Property Investment in Leicester

LAT Property Investments providing exciting property investment opportunities in LEICESTERSHIRE with investment entry levels from £20,000+

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

LEICESTER Property Investment

Leicester offers property investors a compelling middle-ground proposition—affordable entry prices combined with respectable yields, major city amenities without premium pricing, and diverse tenant demographics creating resilient rental demand. For investors seeking balanced opportunities avoiding extreme trade-offs between affordability and growth or yields and complexity, Leicester represents a versatile property investment location within England's core markets, offering balanced characteristics that suit both first-time investors and experienced portfolio builders.

Property prices averaging £130,000-£160,000 for investment-grade houses require deposits of £33,000-£40,000, positioning Leicester between Derby's budget accessibility and Birmingham's higher capital requirements. These moderate prices generate gross rental yields of 6-7% for standard buy-to-let, extending to 9-11% for well-positioned HMO conversions—returns balancing immediate income against sustainable long-term viability.

Leicester's economic foundation rests on diverse sectors including textiles and garment manufacturing (historically significant, now modernized), food processing, engineering, higher education, and healthcare. The city's substantial South Asian community has driven entrepreneurial growth and cultural vibrancy, creating unique market characteristics distinguishing Leicester from other Midlands cities.

University of Leicester and De Montfort University enroll approximately 40,000 students, providing consistent accommodation demand supporting both student HMO strategies and broader private rental markets as graduates remain in the city post-study. Leicester's multicultural character—among the UK's most diverse cities—creates varied tenant demographics across different neighborhoods.

Transport infrastructure provides solid connectivity—direct rail services to London, Birmingham, Nottingham, and Sheffield, M1 motorway minutes east, and Leicester's compact geographic footprint making most areas accessible within 20-minute drives from city center. These fundamentals support both current rental demand and reasonable capital growth prospects historically averaging 3-5% annually.

Leicester presents few obvious weaknesses but also lacks standout exceptional characteristics—it doesn't offer Derby's extreme affordability, Nottingham's student market depth, or Birmingham's major city scale. This middle positioning suits investors valuing consistency and balance over pursuing maximum performance in any single dimension.

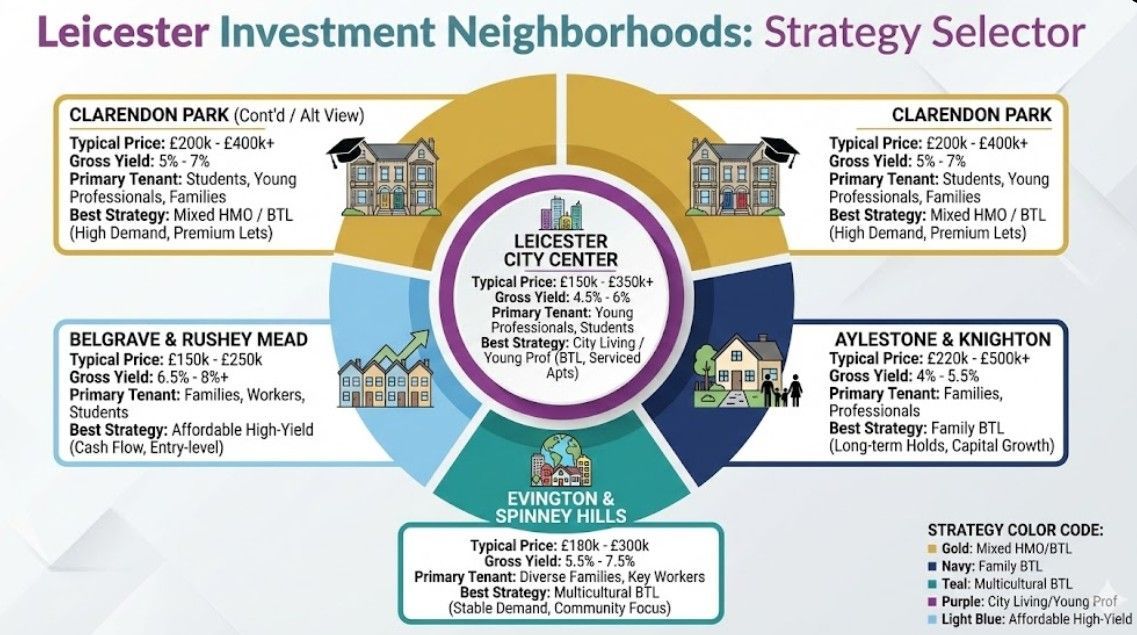

Key Leicester Neighborhoods for Investment

Leicester's relatively compact geography creates distinct neighborhood identities, each supporting particular tenant demographics and investment strategies.

Clarendon Park (Student and Young Professional Hub)

Clarendon Park sits immediately south of city center, housing substantial student populations alongside young professionals and creative sector workers. Victorian terraced houses dominate, with properties typically costing £140,000-£170,000 suitable for either HMO conversion or single-let strategies.

The area offers established infrastructure—independent shops, cafes, and community atmosphere—attracting tenants valuing character over modern conveniences. Student HMO conversions achieve 9-11% gross yields when fully tenanted, whilst professional single-lets deliver 6-7% with longer tenancy durations and reduced management intensity. Clarendon Park serves Leicester's student population with Victorian terraces suitable for HMO conversion, though the market operates at smaller scale than Nottingham's extensive student accommodation sector just 25 miles northeast.

This represents Leicester's most versatile investment area, supporting multiple strategies within single neighborhoods and allowing portfolio diversification without geographic spread.

Aylestone and Knighton (South Leicester Residential)

These southern neighborhoods provide family-oriented rental markets with properties ranging £130,000-£170,000 appealing to working families, established professionals, and some retirees. Semi-detached and terraced houses generate 6-7% gross yields to stable, long-term tenants.

The areas benefit from reasonable local amenities, decent schools (particularly in Knighton), and park access including Aylestone Meadows. Properties let to families seeking Leicester employment or professionals commuting to nearby cities, with average tenancies extending 24+ months.

These neighborhoods suit investors prioritizing straightforward buy-to-let with minimal management, accepting moderate yields in exchange for tenant stability and operational simplicity.

Evington and Spinney Hills (East Leicester)

East Leicester areas demonstrate Leicester's multicultural character particularly strongly, with substantial South Asian communities and diverse tenant demographics. Properties cost £110,000-£140,000, delivering gross yields of 6.5-7.5% predominantly to family tenants.

The areas require understanding specific cultural preferences—some properties particularly appeal to extended family arrangements, whilst others suit standard nuclear family configurations. Local knowledge helps identifying which property types and configurations work optimally for predominant tenant demographics.

Evington and Spinney Hills offer accessible entry points whilst maintaining decent yields, though investors should recognize these aren't premium neighborhoods—properties serve working-class families seeking affordable, functional accommodation rather than aspirational lifestyle housing.

City Center and Cultural Quarter

Leicester city center contains modern apartment developments targeting young professionals, students, or potentially serviced accommodation strategies. Purchase prices typically range £130,000-£180,000 for one or two-bedroom units, generating 5.5-6.5% gross yields.

The Cultural Quarter around St Nicholas Circle and the Waterside developments offer newer stock with contemporary specifications. However, Leicester's city center hasn't experienced regeneration intensity matching Birmingham or Manchester, meaning apartment markets remain more modest in scale and appreciation potential.

City center investment works for investors wanting urban living exposure within affordable Midlands pricing, though opportunities lack the growth dynamism of larger cities' regeneration zones.

Belgrave and Rushey Mead (North Leicester)

North Leicester areas provide very affordable entry—properties from £100,000-£130,000—delivering gross yields potentially reaching 7-8% to diverse tenant populations including families, young couples, and some benefit recipients.

These areas require careful property and street-level selection. Some locations demonstrate stable demand and reasonable conditions; others face challenges around property maintenance standards or neighborhood issues. Thorough due diligence prevents investing in superficially attractive high-yield properties in fundamentally problematic pockets.

North Leicester suits experienced investors comfortable with higher-yield, higher-management strategies rather than first-time investors seeking straightforward passive income.

What Makes Leicester Different

Leicester's investment market demonstrates several distinctive characteristics requiring understanding for optimal strategy selection and execution.

Multicultural Tenant Demographics

Leicester ranks among the UK's most ethnically diverse cities, with substantial South Asian, African, Caribbean, and Eastern European communities. This diversity creates varied tenant preferences—some properties appeal particularly to specific cultural groups preferring certain configurations or neighborhood characteristics.

Understanding these preferences improves letting success. Properties near specific amenities—particular places of worship, cultural centers, or ethnic grocery stores—sometimes achieve premium rents from tenants valuing proximity. Conversely, generic properties in less culturally specific locations maintain broader appeal across all demographics.

This diversity provides market resilience—economic changes affecting specific communities don't devastate overall rental demand given the varied tenant base. Leicester's multicultural character also attracts continued immigration supporting population growth and rental demand sustainability.

Student Market Balance

Leicester's universities generate substantial student numbers (40,000+) without overwhelming the city's character or creating excessive student-market dependency. This balance means student accommodation strategies work in appropriate areas whilst avoiding the complete market saturation affecting some university cities.

Student areas like Clarendon Park support HMO investments without extreme competition or regulatory restrictions limiting further development. However, student markets remain secondary to broader residential rental demand - Leicester succeeds as investment location independent of university presence rather than relying primarily on student tenants. Leicester's balanced positioning appeals particularly to investors building diversified portfolios.

Steady Performance Without Volatility

Leicester demonstrates consistent, measured performance through economic cycles—neither explosive growth during boom periods nor severe corrections during downturns. This stability suits investors prioritizing predictability and risk management over pursuing maximum returns during favorable conditions.

Capital appreciation historically averages 3-5% annually, respectable without being exceptional. Rental demand remains steady with void periods typically under four weeks between good tenants. These characteristics create dependable long-term investment environments lacking dramatic upside but avoiding significant downside risks.

Affordability Maintenance

Leicester has avoided extreme price inflation affecting some UK cities, maintaining relative affordability even as other Midlands markets appreciated substantially. This ongoing accessibility allows continued portfolio building at realistic capital requirements whilst yields remain viable. Leicester's balanced positioning appeals particularly to investors building diversified portfolios. Properties cost moderately more than Derby's budget-friendly entry points, but deliver stronger growth prospects whilst maintaining accessible capital requirements.

However, modest appreciation also means Leicester offers limited pure capital growth speculation opportunities. Investors prioritizing property value increases over rental income often prefer Birmingham or Manchester despite higher entry costs.

Leicester Investment Performance

Standard Buy-to-Let Returns

Typical Leicester family home (£145,000 in Aylestone):

- Monthly rent: £800-£950

- Gross yield: 6-7%

- Net yield: 3.5-4.5%

- Tenancy duration: 24+ months average

- Void periods: 2-4 weeks typical

Student/Young Professional HMO

Clarendon Park HMO (£155,000, 5 rooms):

- Monthly rent: £1,300-£1,600

- Gross yield: 9-11%

- Net yield: 6-7.5%

- Management: Moderate intensity

- Market: Mixed student/young professional

Affordable High-Yield

North Leicester property (£120,000):

- Monthly rent: £750-£850

- Gross yield: 7-8%

- Net yield: 4.5-5.5%

- Management: Higher intensity

- Tenant mix: Diverse working families

Market Considerations

Leicester's tenant demand demonstrates remarkable consistency—properties in reasonable condition at market rents let reliably regardless of broader economic conditions. This dependability provides confidence for long-term investment planning.

Competition for quality Leicester properties exists but remains more manageable than Nottingham or Birmingham's growth-focused characteristics. Properties occasionally stay available for days or weeks, allowing proper evaluation rather than rushed decisions under competitive pressure.

Leicester works particularly well for building substantial portfolios—affordable prices allow acquiring multiple properties relatively quickly, whilst consistent performance provides reliable income supporting further expansion.

Leicester's Position in East Midlands Property Portfolios

Leicester functions effectively either as standalone investment market or strategic component within broader East Midlands portfolios combining multiple regional cities.

Compared to Nottingham

Nottingham offers higher yields (particularly for HMOs reaching 10-12%) and stronger student market depth. Leicester provides better tenant demographic diversity, reduced student-market dependency, and slightly superior affordability. Many investors maintain properties in both cities—Nottingham for maximum yields, Leicester for balanced stability.

Compared to Derby

Derby delivers superior affordability (£20,000-£30,000 lower average prices) and extreme simplicity focusing almost exclusively on straightforward buy-to-let. Leicester offers more strategic variety, university presence enabling HMO strategies, and marginally stronger growth prospects. First-time investors often start Derby before expanding to Leicester as experience builds.

Regional Portfolio Building

Leicester, Nottingham, and Derby sit within 30-mile radius, allowing managing multi-city East Midlands portfolios efficiently. Geographic proximity enables single-day property viewings, contractor coordination, or tenant meetings across all three cities without excessive travel.

Building portfolios across these markets provides diversification - Derby's affordability, Nottingham's yields, Leicester's balance, whilst maintaining regional concentration simplifying operational logistics compared to nationwide geographic spread. Coventry's ongoing regeneration sits just 30 miles southwest, allowing investors to build concentrated Midlands portfolios across complementary markets.

Leicester's diverse employment base - healthcare, education, logistics, professional services - creates varied tenant demographics supporting multiple strategies. This employment diversity mirrors Sheffield's mixed economic base, both cities benefiting from varied sector representation.

Invest in Leicester Property

Leicester's balanced characteristics—moderate pricing, decent yields, diverse strategies, stable performance—create accessible investment opportunities for various investor profiles and objectives.

Our established Leicester market knowledge and local relationships deliver advantages identifying optimal neighborhoods and properties matching your specific requirements within the city's diverse landscape. Our property sourcing expertise identifies Leicester opportunities matching your specific strategy, whether targeting student HMOs, professional buy-to-lets, or family rentals.

FAQs ABOUT LEICESTER property investment

Is Leicester good for first-time property investors?

Leicester works well for first-time investors offering middle-ground positioning between Derby's extreme affordability and Nottingham's yield focus. Entry costs (£130k-160k typical, requiring £33k-40k deposits) remain accessible for professionals with reasonable savings whilst delivering solid 6-7% gross yields. Investment strategies concentrate primarily on straightforward buy-to-let in most neighborhoods, avoiding excessive complexity whilst offering HMO opportunities in specific areas like Clarendon Park for those wanting higher yields. Tenant demographics are predominantly working families and young professionals providing stable, manageable rental relationships. Leicester's consistency and balance suit investors wanting dependable performance without extreme positions on any dimension, making it appropriate for building initial investment confidence.

How does Leicester's multicultural character affect property investment?

Leicester's ethnic diversity creates varied tenant preferences and neighborhood characteristics requiring understanding for optimal investment success. Some properties near specific cultural amenities—places of worship, community centers, ethnic shops—achieve premium rents from tenants valuing proximity to cultural resources. Certain property configurations appeal particularly to extended family arrangements common in some cultural communities. Understanding these preferences improves letting success and reduces void periods. However, diversity also provides market resilience—economic changes affecting specific communities don't devastate overall rental demand given the varied tenant base. Leicester's multicultural character supports continued population growth through immigration, sustaining long-term rental demand. Work with advisors possessing genuine local knowledge understanding neighborhood-specific dynamics rather than applying generic assumptions.

Should I choose Clarendon Park for student HMOs or family buy-to-let?

Clarendon Park supports both strategies effectively depending on specific property characteristics and investor preferences. Student HMO conversions deliver 9-11% gross yields but require managing academic letting cycles, summer void periods, and higher tenant turnover. Professional single-lets to young workers or small families generate 6-7% yields with longer tenancies (18-24+ months) and reduced management intensity. Properties with multiple good-sized bedrooms and layouts accommodating 5+ occupants suit HMO conversion. Houses with better condition, gardens, or family-friendly features work well as single-lets. Your optimal strategy depends on capital availability (HMOs require higher setup investment), management tolerance (students demand more attention), and return priorities (maximum yield versus operational simplicity). Many investors pursue both strategies within Clarendon Park, diversifying portfolio approaches within single neighborhoods.

What capital growth should I expect from Leicester property?

Leicester demonstrates steady, measured capital appreciation historically averaging 3-5% annually over extended periods, though individual years vary considerably. This growth exceeds inflation providing genuine capital preservation whilst trailing higher-growth cities like Birmingham (4-6%) or Manchester (5-7%). Leicester's appreciation reflects solid economic fundamentals and population growth without speculative exuberance driving unsustainable price increases. Investors prioritizing primarily capital growth often prefer Birmingham or Manchester despite higher entry costs and lower yields. Those valuing balanced returns combining decent current income (6-7% yields) with reasonable long-term value building find Leicester's measured growth acceptable trade-off. Realistic 10-year projections might show properties purchased at £150,000 appreciating to £225,000-250,000 whilst generating consistent rental income throughout, creating substantial total returns despite modest annual appreciation percentages.