Buy-to-Let Investment Advice and Strategy

Let LAT Property Investments DEMYSTIFY Buy-to-let with upto date advice to help with your property investment strategy

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

Buy-to-Let Investments

Buy-to-let property investment remains one of Britain's most accessible wealth-building strategies, allowing individuals with moderate capital to create tangible assets generating income whilst benefiting from long-term capital appreciation. Despite regulatory changes and tax modifications over recent years, strategically selected buy-to-let properties in fundamentally strong markets continue delivering positive returns for investors approaching the strategy with realistic expectations and proper guidance.

We provide comprehensive buy-to-let investment advice helping both first-time investors and experienced portfolio builders make informed decisions about property selection, location strategy, and long-term wealth creation. Our guidance emphasizes honest market assessment rather than promotional optimism, focusing on markets where genuine tenant demand, sound employment fundamentals, and viable property economics create sustainable investment opportunities.

Realistic buy-to-let expectations center on net rental yields of 5-6.5% after all costs in strong markets, combined with capital appreciation averaging 3-5% annually in well-selected locations. These returns compound powerfully over 10-15 year timeframes as tenants gradually pay down mortgages whilst property values appreciate. However, short-term thinking, insufficient capital reserves, or poor location selection frequently transforms potentially viable investments into disappointing outcomes.

Buy-to-let suits investors with minimum £30-40k available capital (ideally £50k+ for comfortable contingency), ability to secure buy-to-let mortgages, and patience for long-term wealth accumulation rather than immediate returns. The strategy rewards strategic thinking and disciplined execution whilst punishing impulsive decisions and inadequate research. Our role involves helping investors avoid common pitfalls whilst identifying opportunities aligned with their specific circumstances and objectives.

Why Buy-to-Let Investment Remains Viable

Current Market Reality

Buy-to-let investment has undeniably become more challenging following regulatory and tax changes introduced over the past decade. Section 24 tax relief restrictions, additional stamp duty surcharges on investment properties, enhanced mortgage stress testing, and stricter licensing requirements have collectively increased costs and complexity for landlords. Many commentators periodically declare buy-to-let "dead" or unviable, particularly following each new regulatory announcement.

However, carefully selected properties in fundamentally strong markets continue generating positive returns for strategic investors. The key distinction lies between indiscriminate buy-to-let investment—purchasing any property in any location based solely on affordability—and strategic investment focused on locations demonstrating robust tenant demand, sound employment fundamentals, and property prices supporting viable yields after realistic cost accounting.

Our buy-to-let guidance emphasizes markets where investment economics remain sound despite increased costs. England's strongest buy-to-let markets predominantly sit in Midlands and Northern regions where property prices remain accessible whilst rental demand stays robust. Derby properties purchased for £120-140k delivering £800-900 monthly rent, Leicester houses costing £180-220k generating £1,100-1,300 monthly income, or Birmingham properties at £200-250k producing £1,200-1,500 monthly rent all support positive cash flow and acceptable returns even after accounting for higher costs.

Conversely, many Southern markets outside London struggle providing viable buy-to-let returns. Properties costing £300-400k generating £1,500-1,800 monthly rent face difficulty covering mortgage costs, particularly at current interest rates, whilst offering limited capital appreciation potential beyond general inflation. Geographic selection increasingly determines investment viability—the same capital deployed in Derby versus Brighton produces dramatically different outcomes.

We guide investors toward locations where fundamentals support long-term success rather than chasing short-term "hotspots" or media-promoted opportunities frequently lacking sustainable tenant demand or viable economics.

Long-Term Wealth Building

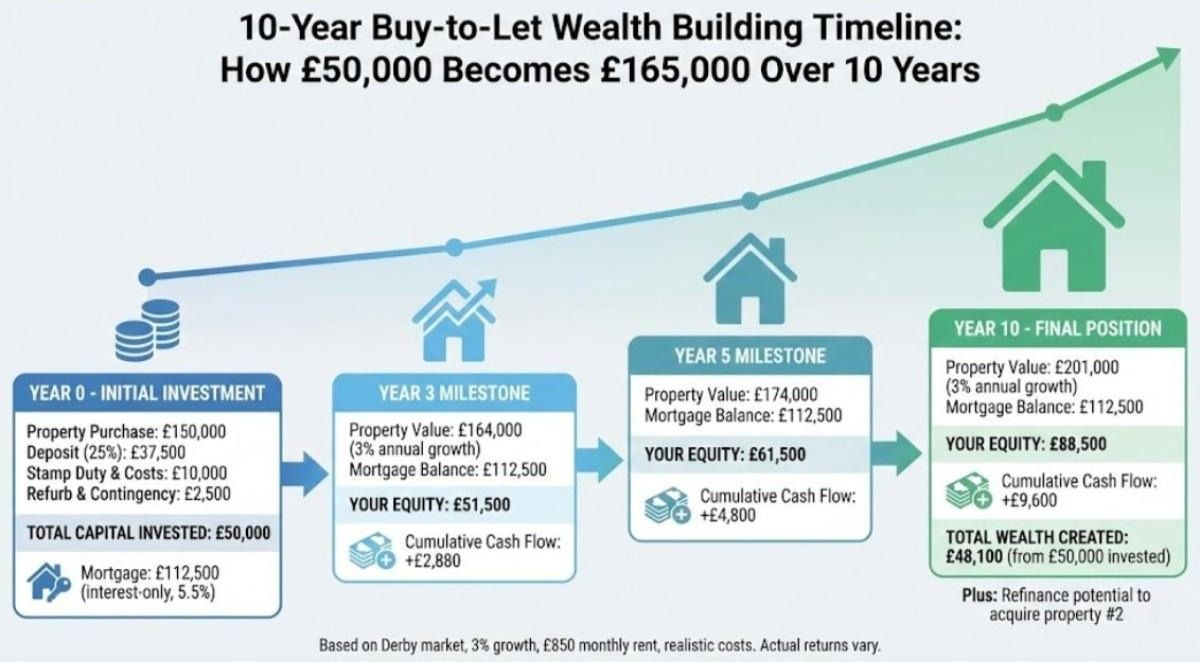

Buy-to-let's wealth-building power stems from tenant contributions toward mortgage pay-down combined with property value appreciation over extended timeframes. Consider a straightforward example demonstrating these mechanics:

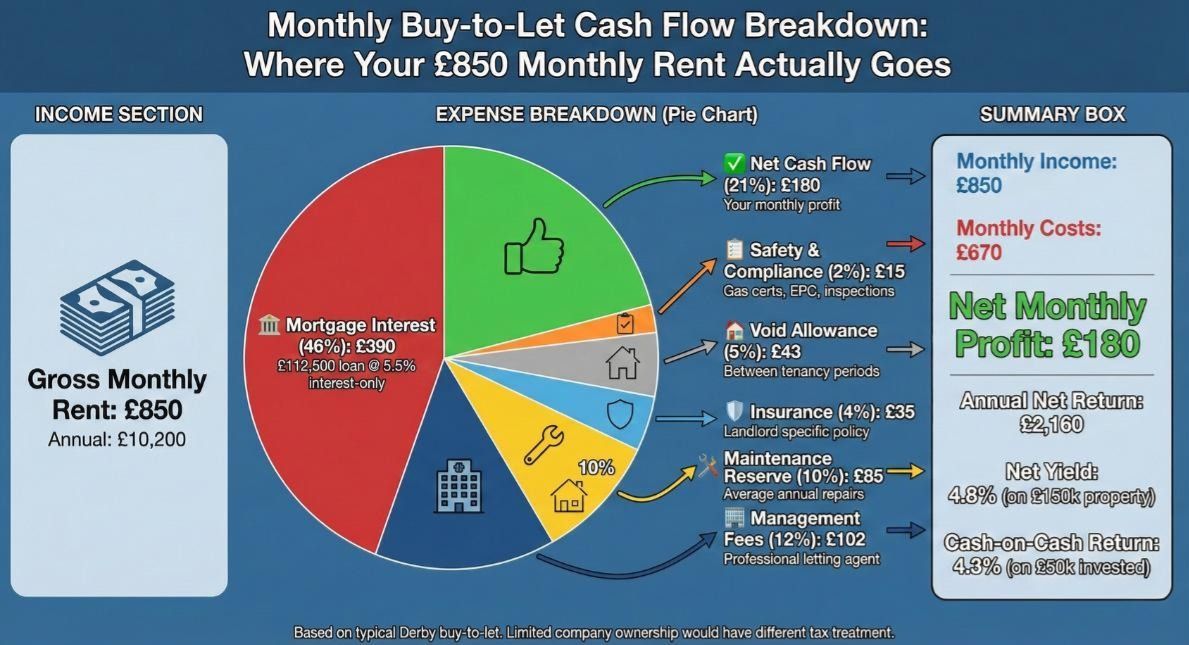

An investor purchases a £150,000 Derby property with £37,500 deposit (25%), securing a £112,500 interest-only mortgage at 5.5% annually. Monthly mortgage interest costs £516. The property generates £850 monthly rent. After management fees (£102), maintenance reserves (£75), insurance (£35), and void allowance (£40), net monthly income approximates £598, providing positive cash flow of £82 monthly after mortgage costs.

Over 15 years, assuming modest 3% annual property appreciation, the property value grows to £233,000. The investor's equity increases from initial £37,500 to £233,000 (property value) minus £112,500 (remaining mortgage) = £120,500. Additionally, cumulative positive cash flow over 15 years (£82 monthly × 180 months) adds approximately £14,760, though inflation reduces real value of these payments over time.

Total wealth creation: £120,500 final equity minus £37,500 initial equity = £83,000 gain, plus £14,760 cumulative cash flow = approximately £97,760 total return on £37,500 initial investment over 15 years. This represents roughly 13% average annual return combining equity growth with cash flow.

This simplified example excludes transaction costs, potential refinancing, and assumes consistent tenancy—real outcomes vary. However, it illustrates fundamental wealth-building mechanics: tenants fund mortgage interest whilst property appreciation builds equity. Capital repayment mortgages accelerate equity accumulation further, as portion of rent payments reduce mortgage balance monthly.

Portfolio compounding amplifies returns as initial properties appreciate. After several years, equity release through refinancing provides deposits for additional properties without requiring new capital injection. Investors starting with one property frequently build 3-5 property portfolios over 10-15 years through systematic equity recycling, multiplying wealth creation potential considerably beyond single-property returns.

However, these outcomes require patience and strategic discipline. Markets experiencing 10+ years without significant appreciation, extended void periods, or requiring substantial unexpected repairs can dramatically reduce actual returns versus theoretical projections. Realistic expectations and quality location selection prove essential.

Essential Considerations Before Investing

Capital Requirements

First-time buy-to-let investors frequently underestimate total capital requirements, focusing primarily on deposit amounts whilst overlooking substantial additional costs. Comprehensive capital planning prevents financial strain and forced sales during difficult periods.

Buy-to-let mortgages typically require minimum 25% deposits, though some lenders demand 30-40% depending on applicant circumstances and property characteristics. A £120,000 Derby property requires £30,000 minimum deposit at 25% LTV, whilst a £200,000 Leicester property demands £50,000. These represent starting points—additional capital needs extend beyond deposits significantly.

Stamp duty on investment properties includes standard rates plus 5% surcharge on entire purchase price. On a £150,000 property, stamp duty totals £7,500 (£2,500 standard rate plus £7,500 surcharge minus £2,500 nil-rate band = £7,500 total). On £200,000 properties, stamp duty reaches £10,500. These costs are due at completion and cannot be financed through mortgages.

Legal fees, surveys, mortgage arrangement fees, and valuation costs typically add £2,000-3,000 to transaction expenses. Properties requiring immediate refurbishment, redecoration, or repairs before letting add further costs—budget £3,000-8,000 for typical cosmetic works bringing properties to lettable standard.

Realistic total capital requirements for first buy-to-let investment:

- £120,000 Derby property: £30k deposit + £7.5k stamp + £2.5k transaction + £4k refurb + £4k contingency = £48k total

- £150,000 Leicester property: £37.5k deposit + £7.5k stamp + £2.5k transaction + £5k refurb + £5k contingency = £57.5k total

- £200,000 Birmingham property: £50k deposit + £10.5k stamp + £3k transaction + £6k refurb + £6k contingency = £75.5k total

Contingency funds covering 6-12 months' mortgage payments and operating costs prove essential. Unexpected major repairs, extended void periods, or economic downturns requiring temporary rent reductions occur periodically. Investors lacking adequate reserves face forced sales during unfavorable conditions, crystalizing losses and ending investment journeys prematurely.

We recommend minimum £40-50k total capital for viable first buy-to-let investment, with £60k+ providing comfortable contingency margins. Lower capital levels constrain options to potentially problematic properties or locations, increasing risk substantially.

Mortgage and Finance Fundamentals

Buy-to-let mortgages operate differently from residential mortgages, with distinct criteria and assessment methodologies. Understanding these requirements prevents wasted time pursuing unsuitable properties or experiencing finance-related purchase collapses.

Lenders assess buy-to-let mortgage affordability using Interest Coverage Ratios (ICR) rather than borrower income multiples. ICR requirements typically mandate rental income covering 125-145% of mortgage interest costs calculated at stress test rates (usually 5.5-6%, regardless of actual mortgage rate). A £112,500 mortgage at 5.5% stress rate generates £516 monthly interest. At 125% ICR, required rent is £645 monthly minimum; at 145% ICR, required rent reaches £748 monthly.

These calculations determine maximum loan amounts for specific properties based on achievable rents, not borrower affordability. A property generating £900 monthly rent supports approximately £140-155k maximum mortgage at typical ICR requirements, regardless of borrower income levels. Properties with rental income insufficient for ICR requirements cannot secure full 75% LTV financing, requiring larger deposits or alternative properties.

Most lenders require applicants earn minimum £25,000 annually from sources outside rental income, own their primary residence (no outstanding mortgage acceptable for some lenders), and demonstrate acceptable credit history. First-time landlords face more restrictive criteria and higher interest rates versus experienced landlords with existing portfolios.

Limited company versus personal ownership presents significant decision requiring professional tax advice. Limited company ownership offers corporation tax advantages (currently 19-25% versus income tax at 20-45%), full mortgage interest deductibility, and cleaner estate planning. However, limited company mortgages typically carry 0.5-1% higher interest rates, require more complex administration, and complicate future portfolio refinancing or sales.

We strongly recommend arranging mortgage agreements in principle before serious property hunting. Pre-approval clarifies maximum borrowing capacity, identifies any application issues requiring resolution, and prevents wasted time on properties ultimately unfinanceable. Experienced mortgage brokers specializing in buy-to-let finance prove invaluable navigating lender criteria variations and securing optimal terms.

Ongoing Costs and Cash Flow

Accurate ongoing cost projections separate realistic investment assessments from optimistic fantasies. Many first-time investors dramatically underestimate operating expenses, expecting gross rental income to translate directly to profit after mortgage costs alone.

Management fees for professional letting agents typically consume 10-12% of rental income, covering tenant finding, rent collection, property inspections, maintenance coordination, and compliance administration. On £900 monthly rent, management fees cost £90-108 monthly or £1,080-1,296 annually. Self-management eliminates these fees but requires significant time commitment and landlord expertise.

Maintenance and repairs average 10-15% of rental income annually over extended periods, though expenses fluctuate unpredictably year-to-year. Budget £750-1,350 annually for £900 monthly rent properties. Some years pass without major expenses; other years require new boilers (£2,000-3,000), roof repairs (£1,500-4,000), or drainage work (£1,000-2,000). Adequate reserves prevent financial strain when inevitable major expenses arise.

Insurance costs for landlord-specific policies typically run £300-600 annually depending on property value, construction type, and coverage levels. Standard home insurance proves inadequate for rental properties—specialist landlord insurance covers tenant-related risks, rent guarantee options, and appropriate liability protection.

Void periods—times between tenancies when properties generate no rental income—realistically average 4-6% annually in well-managed properties in strong markets. Plan for one month vacancy every 18-24 months as tenants move and new occupants are sourced. Poor locations or poorly maintained properties experience significantly higher void rates undermining investment viability.

Additional costs include annual gas safety certificates (£80-120), periodic electrical safety inspections (£150-250 every 5 years), EPC renewals (£60-100 every 10 years), and potential licensing fees in selective licensing areas (£500-1,000 per 5 years).

Comprehensive cost accounting for £900 monthly rent property:

- Gross annual rent: £10,800

- Management (12%): -£1,296

- Maintenance (12%): -£1,296

- Insurance: -£400

- Void (5%): -£540

- Safety certificates: -£120

- Net annual income: £7,148

On £112,500 mortgage at 5.5% interest-only, annual mortgage costs equal £6,188, leaving £960 positive cash flow annually (approximately £80 monthly). This represents realistic outcome for well-selected property—positive cash flow but modest absolute amounts. Higher leverage, worse locations, or inadequate maintenance reserves quickly convert positive to negative cash flow.

LAT's Strategic Buy-to-Let Guidance

Location Selection Strategy

Location determines approximately 80% of buy-to-let investment success—property type, price point, and condition prove largely irrelevant without fundamentally sound location supporting sustainable tenant demand and viable returns. Our strategic guidance centers on identifying locations where employment fundamentals, demographic trends, transport infrastructure, and property price to rent ratios create favorable investment conditions.

Strong employment diversity matters enormously. Cities dependent on single industries or major employers carry concentration risk—economic difficulties affecting dominant sectors cascade through entire rental markets. We prioritize locations with mixed employment bases across professional services, healthcare, education, retail, logistics, and manufacturing. Derby's accessible entry prices for first-time investors benefit from diverse manufacturing, professional services, and healthcare employment preventing over-reliance on any single sector.

Demographic trends influence long-term tenant demand sustainability. Areas attracting working-age populations through employment opportunities or lifestyle appeal demonstrate strengthening fundamentals. Conversely, regions experiencing population decline, aging demographics, or youth out-migration face weakening tenant markets regardless of current yields. Leicester's balanced buy-to-let fundamentals benefit from growing population, strong university presence creating steady young professional influx, and economic expansion diversifying employment beyond traditional manufacturing base.

Transport connectivity increasingly determines location viability. Direct rail connections to major employment centers expand tenant pools beyond purely local workers. Properties within 45-60 minutes of Manchester, Birmingham, or Leeds via regular train services attract commuters unable or unwilling to afford those cities' higher housing costs. Road infrastructure quality and motorway access similarly influence both tenant appeal and broader economic prospects.

Property price to rent ratios provide essential viability indicators. Areas where average property prices equal 15-20 times annual rent generally support viable investment returns. Ratios exceeding 25 times indicate overpriced markets where rental income struggles justifying purchase costs. Ratios below 12 times sometimes signal declining areas with weakening fundamentals despite superficially attractive yields. Birmingham's growth-focused characteristics demonstrate reasonable price-to-rent ratios around 18-20 times in many neighborhoods, balancing yield and growth potential.

We specifically avoid "hotspot" chasing—investing in locations promoted by media or property forums based on recent price growth or temporary demand spikes. These areas frequently experience rapid investor interest inflating prices beyond sustainable levels, followed by corrections when growth moderates. Our focus remains on locations demonstrating consistent, long-term fundamentals rather than short-term excitement or speculative potential.

Property Type and Tenant Matching

Successful buy-to-let investment requires matching property types to tenant demographics prevalent in specific locations. Mismatches between property configuration and tenant needs create extended void periods, lower achievable rents, and problematic tenancies.

Terraced houses suit professional couples or small families, particularly in suburban locations near good schools and transport links. These properties typically offer 2-3 bedrooms, small gardens, and off-street parking where available. They generate steady demand from stable, long-term tenants valuing space and local amenities over city center proximity.

Semi-detached properties appeal primarily to families requiring 3-4 bedrooms, larger gardens, and quieter residential locations. These tenants typically stay longer (3-5 years common), reducing turnover costs and void periods. However, family properties command lower yields than smaller units relative to purchase price, and dependent on school catchment areas and local amenities.

Apartments and flats attract young professionals, couples without children, and individuals prioritizing convenience and lower maintenance over space. City center or well-connected suburban apartments near employment hubs generate consistent demand but often face higher service charges and building insurance costs reducing net returns. Modern, purpose-built apartments typically prove easier to let than older conversions in poorly maintained buildings.

Avoid property types with narrow tenant appeal unless deliberately targeting niche markets. Studio apartments, one-bedroom properties in family-oriented suburbs, large family homes in city centers, or unusual configurations limiting furnishing flexibility all suffer restricted tenant pools creating letting difficulties and extended voids.

Property condition significantly impacts lettability and maintenance costs. Newly refurbished properties command premium rents and attract quality tenants but require substantial upfront capital. Cosmetically tired but structurally sound properties offer value-add opportunities through strategic improvements but demand renovation expertise and project management capability. Properties requiring major structural works or systems replacement rarely suit first-time investors lacking experience accurately estimating costs and timescales.

Our property sourcing service matches property types to specific locations and investor capabilities, identifying opportunities where property configuration aligns naturally with local tenant demographics and investor experience levels.

Realistic Return Expectations

Accurate return projections require comprehensive cost accounting and realistic appreciation assumptions based on long-term market fundamentals rather than recent short-term performance.

Gross rental yields in our core markets typically range 5.5-7% for standard buy-to-let properties. Derby properties delivering 7-8% gross yields, Leicester properties at 6-7%, Birmingham properties at 5.5-6.5%, depending on specific neighborhoods and property types. These gross figures provide useful comparison metrics but dramatically overstate actual investor returns.

Net rental yields after all operating costs realistically settle 4-5.5% in well-managed properties. A property delivering 7% gross yield typically nets 4.5-5% after management, maintenance, insurance, voids, and safety compliance costs. This net yield calculation excludes mortgage costs—it represents return on total property value regardless of financing structure.

Capital appreciation varies considerably between locations and timeframes. Strong markets historically average 3-5% annual appreciation over extended periods, though individual years fluctuate dramatically—some years see 8-10% growth, others experience flat or declining values. Conservative projections use 3% annually, recognizing this matches general inflation. Expecting appreciation substantially exceeding inflation requires exceptional confidence in specific location fundamentals.

Total returns combining net rental yield and capital appreciation typically deliver 7-10% annually over 10-15 year periods in well-selected markets. A property with 5% net yield and 4% annual appreciation provides 9% total return. However, these returns require patience through market cycles—short-term periods may deliver minimal or negative returns before long-term averages materialize.

Leverage amplifies returns significantly but also increases risk. A 75% LTV mortgage means investor equity equals 25% of property value. That property's total return (combining yield and appreciation) applies to investor's equity rather than total value, potentially tripling or quadrupling percentage returns on invested capital. However, leverage equally amplifies losses during market downturns and carries mandatory interest costs reducing net cash flow.

We emphasize conservative projections preventing disappointment and facilitating appropriate investment decisions. Properties delivering strong returns beyond conservative estimates provide pleasant surprises; those failing to meet optimistic projections create financial stress and forced sales crystallizing losses.

Common Mistakes First-Time Investors Make

First-time buy-to-let investors repeatedly make predictable mistakes undermining investment success. Understanding these common pitfalls helps investors avoid expensive learning experiences.

Chasing highest advertised yields proves particularly dangerous. Properties marketed with 9-10% gross yields in unfamiliar locations frequently carry hidden problems—high crime areas, concentrated economic dependence on declining industries, oversupplied rental markets, or property condition issues requiring substantial ongoing maintenance. Genuine high-yield opportunities exist, but they demand thorough due diligence verifying sustainable fundamentals rather than surface yield appeal.

Underestimating ongoing costs and void periods creates cash flow difficulties when reality exceeds optimistic projections. Investors calculating returns using gross yields with minimal expense allowances face unpleasant surprises when actual costs consume projected profits. Conservative cost projections—management at 12%, maintenance at 12%, voids at 5%, plus insurance and compliance costs—prevent this mistake.

Buying in unfamiliar locations without local knowledge frequently results in poorly performing investments. Properties appearing attractive on spreadsheets prove problematic when local market realities emerge—difficult tenant demographics, limited letting agent quality, unexpected maintenance issues common to local property construction types, or declining neighborhood trajectories not apparent from data alone. Invest only where you possess genuine understanding or receive guidance from advisors with authentic local expertise.

Insufficient capital reserves for unexpected expenses forces investors into difficult decisions when major repairs arise or extended void periods occur. Properties requiring £4,000 boiler replacement when investors hold £1,500 reserves create genuine hardship—borrowing additional funds or deferring essential repairs both carry serious consequences. Maintain minimum six months' operating costs and mortgage payments as liquid contingency.

Expecting immediate profitability or quick returns reflects fundamental misunderstanding of buy-to-let investment timeframes. Wealth builds gradually through mortgage pay-down and appreciation over years, not through immediate large profits. Investors requiring rapid returns or treating buy-to-let as "get rich quick" schemes invariably face disappointment and frequently exit strategies prematurely, crystallizing losses before long-term benefits materialize.

LAT's Buy-to-Let Advisory Process

Our buy-to-let advisory service provides structured guidance helping investors make informed decisions aligned with their specific circumstances and long-term objectives.

Initial consultation establishes investment goals, available capital, mortgage capacity, and experience levels. We assess whether buy-to-let investment suits specific circumstances or if alternative strategies better serve stated objectives. This honest assessment sometimes involves recommending investors delay property investment until capital reserves strengthen or circumstances improve—we prioritize long-term investor success over immediate transaction generation.

Strategic market recommendations identify locations where employment fundamentals, demographic trends, and property economics create favorable conditions for specific investor profiles. First-time investors typically benefit from Derby's straightforward, lower-capital-requirement opportunities. More experienced investors with larger capital pools might pursue Birmingham or Manchester markets offering stronger growth potential despite higher entry costs and complexity.

Property sourcing aligned with tenant demand identifies specific opportunities matching strategic recommendations. We present properties demonstrating clear tenant appeal through appropriate configuration, condition, and pricing relative to local rental markets. Our sourcing process emphasizes genuine investment viability rather than simply identifying available stock.

Ongoing support through purchase process assists investors navigating surveys, mortgage applications, legal procedures, and completion logistics. First-time buy-to-let purchases involve considerably more complexity than residential purchases—proper guidance prevents costly mistakes and transaction failures.

Post-purchase guidance on management and strategy continues beyond completion. We help investors select appropriate letting agents, establish effective management systems, and develop long-term portfolio growth strategies. Buy-to-let investment represents beginning of ongoing property ownership journey rather than discrete transaction—continued guidance supports sustained success.

Ready to Improve your Understanding of Buy-to-Let options?

Contact us today to arrange your 1-2-1 property investment advice, or complete our online enquiry form for a call back at your convenience.

Frequently Asked Questions About Buy-to-Let Investment

Is buy-to-let still profitable after the Section 24 tax changes?

Yes, buy-to-let remains profitable in strategically selected locations, though Section 24 has significantly impacted higher-rate taxpayers by restricting mortgage interest tax relief to basic rate (20%) only. Higher-rate taxpayers (40% bracket) previously claimed full mortgage interest as deductible expense but now receive only 20% tax credit, effectively increasing their tax liability substantially. This change particularly affects highly leveraged portfolios with large mortgages relative to rental income. However, investors can mitigate impact through limited company ownership (where full mortgage interest remains deductible against corporation tax at 19-25%), or by focusing on lower-leverage investments where mortgage interest represents smaller proportion of costs. Additionally, properties in markets delivering strong capital appreciation help offset reduced income tax efficiency—Derby, Leicester, and Birmingham properties we recommend typically generate sufficient total returns (combining yield and growth) to remain viable even for higher-rate taxpayers. Basic-rate taxpayers (20% bracket) experience minimal Section 24 impact since they now receive equivalent 20% tax credit. We provide tailored advice assessing tax implications for your specific circumstances and recommend appropriate ownership structures maximizing after-tax returns.

How much deposit do I really need for my first buy-to-let property?

Most buy-to-let mortgages require minimum 25% deposit, though this represents only starting point for total capital requirements. For a £150,000 property, a 25% deposit equals £37,500. However, you'll also need approximately £7,500 for stamp duty (including 5% investment property surcharge), £2,000-3,000 for legal fees, surveys, and mortgage costs, £3,000-5,000 for any immediate refurbishment or furnishing, and crucially, £5,000-10,000 contingency reserve covering unexpected expenses and potential void periods. Realistic total capital requirement for £150,000 property therefore sits around £55,000-63,000. We generally recommend first-time buy-to-let investors have minimum £50,000 total available capital, with £60,000+ providing comfortable safety margins. Lower capital levels severely constrain location and property options, often forcing investors toward lower-quality properties or problematic areas where yields appear attractive but tenant demand proves unreliable. Insufficient contingency reserves create genuine financial stress when inevitable major repairs arise or extended void periods occur. Properties priced £120,000-140,000 in areas like Derby can reduce total capital requirements to £45,000-50,000, making them accessible entry points for investors with more limited capital availability while still maintaining investment viability.

Should I buy through a limited company or in my personal name?

This decision depends primarily on your income tax bracket, long-term portfolio ambitions, and inheritance planning objectives—there's no universal "correct" answer. Limited company ownership offers significant advantages for higher-rate taxpayers, as mortgage interest remains fully deductible against corporation tax (19-25%) rather than receiving only 20% tax credit under personal ownership. Companies also facilitate cleaner inheritance planning, allow flexible profit extraction timing, and simplify adding properties without repeated stamp duty on ownership transfers. However, limited company mortgages typically carry 0.5-1% higher interest rates than personal mortgages, require more complex administration including annual accounts and Corporation Tax returns, and create complications if you later wish to transfer properties to personal ownership (triggering capital gains tax and stamp duty). For basic-rate taxpayers planning modest portfolios (1-3 properties), personal ownership often proves simpler and cheaper overall. For higher-rate taxpayers building substantial portfolios (5+ properties), limited company structures typically deliver superior after-tax returns despite higher mortgage costs. We strongly recommend consulting qualified tax advisors before deciding—they'll model specific scenarios for your circumstances showing projected after-tax outcomes under each structure, accounting for your income level, mortgage requirements, and portfolio ambitions over 10-15 year timeframes.

What are realistic rental yields I should expect in different locations?

Realistic net rental yields after all operating costs typically range 4-5.5% in fundamentally strong markets across England. Gross yields (before expenses) might reach 6-8% in more affordable Northern and Midlands markets, but comprehensive cost accounting—management fees (10-12%), maintenance reserves (10-15%), insurance, void allowances (4-6%), and safety compliance—reduces net yields substantially. Derby properties often deliver 7-8% gross yields translating to 5-5.5% net yields after costs. Leicester properties typically provide 6-7% gross yields producing 4.5-5% net yields. Birmingham properties generally offer 5.5-6.5% gross yields resulting in 4-4.5% net yields, though stronger capital appreciation potential partially compensates for lower income yields. Be extremely cautious of advertised yields exceeding 10% gross—these typically indicate problematic locations with weak tenant demand, high crime, economic decline, or properties requiring substantial ongoing maintenance undermining net returns. Properties genuinely delivering sustainable 8%+ net yields exist but represent rare exceptions requiring exceptional circumstances—most commonly HMO properties with their attendant higher complexity and management intensity. Focus primarily on total returns combining realistic net yields with probable capital appreciation over 10+ years rather than chasing maximum gross yield figures. Well-selected properties delivering 4.5-5% net yield plus 3-4% annual appreciation provide 7.5-9% total returns annually—excellent long-term wealth-building performance when compounded over extended periods through leveraged investment structures.

How long should I plan to hold a buy-to-let property?

Plan minimum 5-7 years, ideally 10-15 years, for buy-to-let investments to justify transaction costs and allow sufficient time for mortgage pay-down and capital appreciation to materialize. Property investment involves substantial upfront costs—stamp duty, legal fees, surveys, refurbishment—typically totaling 8-12% of purchase price. Selling within 2-3 years rarely allows sufficient appreciation to recover these costs plus estate agent selling fees (1-2%) and solicitor costs, particularly after accounting for capital gains tax on profits. Markets also fluctuate unpredictably over short periods—5-7 year holding periods provide better probability of selling during favorable conditions rather than being forced to sell during market downturns. Additionally, mortgage pay-down mechanics require years to build meaningful equity through tenant rent contributions—interest-only mortgages provide no pay-down, whilst repayment mortgages take 5-10 years before significant principal reduction occurs. Properties experiencing £3,000-4,000 annual maintenance, void, and operating costs need multiple years of rent increases and capital appreciation to overcome these drains on total returns. Investors requiring capital access within 3-5 years should seriously reconsider whether buy-to-let suits their timeframes—property proves relatively illiquid compared to stocks, requiring months to market and sell, with sales timing dependent on market conditions beyond investor control. Those comfortable with 10-15+ year investment horizons maximally benefit from compounding returns, mortgage pay-down, and portfolio equity recycling enabling additional property acquisitions without new capital injection. The most successful buy-to-let investors we work with view properties as long-term wealth accumulation vehicles rather than short-term profit generators, holding properties through market cycles and building substantial equity over decades.