Lease Option Agreements

Let LAT Property Investments HELP WITH LEASE OPTION AGREEMENTS

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

PROPERTY LEASE OPTION agreements

Lease option agreements represent specialist property investment strategies allowing investors to control properties, generate rental income, and potentially purchase at predetermined prices—without requiring deposits or mortgage financing. These arrangements combine two distinct legal components: a lease granting property control for agreed monthly payments, and an option providing the right (but not obligation) to purchase at a specified future price.

Lease options suit experienced investors comfortable with complex negotiations, sophisticated legal structures, and significant risks inherent in controlling assets they don't own. Finding suitable opportunities proves exceptionally challenging—property owners willing and able to enter lease option agreements represent tiny fractions of available market stock, typically requiring extensive networking and repeated approaches before securing viable deals.

We occasionally identify lease option opportunities when specific circumstances align—property owners facing genuine challenges where lease options provide optimal solutions, properties with suitable rental potential creating viable profit margins, and legal structures protecting all parties appropriately. However, lease options do not represent our primary focus. Conventional buy-to-let strategies typically deliver superior risk-adjusted returns for most investors, whilst our primary property sourcing focus centers on traditional purchase opportunities offering more reliable outcomes.

Investors approaching lease options must understand substantial complexity, legal costs, and significant risks involved. This strategy demands professional legal advice, thorough due diligence, and realistic expectations about deal availability and potential complications. We do not provide lease option education or training—investors should already understand mechanics thoroughly before pursuing opportunities seriously.

How Lease Option Agreements Work

Lease option agreements comprise two interconnected legal contracts creating single unified arrangement between property owner and investor.

The Lease Component establishes investor's right to occupy and control the property for specified period, typically 3-10 years though longer terms occasionally occur. The investor makes monthly payments to the property owner, usually structured to cover the owner's mortgage interest, buildings insurance, and potentially ground rent on leasehold properties. These payments are contractually fixed regardless of rental income the investor generates from sub-tenants.

The Option Component grants the investor exclusive right to purchase the property at predetermined price at any point during the option period. This purchase price is fixed when the agreement is created, regardless of subsequent market value changes. Crucially, the investor holds the right but not obligation to purchase - they can walk away at option expiry without buying, though they forfeit all payments made and any upfront option fee.

The upfront option fee, whilst potentially nominal (£1 in some cases), provides essential legal consideration making the option binding. In practice, meaningful option fees range from several hundred to several thousand pounds, reflecting option value and negotiating dynamics between parties.

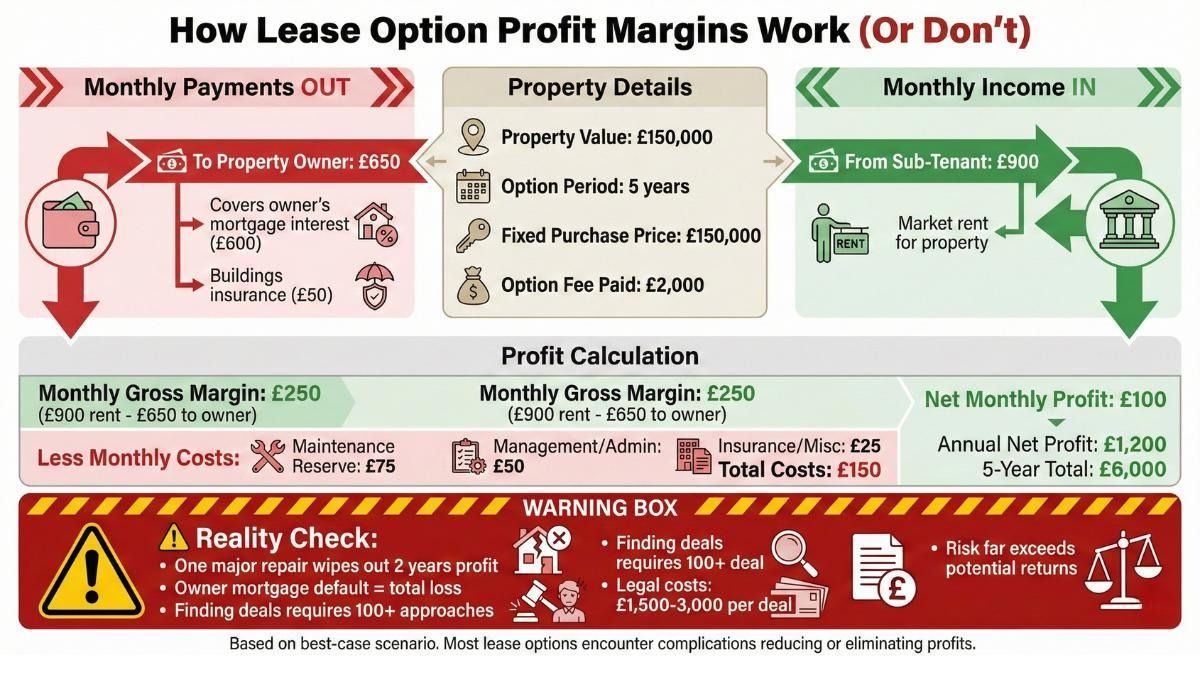

Profit generation occurs through rental income spread—the difference between payments made to the property owner and rent received from sub-tenants. A property where the owner's mortgage interest costs £600 monthly but achieves £900 monthly market rent creates £300 monthly gross profit before maintenance and management costs. Over a 5-year option period, this represents £18,000 gross profit. Additionally, if property values appreciate substantially above the fixed purchase price, exercising the option and immediately selling can generate capital profits.

However, this simplified example excludes numerous costs, risks, and complications making real-world lease option profitability considerably more challenging than theoretical calculations suggest.

Why Property Owners Consider Lease Options

Lease options suit property owners facing specific challenging circumstances where conventional selling proves problematic or impossible. Understanding vendor motivations helps investors identify potentially viable opportunities whilst recognizing why suitable deals prove exceptionally rare.

Negative equity represents the most common scenario where lease options provide solutions. Owners whose property values have fallen below outstanding mortgage balances cannot sell without bringing additional funds to repay shortfalls. For owners needing to relocate for employment, family circumstances, or relationship breakdown, continuing mortgage payments on properties they cannot occupy creates genuine financial hardship. Lease options allow mortgage coverage without forced sales crystallizing losses, whilst retaining potential future ownership if values recover.

Landlord burnout occasionally creates opportunities. Some owners initially purchased as investments but subsequently discovered landlord responsibilities—tenant management, maintenance coordination, regulatory compliance—exceed their capability or appetite. Rather than selling potentially at unfavorable times, lease options delegate operational burdens whilst retaining ownership and potential future benefits. However, many such owners simply sell conventionally, making this motivation less reliable than negative equity situations.

Relocation without immediate sale pressure sometimes encourages lease option consideration. Owners moving for temporary work assignments or personal circumstances who expect returning within several years might prefer mortgage coverage to forced sales. However, most such owners pursue conventional letting, making lease options their consideration only when personal circumstances prevent direct landlord involvement.

Complex ownership situations—disputed inheritances, divorce proceedings, or partnership dissolution—occasionally create scenarios where immediate sales prove impossible but mortgage coverage remains essential. Lease options provide temporary solutions pending final ownership resolution.

Despite these scenarios, property owners willing to enter lease options remain extremely rare. Most negative equity situations involve owners who simply cannot afford leaving properties, most burnt-out landlords sell conventionally, and most relocating owners use standard lettings. Finding suitable deals demands approaching dozens or hundreds of potential situations before identifying single viable opportunity.

Investor Benefits and Profit Mechanics

Lease options offer distinctive advantages for investors capable of navigating inherent complexities and accepting associated risks.

Property control without capital deployment represents lease options' primary appeal. Traditional buy-to-let investment on £150,000 property requires £37,500 deposit plus £10,000+ transaction costs—approximately £50,000 total capital. Lease option agreements on equivalent properties might require just £1,000-3,000 option fee plus first month's payment to the owner, perhaps £3,500-4,000 total. This capital efficiency allows investors with limited funds to control multiple properties impossible to acquire through conventional purchase.

Immediate positive cash flow occurs when rental income exceeds payments to owners plus operating costs. Properties where owner's costs total £650 monthly but market rent reaches £950 create £300 monthly gross margin. After allowing £100 monthly for maintenance and management, net cash flow approximates £200 monthly or £2,400 annually. Over 5-year option periods, cumulative cash flow reaches £12,000 before any capital appreciation benefits.

Leveraged capital appreciation provides additional profit potential. Properties with fixed £150,000 purchase prices appreciating to £180,000 over option periods create £30,000 paper gains. Investors exercising options and immediately reselling capture this appreciation, though various costs including stamp duty on purchase, estate agent fees on sale, and capital gains tax reduce net proceeds substantially.

Portfolio scaling beyond mortgage capacity benefits experienced investors who have exhausted borrowing capacity through conventional mortgages. Buy-to-let mortgage availability depends on income multiples and existing debt—investors holding 5-10 mortgaged properties frequently cannot secure additional borrowing regardless of deal quality. Lease options bypass mortgage requirements entirely, allowing unlimited portfolio expansion subject only to finding viable deals and managing operational complexity.

However, these benefits come with substantial corresponding risks and challenges frequently outweighing advantages for most investors.

Significant Risks and Challenges

Lease option investments carry numerous substantial risks often inadequately appreciated by investors attracted to low capital requirements and potentially high returns.

Deal sourcing difficulty cannot be overstated. Suitable lease option opportunities represent perhaps 0.1-0.5% of total property market stock—most property owners sell conventionally even when circumstances initially suggest lease option suitability. Identifying potentially interested owners requires approaching hundreds of distressed sale situations, contacting owners in negative equity through mortgage arrears databases, networking with estate agents handling problematic sales, or advertising directly seeking lease option candidates. Most approaches yield nothing, whilst viable opportunities demand extensive negotiation reaching mutually acceptable terms.

Owner mortgage default represents critical risk beyond investor control. If owners fail maintaining their mortgage payments despite receiving investor's lease payments, lenders can repossess properties during option periods. Investors lose all lease payments made, lose sub-tenant rental income streams, face potential liability to sub-tenants for displacement, and forfeit any option value from property appreciation. Protecting against this risk requires monitoring owner's mortgage account (requiring owner consent and lender cooperation, both rarely granted) or obtaining indemnity insurance (expensive and difficult to source).

Lender consent requirements prove particularly problematic. Most residential mortgage terms prohibit letting properties without explicit lender consent, and prohibit any arrangement resembling sale or transfer of equitable interest—which lease options arguably represent. Lenders rarely grant consent for lease option arrangements, viewing them as circumventing standard lending criteria. Operating without consent provides lenders grounds for demanding immediate full mortgage repayment, triggering potential repossession. Some investors proceed without disclosure, accepting this substantial risk, whilst others abandon otherwise attractive deals when consent proves unobtainable.

Owner circumstances changing creates various complications. Owners facing bankruptcy, divorce, or serious illness may be unable or unwilling to honor agreements. Owners improving their financial situations may decide selling conventionally yields better outcomes than honoring below-market fixed option prices. Owners simply changing their minds present enforcement challenges—whilst option agreements are legally binding, compelling unwilling owners to sell through court action proves expensive, time-consuming, and uncertain.

Maintenance obligations during lease periods create ongoing costs and responsibilities. Investors typically assume property maintenance duties, absorbing costs that cannot be anticipated accurately. Major structural issues—roof failures, subsidence, drainage collapses—can cost tens of thousands of pounds, completely eliminating multi-year profit accumulations. Clarifying maintenance responsibility divisions proves essential but cannot eliminate financial exposure to unexpected major repairs.

Sub-tenant complications add operational layers. Investors must find, reference, manage, and potentially evict tenants in properties they do not own. Sub-tenants facing issues may research ownership discovering arrangements, potentially questioning investor's authority. Properties requiring possession for sale when exercising options face delays if sub-tenants refuse vacating or require formal possession proceedings.

These risks mean many seemingly attractive lease option deals ultimately deliver disappointing outcomes or outright losses despite initial promising projections..

Legal and Regulatory Requirements

Lease option agreements demand specialist legal advice and proper structure protecting all parties' interests—costs that reduce overall investment viability.

Specialist solicitors experienced in lease options prove essential. Standard conveyancing solicitors typically lack expertise in these relatively uncommon structures and may draft inadequate agreements leaving parties exposed. Specialist advice typically costs £1,500-3,000 per agreement—substantial relative to many deals' potential returns. Both investor and property owner should obtain independent legal advice ensuring full understanding of commitments, rights, and risks.

Lender mortgage consent requires formal application and approval, as discussed previously. Investors must verify owners obtaining proper consent or consciously accept risks of proceeding without. Some investors require owners providing written lender consent as agreement conditions precedent, whilst others accept owner declarations regarding consent status.

Land Registry protection through notice registration alerts subsequent parties to option existence, preventing owners selling to third parties without disclosing options. Registration costs are modest but require proper legal documentation and processing. Unregistered options risk owners selling properties to innocent purchasers unaware of option rights, potentially leaving investors with damages claims against dishonest owners rather than property acquisition rights.

Insurance considerations prove complex. Buildings insurance typically remains owner's responsibility, though investors should verify adequate coverage exists. Contents insurance for investor-owned items and public liability coverage for investor's occupation require separate policies. Some insurers refuse coverage for lease option arrangements, whilst others charge premium rates reflecting perceived additional risks.

Tax implications require professional advice. Investors receiving rental income pay income tax on profits after allowable expenses—lease payments to owners constitute deductible expenses. Exercising options and subsequently selling properties triggers capital gains tax on appreciation from exercise price to sale price. Stamp duty applies at full rates when exercising purchase options, potentially creating substantial unexpected costs if property values have appreciated significantly.

All parties should understand these requirements thoroughly before proceeding—inadequate legal structure or ignoring compliance requirements creates substantial downstream problems potentially exceeding any investment profits.

LAT's Approach to Lease Options

We maintain deliberately conservative approach toward lease option opportunities, reflecting realistic assessment of strategy's challenges, risks, and limited availability.

Lease options do not represent our primary sourcing focus or expertise. We occasionally identify situations where all necessary elements align—financially distressed owners genuinely benefiting from lease option solutions, properties with sufficient rental value to support viable investor returns, and legal structures adequately protecting all parties. When such opportunities arise, we present them to experienced investors who demonstrate thorough strategy understanding and proper professional advice arrangements.

However, we actively discourage investors viewing lease options as primary portfolio growth strategies. Finding consistent deal flow proves virtually impossible—most investors pursuing lease options aggressively invest enormous time approaching countless potential situations before securing single viable deal. The time investment required frequently exceeds returns generated, particularly when accounting for inevitable deal failures, complicated situations consuming weeks of negotiation before collapse, and successful deals subsequently encountering unforeseen problems.

We do not provide lease option education, training, or mentoring. Investors approaching us regarding lease options should already understand mechanics thoroughly, have accessed specialist legal advice, and realistically assessed whether strategy suits their circumstances, risk tolerance, and available time. We assume investors contacting us about lease options are experienced property investors capable of independent due diligence rather than newcomers seeking introduction to creative strategies.

For most investors, conventional buy-to-let strategies deliver superior risk-adjusted returns with dramatically fewer complications. For investors comfortable with increased complexity, joint venture opportunities often provide better partnership structures with clearer legal frameworks and shared risk than lease options with financially distressed owners.

We will continue identifying occasional lease option opportunities when circumstances warrant, but investors should not expect regular deal flow or consider this strategy core to portfolio development plans we recommend.

Contact us today to arrange your lease option agreement, or complete our online enquiry form for a call back at your convenience.

Frequently Asked Questions About Lease Option Agreements

How much money do I actually need to start with lease option investments?

Lease options require substantially less upfront capital than traditional property purchases—typically £2,000-5,000 covering option fees, first month's payment to the owner, legal costs, and initial working capital. However, this apparent low entry barrier proves misleading for several reasons. Specialist legal advice costs £1,500-3,000 per agreement, consuming significant portion of initial capital. You'll need sufficient reserves covering unexpected maintenance issues, potential void periods between sub-tenants, and monthly payments to owners during any rental vacancies—budget minimum £5,000-8,000 liquid reserves per property. Additionally, finding viable deals demands extensive time investment approaching countless potential opportunities before securing agreements—this time cost, whilst not monetary, represents real economic cost many investors underestimate. Most importantly, lease options suit experienced investors who already understand property fundamentals, tenant management, and negotiation—attempting lease options as first property investment frequently results in expensive mistakes. We recommend investors have successfully operated at least 2-3 conventional buy-to-let properties before attempting lease option strategies, ensuring foundational property knowledge before adding complexity of controlling assets you don't own. The "no money down" marketing surrounding lease options dangerously oversimplifies capital requirements and ignores substantial hidden costs making strategy considerably more expensive than superficial analysis suggests.

Are lease option agreements actually legal in the UK?

Yes, lease option agreements are entirely legal and have long-standing basis in English property law. The option component derives from established contract law principles allowing parties to agree future purchase rights, whilst the lease component represents standard tenancy arrangements. However, legality doesn't eliminate significant complications requiring careful navigation. The primary legal challenge involves lender mortgage consent—most residential mortgage terms prohibit letting properties without explicit lender permission and prohibit any arrangement transferring equitable interest in properties. Lease options arguably create equitable interest transfers, meaning many lenders refuse consent even when technically their mortgage terms might allow letting. Operating lease options without lender consent, whilst not criminal, provides lenders contractual grounds for demanding immediate full mortgage repayment and potentially repossessing properties. This risk means many otherwise suitable lease option opportunities prove unworkable when owners cannot obtain lender consent. Additionally, improperly structured agreements may be challenged or set aside by courts if deemed "unfair" or insufficiently protecting property owners' interests—which is why both parties obtaining independent specialist legal advice proves essential. Tax authorities also scrutinize lease option arrangements ensuring proper income tax treatment and stamp duty payment when options are exercised. All parties must understand these legal complexities and structure agreements properly with specialist solicitor involvement—attempting DIY lease option agreements using internet templates creates substantial legal exposure potentially costing far more than proper legal advice.

How do I find property owners willing to do lease option deals?

Finding lease option opportunities represents the strategy's greatest practical challenge, requiring extensive, sustained effort with very low success rates. Most investors pursuing lease options aggressively report approaching 50-100+ potential situations before securing single viable agreement. Effective sourcing strategies include: monitoring mortgage arrears and repossession lists identifying owners in financial distress (though data access proves increasingly restricted under privacy regulations); networking with estate agents handling "unmortgageable" properties or distressed sales where owners face negative equity; advertising directly in local publications or online platforms targeting owners struggling with mortgage payments; attending property auctions speaking with unsuccessful bidders or withdrawn lot owners; and building referral networks with solicitors, insolvency practitioners, and debt advisors who encounter clients where lease options might provide solutions. However, even when identifying potentially suitable owners, converting conversations into signed agreements proves extremely difficult—most owners ultimately choose conventional sales despite negative equity, or simply cannot obtain necessary lender consent making agreements impossible. Success requires exceptional persistence, highly developed negotiation skills, ability to explain complex arrangements to often financially distressed and unsophisticated property owners, and realistic expectations that majority of time investment yields no results. Many investors pursuing lease options seriously treat it essentially as full-time business activity, dedicating 20-40 hours weekly to sourcing and negotiating, for results of perhaps 2-4 completed deals annually. This time investment makes strategy unsuitable for investors seeking passive income or part-time involvement—lease option sourcing demands active, persistent, professional approach more resembling business development than traditional property investment.

What happens if the property owner stops paying their mortgage during my lease option?

Owner mortgage default represents one of lease option investment's most serious and largely uncontrollable risks. If the owner fails maintaining mortgage payments—whether due to continued financial difficulties, bankruptcy, death, or simple dishonesty—the lender can commence repossession proceedings potentially culminating in property sale. As the lease option holder, you have extremely limited ability to prevent this outcome. You do not own the property, meaning you cannot directly pay the owner's mortgage (lenders won't accept payments from non-borrowers). You cannot force the owner to maintain payments. In most cases, you won't even know default is occurring until repossession proceedings begin, as mortgage lenders won't discuss owner's account with you without explicit written authorization (rarely granted). When repossession occurs, you typically lose all lease payments made to the owner, lose your option rights (as property ownership transfers to lender then new buyer), face immediate eviction along with any sub-tenants you've placed in the property, and may face liability to sub-tenants for displacement and their moving costs. Some investors attempt protecting against this risk by: requiring regular evidence of owner's mortgage payment (bank statements, mortgage account screenshots); negotiating agreements where investor makes payments directly to owner's mortgage account rather than to owner personally (requires lender cooperation, rarely obtained); or obtaining specialist insurance products indemnifying against owner default (expensive, difficult to source, and often containing substantial exclusions). However, none of these protections prove completely effective. The fundamental reality is that lease options place significant financial stakes in hands of property owners who, by definition, are experiencing financial difficulties—which is why they agreed to lease options initially. This risk makes lease option investments substantially more speculative than they superficially appear.

Can I get a mortgage to exercise my option and purchase the property at the end of the lease term?

Obtaining mortgages to exercise lease options and purchase properties proves more complicated than many investors anticipate. Standard buy-to-let mortgage criteria apply—you'll need minimum 25% deposits based on agreed purchase prices, adequate income or rental coverage for lender stress testing, acceptable credit history, and property valuations supporting loan amounts. However, several lease option-specific complications arise. First, if agreed purchase prices significantly exceed current market values (perhaps because property values declined during option period), lenders provide mortgages based on current valuations not option prices, meaning you'll need substantially larger deposits covering the difference. Conversely, if property values appreciated significantly above option prices, lenders require verification that you're purchasing at proper market rates and may scrutinize whether arrangements constitute "connected party transactions" potentially indicating fraud. Second, if you've been collecting rent during the option period but haven't registered as property owner with HMRC for income tax purposes, lenders may question income sources and tax compliance. Third, some lenders view lease option backgrounds suspiciously, questioning why owners originally agreed to such arrangements and whether underlying property issues exist. You must disclose lease option history during mortgage applications—failing to do so constitutes mortgage fraud. Finally, timing pressures exist—option expiry dates create deadlines for completing purchases, whilst mortgage applications require 6-12 weeks processing. If complications arise delaying mortgage approval beyond option expiry, you lose purchase rights entirely. We strongly recommend investors planning to exercise options beginning mortgage application processes 3-6 months before option expiry, obtaining agreements in principle confirming likely mortgage availability well before deadlines. However, investors should not assume mortgage availability guarantees—property condition issues discovered during surveys, valuation problems, or changing lender criteria can prevent completion even with initial approval indications.