HMO Property Investment Opportunities

LAT Property Investments - expert HMO property INVESTMENT opportunities across the country

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

HMO Propery investment

Houses in Multiple Occupation represent property investment's highest-yielding mainstream strategy, consistently delivering 9-12% gross returns in established markets—nearly double what standard buy-to-let properties achieve. This superior income comes from renting properties room-by-room rather than as whole units, creating multiple income streams from single assets. However, HMO investment demands considerably more sophistication than traditional buy-to-let approaches, involving complex licensing requirements, strict property standards, and intensive ongoing management.

We specialize in HMO opportunities across England's strongest markets, particularly Midlands and Northern university cities where tenant demand remains robust and property prices support viable investment economics. Our focus centers on compliance-first sourcing—every HMO opportunity we present carries appropriate licensing, meets all regulatory standards, and operates in areas with proven rental demand. This eliminates the regulatory navigation burden that defeats many investors attempting HMO strategies independently.

HMO investment suits experienced property investors comfortable with regulatory complexity and prepared for higher capital requirements. Typical deposit expectations run £40-50k minimum, with properties requiring either professional management (15-20% of rent) or significant investor time commitment. Investors prioritizing immediate income over maximum capital appreciation find HMOs compelling; those focused primarily on wealth accumulation through property value growth often prefer alternative strategies delivering stronger appreciation despite lower yields.

The distinction matters considerably. HMO properties generate exceptional current income but historically appreciate more modestly than equivalent single-let properties, as HMOs are valued predominantly on rental yield rather than comparable sales. Understanding this trade-off proves essential before committing capital to HMO strategies.

What Makes HMO Investments Attractive

Superior Rental Yields

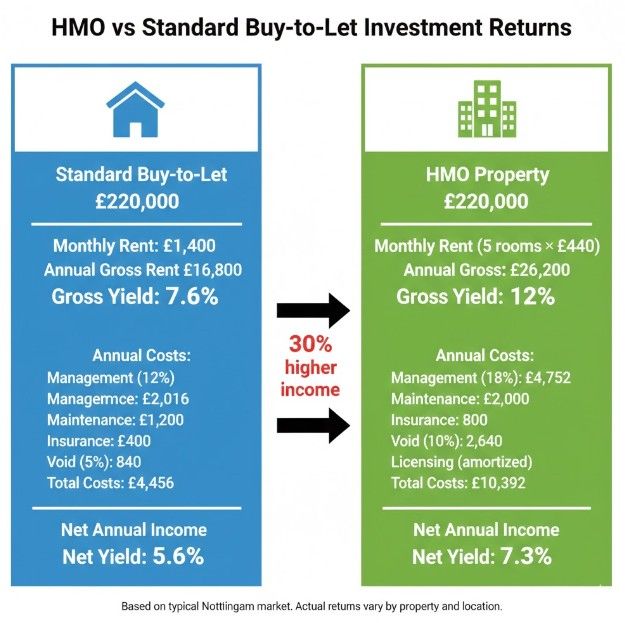

Room-by-room letting fundamentally changes property economics. A five-bedroom house in Nottingham might rent for £1,400 monthly as a single family let, delivering perhaps 6-7% gross yield on a £220,000 purchase price. That identical property configured as an HMO—five individual rooms at £440 each—generates £2,200 monthly, pushing gross yields to 12% before expenses.

This yield premium exists across established HMO markets. Leicester properties delivering 6.5% yields as standard lets reach 10-11% as HMOs. Sheffield's already-attractive 7-8% buy-to-let returns extend to 11-13% through HMO conversion. Birmingham properties in student-dense neighborhoods achieve 9-10% HMO yields versus 5.5-6% as single lets.

However, gross yields tell incomplete stories. HMO properties incur substantially higher operating costs than standard rentals. Professional management typically consumes 15-20% of rental income versus 10-12% for single lets, reflecting increased tenant liaison, viewing coordination, and turnover management. Maintenance costs run considerably higher—five tenants create more wear than one family, whilst room-by-room configuration means more frequent redecorating, appliance replacement, and repair requirements.

Void periods, whilst affecting smaller portions of income, occur more frequently as individual tenants move independently rather than whole households remaining multi-year. A well-managed Nottingham HMO might experience 8-10% annual void rates across all rooms, versus 4-5% for equivalent family lets. These factors typically reduce net yields to 6-8% after all costs—still superior to standard buy-to-let returns, but not the headline figures superficially suggest.

Realistic return expectations matter enormously. Investors calculating returns on gross yields alone face considerable disappointment when actual net income proves 30-40% lower than anticipated.

Diversified Income Streams

HMO properties spread risk across multiple tenants rather than concentrating income dependency on single households. When one room in a five-bed HMO becomes vacant, 80% of rental income continues flowing whilst that room finds new occupants. Single-let properties experiencing tenant departure lose 100% of income until re-letting completes.

This diversification creates meaningful cash flow stability, particularly during economically uncertain periods when tenant turnover accelerates. Properties generating £2,000+ monthly from five separate income sources weather individual tenant issues—job losses, relationship breakdowns, relocations—far better than single-income properties of equivalent value.

The diversification benefit extends beyond simple vacancy mitigation. Rent arrears from individual tenants impact fractional portions of income rather than total revenue. One tenant falling behind on £400 monthly rent creates manageable short-term challenges; one family defaulting on £1,400 monthly creates immediate financial stress requiring urgent resolution.

However, this diversification comes at management complexity cost. Coordinating five separate tenancy agreements, conducting individual viewings, managing diverse tenant personalities and expectations, and handling multiple move-in/move-out processes demands considerably more time and expertise than managing single household tenancies. Investors underestimating this workload frequently abandon HMO strategies after experiencing the operational intensity firsthand.

Professional HMO management services exist specifically addressing this complexity, though their 15-20% fees significantly impact net returns. The choice becomes accepting reduced income through professional management, or accepting substantial time commitment through self-management. Neither option suits all investors.

HMO Regulatory Requirements and Compliance

Mandatory HMO Licensing

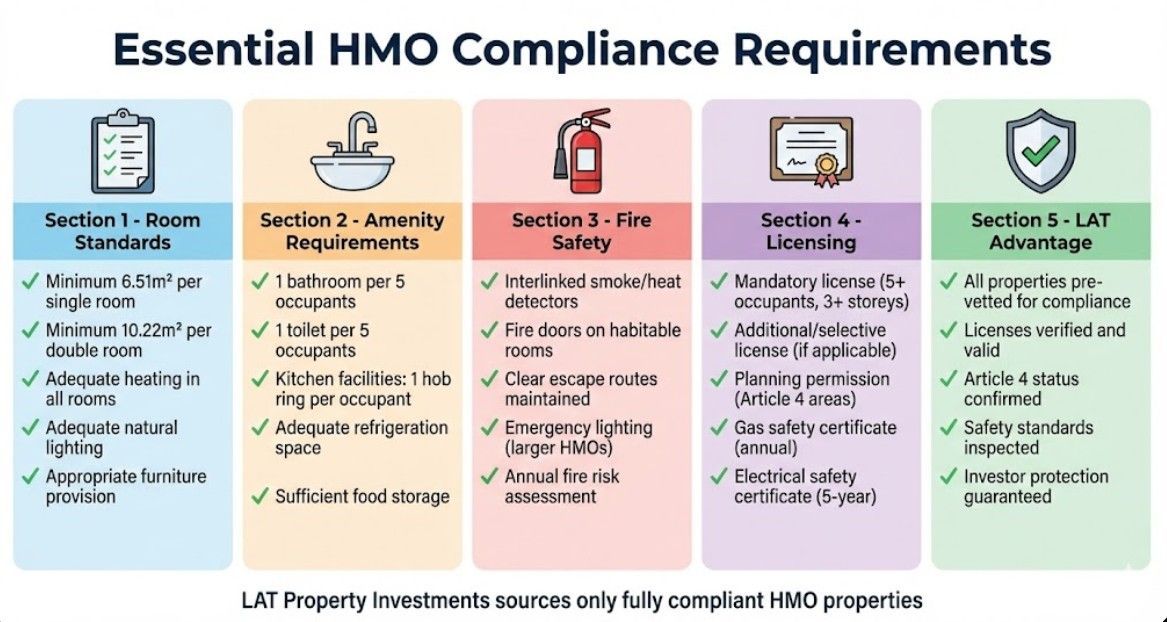

Properties meeting specific criteria require mandatory HMO licenses before legally accepting tenants. The threshold applies to properties occupied by five or more people forming two or more households, across three or more storeys including basements and attics. Licensing isn't optional—operating unlicensed HMOs constitutes criminal offence, exposing landlords to unlimited fines, rent repayment orders potentially spanning years, and prosecution.

License applications require demonstrating property suitability through room size compliance, adequate amenity provision, appropriate fire safety measures, and landlord "fit and proper person" status. Local authorities inspect properties verifying standards before issuing licenses, typically valid 5 years subject to ongoing compliance. Licensing costs vary by council but generally run £500-1,200 per application, with substantially higher fees for non-compliant properties requiring additional inspections.

Beyond mandatory licensing, many councils operate additional or selective licensing schemes applying to smaller HMOs or specific geographic areas. These schemes often cover properties with three or four occupants, or all rental properties within designated wards regardless of occupancy. Leicester, Nottingham, Birmingham, and numerous other cities maintain extensive additional licensing coverage, effectively requiring licenses for most HMO properties regardless of size.

We source only fully licensed HMO properties or opportunities where licensing pathways are clearly established and achievable. This compliance-first approach eliminates the regulatory navigation burden, but necessarily limits available opportunities to properties and locations where licensing proves viable. Investors occasionally find apparently attractive HMO opportunities at significant discounts—these typically carry licensing complications making them unsuitable regardless of surface appeal.

Article 4 Directions

Article 4 directions remove permitted development rights converting dwelling houses (C3 use class) to HMOs (C4 use class), requiring explicit planning permission for such conversions. Most university cities including Nottingham, Leicester, Sheffield, and numerous others maintain Article 4 directions covering areas with existing HMO concentrations, preventing further HMO proliferation without planning approval.

Planning permission requirements add significant complexity, cost, and uncertainty to HMO conversions. Applications require detailed proposals, neighbor consultation, and council planning committee consideration with no guaranteed approval. Processing takes months, fees run several thousand pounds, and rejection remains entirely possible regardless of property suitability or licensing compliance.

Article 4 directions fundamentally change HMO investment approaches in affected areas. Converting additional properties into HMOs becomes considerably more difficult and expensive, whilst existing licensed HMOs gain quasi-protected status through limited new competition. This creates interesting dynamics—Article 4 areas often offer both the strongest HMO markets (hence the Article 4 implementation) and the most complex entry barriers for new investors.

Our HMO sourcing focuses heavily on ready-made opportunities in Article 4 areas, acquiring existing licensed HMOs rather than attempting complex conversion projects facing planning uncertainty. This approach provides immediate income from established operations whilst avoiding planning permission complications. Properties cost more than conversion projects might, but eliminated uncertainty and immediate cash flow often justify premium pricing.

Property Standards and Safety

HMO properties must meet substantially higher standards than standard rental properties, covering room sizes, amenity provision, and fire safety requirements. Minimum room sizes vary by council but typically require 6.51 square metres for single occupancy, 10.22 square metres for double occupancy, with additional space requirements for rooms serving multiple purposes.

Amenity standards mandate adequate bathroom, toilet, and kitchen facilities relative to occupant numbers. Generally, one toilet and bathroom serves up to five occupants, with additional facilities required for larger HMOs. Kitchen facilities must provide adequate cooking, food preparation, and food storage capacity—typically one hob ring, oven shelf, and refrigerator compartment per occupant.

Fire safety requirements prove particularly stringent, mandating interconnected smoke and heat detection throughout properties, fire doors on habitable rooms, adequate means of escape, and appropriate emergency lighting in larger HMOs. These aren't one-time installation requirements—ongoing maintenance and testing obligations continue throughout HMO operation, with annual gas and electrical safety checks mandatory regardless of property size.

Non-compliance carries serious consequences. Councils possess extensive enforcement powers including prohibition orders preventing property occupation, improvement notices requiring specific works, and ultimately prosecution for serious breaches. We thoroughly vet all HMO opportunities verifying full standards compliance before presenting to investors, eliminating properties requiring substantial remedial works or carrying compliance risks.

LAT's HMO Sourcing Approach

Ready-Made vs Conversion Opportunities

HMO investors face fundamental choice between acquiring established, income-generating HMOs or purchasing properties for conversion into HMOs. Each approach carries distinct advantages, costs, and risk profiles shaping investment outcomes significantly.

Ready-made HMOs provide immediate income from day one, typically with established tenant bases continuing occupancy through ownership transfer. These properties already hold appropriate licenses, meet all property standards, and operate successfully within local rental markets. Investors avoid conversion project management, planning permission complications, and the extended void period between purchase and first rent payment. The primary disadvantage is cost—ready-made HMOs command premium pricing reflecting their income-ready status and eliminated execution risk.

Conversion projects offer potentially higher returns through acquiring properties below HMO value, adding value through conversion works, and ultimately creating HMO assets at total costs below ready-made equivalents. However, conversions demand substantial investor capability—project managing refurbishment work, navigating licensing and planning processes, estimating costs accurately, and managing extended periods without rental income while works complete. Conversion projects frequently overrun budgets and timescales, particularly for investors lacking construction and project management experience.

Our HMO sourcing emphasizes ready-made opportunities, particularly in Article 4 areas where planning permission requirements make conversions significantly more complex. This turnkey focus suits investors prioritizing immediate cash flow and minimal project involvement over absolute maximum returns. Investors comfortable managing substantial refurbishment projects and navigating regulatory complexities occasionally find conversion opportunities through our comprehensive deal sourcing service, though these represent minority of HMO opportunities we present.

Target Markets and Locations

HMO success depends fundamentally on location—even perfectly configured, fully compliant HMOs fail without sufficient tenant demand. We focus HMO sourcing on markets demonstrating consistent demand through large student populations, significant young professional employment, or both factors combined.

Nottingham represents England's strongest HMO market outside London, combining two substantial universities (45,000+ students) with established student accommodation infrastructure spanning multiple neighborhoods. Nottingham's established student accommodation sector delivers the most reliable HMO performance we encounter, with proven tenant demand, sophisticated letting agent networks, and property prices supporting viable investment economics. Lenton, Beeston, Dunkirk, and Radford provide particularly strong HMO fundamentals.

Leicester offers more balanced HMO characteristics, serving both substantial student population (40,000+ across two universities) and growing young professional demographic. Leicester's balanced HMO opportunities suit investors seeking diversified tenant bases reducing dependency on student market cycles. Clarendon Park, Knighton, and Evington provide established HMO locations, whilst Highfields offers higher-yield opportunities requiring more active management.

Sheffield's HMO market benefits from two universities creating 60,000+ student population, combined with significantly lower property prices than comparable university cities. Sheffield's affordable double-university market allows HMO entry at costs 20-30% below Nottingham equivalents, delivering similar yields with reduced capital requirements. Crookes, Broomhill, Ecclesall, and Sharrow Vale represent core student HMO areas.

Derby maintains limited but profitable HMO opportunities, primarily avoiding Article 4 complications affecting neighboring cities. Specific pockets near university campus support viable HMO operations, though overall market scale proves considerably smaller than university city alternatives.

Due Diligence and Vetting

Every HMO opportunity requires rigorous due diligence verifying regulatory compliance, assessing tenant demand sustainability, and establishing realistic financial projections. Our vetting process examines multiple critical factors before presenting opportunities to investors.

Licensing verification proves essential—we confirm current license validity, review any license conditions or restrictions, and check council enforcement records for compliance history. Properties with expired licenses, pending enforcement action, or recurring compliance issues are rejected regardless of surface financial appeal. We also verify whether properties sit within additional or selective licensing areas requiring separate licenses beyond mandatory HMO licensing.

Article 4 status determines whether properties can continue operating as HMOs long-term or face planning enforcement risk. We verify planning permission status for properties in Article 4 areas, ensuring established use rights or explicit planning approval protect continued HMO operation. Properties operating without appropriate permissions in Article 4 areas are avoided entirely—the planning enforcement risk proves unacceptable regardless of current income generation.

Tenant demand assessment examines proximity to universities or major employers, local rental market dynamics, competing HMO supply, and demographic trends affecting demand sustainability. Properties in areas experiencing declining student numbers, major employer departures, or oversupplied HMO markets are rejected even when currently tenanted—we focus on markets demonstrating sustainable long-term fundamentals rather than short-term occupancy.

Property condition evaluation establishes realistic maintenance cost expectations and identifies any significant remedial works affecting investment viability. We're particularly attentive to deferred maintenance affecting compliance—deteriorating fire doors, ageing electrical systems, inadequate heating—as these represent both immediate costs and ongoing compliance risks.

Financial projections are stress-tested against realistic void assumptions, proper management cost accounting, and conservative maintenance reserves. We reject opportunities where headline yields rely on unrealistic 100% occupancy assumptions or insufficient expense allowances, presenting only properties delivering acceptable returns under realistic operating conditions.

Who Should Consider HMO Investment

HMO investment rewards specific investor profiles whilst proving unsuitable for others regardless of surface appeal. Understanding whether HMOs align with your circumstances and objectives prevents costly mismatches between strategy and capability.

Capital requirements exceed standard buy-to-let investments significantly. Minimum viable entry typically requires £40-50k deposits, with many strong HMO opportunities demanding £60-80k given property prices in established markets. Nottingham HMOs typically cost £200-280k, Leicester properties £180-240k, Sheffield opportunities £160-220k. These price points place HMOs beyond reach for investors with limited capital, regardless of strategy interest.

Experience managing rental properties proves highly beneficial, if not strictly essential. HMO complexities—multiple tenant management, compliance maintenance, higher turnover rates—overwhelm investors lacking foundational landlord experience. We generally recommend investors operate at least 2-3 standard buy-to-let properties successfully before attempting HMO strategies, building management capability and landlord experience through simpler property types first.

Comfort with regulatory complexity determines whether investors thrive or struggle with HMO operations. The licensing requirements, property standards, ongoing compliance obligations, and potential enforcement interactions demand patience and attention to detail. Investors finding standard landlord regulations burdensome typically find HMO compliance overwhelming. Those comfortable navigating regulatory frameworks and maintaining detailed compliance records suit HMO strategies considerably better.

Yield-priority investment objectives align naturally with HMO characteristics. Investors focused primarily on current income generation find HMOs' 9-12% gross yields compelling, accepting modest capital appreciation in exchange for superior cash flow. Conversely, investors prioritizing maximum wealth accumulation through property value growth often prefer alternative strategies—Birmingham or Manchester properties, for example, delivering stronger appreciation despite lower yields.

Time availability or willingness to pay professional management costs determines operational viability. Self-managed HMOs demand substantial ongoing time—tenant liaison, viewing coordination, maintenance management, compliance administration. Investors lacking 10-15 hours weekly for HMO management must budget 15-20% of rental income for professional services, significantly impacting net returns. Neither approach suits investors wanting passive income with minimal management cost—HMOs inherently demand either significant time or significant management expense.

Investment time horizons should extend 5+ years minimum, preferably 7-10 years. HMO setup costs—higher purchase expenses, potential refurbishment works, licensing fees—require multi-year holding periods justifying initial capital deployment. Additionally, HMO markets occasionally experience regulatory changes or demand shifts requiring investor adaptation. Longer time horizons provide flexibility navigating these dynamics without forced sales during unfavorable conditions.

Realistic HMO Returns and Expectations

Before engaging our sourcing service we require a simple initial consultation discussing your investment objectives, available capital, and property preferences. This conversation typically takes 45-60 minutes and establishes the clear sourcing brief guiding our property hunting.

Following consultation, we begin active sourcing immediately, typically presenting first opportunities within 2-4 weeks depending on market conditions and criteria specificity. Some investors find suitable properties quickly; others prefer evaluating multiple opportunities before committing, which we fully support - property investment involves too much capital to rush poor decisions.

Our sourcing service operates on success-based fees charged only on completed purchases, aligning our interests with yours. We succeed when you acquire properties that genuinely meet your criteria, not from presenting endless unsuitable opportunities hoping something eventually sticks.

Ready to Access Off-Market Property Deals?

Stop competing with hundreds of investors on Rightmove. Get exclusive access to properties most investors never see.

Contact us today to discuss your property investment requirements, or complete our online enquiry form for a call back at your convenience. International investors welcome—we regularly work with investors across Europe, Middle East, and Asia seeking UK property opportunities.

Not sure which location suits your investment goals? Compare property investment opportunities

across our core cities

including the Midlands, Manchester, Leeds, and Sheffield.

FAQs on HMO Property INVestment

What's the minimum capital required to invest in an HMO property?

O investment typically requires £40-50k minimum deposit, though many viable opportunities demand £60-80k given property prices in established markets. A £220,000 Nottingham HMO requires £55,000 deposit at 25% LTV, plus approximately £8-10k for stamp duty (including 5% surcharge), legal fees, surveys, and initial setup costs. Budget an additional £5-10k contingency for any immediate property works or furnishing requirements. Total realistic capital requirement sits around £70-80k for your first HMO investment in a strong market. Properties requiring less capital often carry compliance complications, problematic locations, or condition issues making them unsuitable regardless of lower entry costs. We recommend investors have sufficient reserves beyond deposit and transaction costs, covering at least six months' mortgage payments and operating expenses before generating positive cash flow.

Do I need an HMO license for every rental property with multiple tenants?

Not necessarily - mandatory HMO licensing applies specifically to properties with five or more occupants from two or more households, across three or more storeys including basements and attics. However, many councils operate additional or selective licensing schemes covering smaller HMOs (three or four occupants) or all rental properties within specific geographic areas. Nottingham, Leicester, Birmingham, and numerous other cities maintain extensive additional licensing requiring licenses for most HMO properties regardless of size. Before purchasing any property intended for multi-occupant letting, verify licensing requirements with the specific local authority - requirements vary considerably between councils. Operating unlicensed HMOs constitutes criminal offence exposing landlords to unlimited fines and rent repayment orders potentially spanning years of tenancy. We source only fully licensed properties or opportunities where licensing pathways are clearly established, eliminating regulatory navigation burden for investors.

Can I convert my existing rental property into an HMO?

Possibly, but conversion viability depends on multiple factors including property configuration, local planning requirements, and council licensing policies. Properties in Article 4 direction areas require explicit planning permission for HMO conversion—applications take months, cost several thousand pounds, and carry rejection risk regardless of property suitability. Even outside Article 4 areas, properties must meet stringent room size, amenity provision, and fire safety standards before legally operating as HMOs. Minimum room sizes (6.51m² single, 10.22m² double), adequate bathroom/kitchen facilities for occupant numbers, and comprehensive fire safety measures including interconnected detection and fire doors represent mandatory requirements. Properties lacking suitable layout—insufficient bedrooms, inadequate communal space, poor bathroom provision—prove unsuitable for HMO conversion regardless of location. We recommend thorough professional assessment before attempting conversions, as projects frequently encounter unforeseen complications significantly exceeding initial budget and timeline estimates. Our focus emphasizes ready-made HMO opportunities providing immediate income without conversion project risks.

How do HMO returns compare to standard buy-to-let properties after all costs?

HMOs deliver superior returns but the margin narrows considerably after accounting for higher operating costs. Gross yields of 10-12% for HMOs versus 6-7% for standard buy-to-let appear dramatically different, but net yields after management (18% vs 12%), higher maintenance costs, increased void rates, and HMO-specific insurance typically settle around 7-8% for HMOs versus 5-6% for standard lets. A £220,000 Nottingham HMO generating £26,400 gross annual rent might deliver £16-18k net income after all costs—approximately 7.3% net yield. An equivalent single-let property at £220k producing £16,800 gross rent might generate £12-13k net income—approximately 5.6% net yield. HMOs provide roughly 30-40% higher net income from equivalent capital investment, but demand significantly more management time or higher professional management costs. Additionally, HMO capital appreciation typically lags standard residential properties, as HMOs are valued on yield basis rather than comparable sales. Total returns (income plus appreciation) over 10 years might be similar, with HMOs delivering superior current income whilst standard properties provide stronger capital growth.

Should I self-manage my HMO or use professional management?

This decision depends primarily on available time, property management experience, and proximity to the property. Self-managing HMOs demands 10-15 hours weekly minimum handling tenant enquiries, coordinating viewings, managing maintenance issues, conducting check-ins/check-outs, and maintaining compliance records. Five separate tenancies create considerably more administrative burden than single household management—each tenant departure requires viewings, referencing, agreements, and deposits handling. Investors living locally with landlord experience and available time can self-manage successfully, retaining the 15-20% of rent otherwise paid to agents. However, investors lacking time, living distant from properties, or new to landlord responsibilities typically find professional management essential despite cost impact on net returns. Professional HMO management services handle all tenant liaison, coordinate maintenance, manage compliance obligations, and provide buffer between investors and day-to-day operational issues. We generally recommend first-time HMO investors use professional management initially, potentially transitioning to self-management after experiencing HMO operational requirements firsthand and developing necessary systems and knowledge.