially delaying or modifying plans. Invest based on Birmingham's current fundamentals rather than speculative HS2 benefits, treating eventual infrastructure improvements as upside rather than essential return drivers. Our recommendations focus on neighborhoods demonstrating strong current demand rather than purely speculative proximity to proposed developments

Is Birmingham safer than other major cities for investment?

Birmingham, like all major cities, contains areas with varying safety profiles requiring neighborhood-specific evaluation rather than citywide generalizations. Premium areas like Edgbaston, Harborne, and Moseley demonstrate low crime rates comparable to affluent suburbs anywhere. City center experiences typical urban crime patterns—higher than suburban areas but comparable to Manchester or other major cities. Some neighborhoods, particularly parts of North and East Birmingham, face persistent challenges around antisocial behavior requiring careful property and street-level selection. Overall crime statistics show Birmingham improving over recent years with sustained police investment and community programs. Safety shouldn't deter Birmingham investment but should inform thorough area research ensuring properties sit in stable neighborhoods rather than problematic pockets.

Should I invest in Birmingham city center apartments?

Birmingham city center apartments suit specific investor profiles—those prioritizing capital growth over immediate yields, comfortable with leasehold complications and service charges, and targeting young professional tenants. Yields typically range 5-6.5%, moderate compared to suburban or student alternatives, but capital appreciation prospects remain solid given ongoing regeneration and economic growth. Carefully evaluate specific developments—some demonstrate strong demand and letting success, whilst others face challenges with build quality, management issues, or local oversupply. Avoid developments with excessive available units or clear tenant demand softening. Focus on established locations near major employment centers, proven developments with solid management, and realistic service charge levels. City center investment works best as portfolio diversification rather than sole holdings, balancing growth potential against lower yields.

How does Birmingham compare to Nottingham for investment?

Birmingham and Nottingham serve different investor priorities. Birmingham offers superior capital growth prospects (4-6% versus 3-4% in Nottingham), major city economic diversity, and stronger infrastructure investment visibility. Nottingham provides higher rental yields (6.5-7.5% BTL, 10-12% HMO versus Birmingham's 5.5-7% and 8-10% respectively) and lower entry costs (£120k-150k typical versus £150k-220k). Birmingham suits investors prioritizing long-term appreciation and major city fundamentals. Nottingham works better for yield-focused investors or those with limited capital. Many experienced investors maintain properties in both cities—Birmingham for growth, Nottingham for income—creating balanced Midlands portfolios optimizing different return characteristics.