Joint Venture Partnerships

Let LAT Property Investments ARRANGE YOUR Joint Venture Partnerships

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

joint venture in property

Joint venture partnerships in property investment involve two or more parties combining complementary resources—typically capital from one partner and expertise, time, or deal-sourcing capability from another—to pursue investment opportunities neither could effectively execute independently. These collaborative structures allow investors with available funds but limited time or property knowledge to gain property exposure, whilst enabling investors with expertise but insufficient capital to build portfolios beyond their personal financial capacity.

The fundamental JV structure involves a "money partner" providing investment capital covering deposits, transaction costs, refurbishment expenses, and ongoing property costs, whilst a "working partner" contributes property sourcing, project management, tenant placement, and ongoing operational oversight. Profit distribution and equity ownership percentages vary significantly depending on negotiated terms, partners' respective contributions, and market conditions—50/50 splits represent common starting points but 60/40, 70/30, or other arrangements occur frequently based on specific circumstances.

We occasionally facilitate joint venture introductions when circumstances align—experienced investors seeking capital partners for specific opportunities, or trusted capital sources seeking suitable working partners with proven track records. However, joint venture facilitation does not represent our core service offering. We do not operate active JV matchmaking platforms, maintain investor databases seeking partners, or regularly coordinate partnership formations. Our property sourcing expertise and direct property investment strategies remain our principal focus areas where we deliver greatest value to clients.

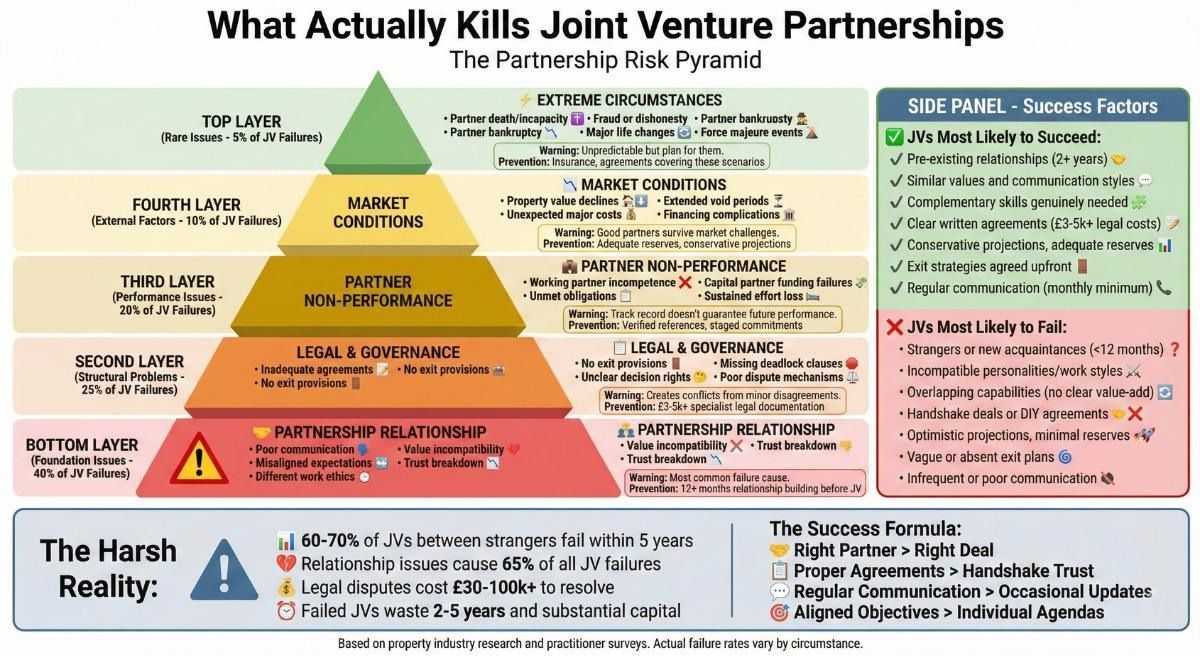

Joint ventures demand exceptional levels of mutual trust, clearly documented legal agreements, and aligned long-term objectives between partners. The partnership relationship quality determines success far more than underlying property quality—excellent properties held within dysfunctional partnerships typically deliver disappointing outcomes, whilst modest properties held within strong, aligned partnerships often exceed expectations. Investors considering JV structures must prioritize partner selection and relationship quality alongside financial structuring and property selection.

How Property Joint Ventures Work

Property joint venture mechanics vary considerably depending on specific partnership structures, investment strategies, and negotiated terms, but fundamental principles remain consistent across most arrangements.

Capital partner responsibilities center on providing all necessary investment funds. This typically includes purchase deposits (25% of property prices), stamp duty and transaction costs (approximately 8-12% of purchase price for investment properties), refurbishment and setup costs (£5,000-30,000 depending on property condition and strategy), and ongoing operational funding covering mortgage payments, maintenance reserves, and unexpected costs during void periods or major repairs. Capital partners generally remain passive investors, receiving regular updates but not involving themselves in day-to-day property operations or decisions. Their return comes through agreed profit distributions and eventual capital appreciation when properties are refinanced or sold.

Working partner responsibilities encompass everything beyond capital provision. Property sourcing—identifying suitable investment opportunities, conducting due diligence, negotiating purchases—represents the working partner's primary value contribution, particularly in competitive markets where good opportunities disappear rapidly. Project management during refurbishments, coordinating contractors, ensuring quality standards, and managing budgets and timelines prove essential for properties requiring improvement works. Tenant sourcing, referencing, and placement ensure properties generate rental income promptly. Ongoing management including rent collection, maintenance coordination, tenant liaison, and compliance administration continues throughout ownership periods. Working partners earn their equity stakes and profit shares through these substantial time and expertise commitments.

Profit sharing structures follow various models depending on partnership negotiations and exit strategies. In buy-and-hold scenarios where properties generate ongoing rental income, partners might split net monthly cash flow (after all costs including mortgage interest, management, maintenance, and reserves) according to agreed percentages—commonly 50/50 though variations exist. Capital partner initial investment recovery sometimes occurs before profit splitting begins—for example, capital partners might receive first £50,000 of proceeds recovering their initial investment, with subsequent profits split equally. In buy-to-sell scenarios where properties are refurbished and resold, gross profits (sale price minus all costs including purchase, refurbishment, financing, and transaction expenses) are divided per agreed percentages after capital partner investment recovery.

Property ownership arrangements require careful structuring with professional legal advice. Joint ownership where both partners hold property titles directly proves simplest but creates complications for mortgage financing, exposes both parties to unlimited liability, and complicates exit if partners disagree. Special Purpose Vehicle (SPV) company structures where partners hold shares in companies owning properties provide cleaner arrangements—companies obtain mortgages, own properties, and distribute profits to shareholders based on shareholdings. SPVs offer limited liability protection, clearer governance through shareholder agreements, and simpler exit mechanisms through share sales. However, company structures require proper administration, annual accounts, and corporation tax compliance creating ongoing costs and complexity.

Exit strategies must be agreed explicitly before partnerships begin. Fixed-term arrangements where properties will be sold after specified periods (typically 3-7 years) provide certainty but might force sales during unfavorable market conditions. Refinancing strategies where increasing property values allow equity extraction can provide capital partner investment recovery whilst maintaining ongoing rental income. Buyout provisions allowing one partner to purchase the other's equity stake at agreed valuation methodologies provide flexibility when partners' objectives diverge. Clear exit provisions including dispute resolution mechanisms prove absolutely essential—partnerships without defined exit routes frequently deteriorate into expensive legal conflicts.

Capital Partner Perspective

For investors with available capital but limited time, property knowledge, or appetite for active landlord involvement, joint ventures offer property exposure without operational burdens.

Primary benefits include genuine property investment participation without requiring personal sourcing capability—competitive property markets where good opportunities receive multiple offers within hours favor experienced investors with agent relationships and rapid decision-making ability. Working partners provide this expertise, securing opportunities capital partners couldn't access independently. Ongoing management delegation means capital partners avoid tenant calls, maintenance coordination, compliance obligations, and the general operational intensity of direct landlord responsibilities. Time commitment reduces to perhaps quarterly updates and annual account reviews versus weekly involvement managing properties directly. Expertise leverage allows capital partners benefiting from working partners' market knowledge, project management capability, and property operational experience accumulated over years rather than learning through expensive mistakes. Portfolio diversification becomes possible—£100,000 capital might fund one wholly-owned property or partial stakes in 2-3 JV properties across different locations or strategies, spreading risk and potentially improving overall returns.

Capital requirements typically range £50,000-200,000+ depending on investment types and working partner requirements. Smaller JV opportunities around £50,000-75,000 exist but prove rare—most working partners seek £75,000-150,000 per deal allowing acquisition of properties with better fundamentals. Larger opportunities involving commercial property, significant refurbishment projects, or multiple-property portfolios might require £200,000-500,000+ capital commitments. Additionally, capital partners should maintain reserves beyond invested amounts covering potential capital calls if properties underperform, unexpected major repairs exceed initial budgets, or market conditions require additional funding maintaining properties through difficult periods.

Return expectations should be realistic—JV returns typically deliver lower percentages than direct investment since working partners earn meaningful shares for their expertise and time. Whilst direct property investment might target 8-10% annual returns combining rental yield and appreciation, JV arrangements might deliver 5-7% to capital partners after working partner profit shares. However, this comparison proves somewhat misleading—capital partners avoiding time commitments, sourcing challenges, and operational headaches might accept lower returns for genuinely passive exposure. The relevant comparison involves JV property returns versus alternative passive investments (stocks, bonds, commercial property funds) rather than versus active direct property investment requiring substantial personal involvement.

Critical risks center on working partner reliability and performance. Capital partners place enormous trust in working partners' competence, integrity, and sustained effort—discovering working partners lack claimed expertise, mismanage properties, or simply lose motivation after securing capital proves devastating. Due diligence on working partners becomes absolutely essential—verified references from previous partners, evidence of successful prior projects, clear track records, and professional reputations matter enormously. Control limitations mean capital partners cannot directly influence property selection, refurbishment decisions, tenant selection, or operational management beyond governance rights specified in partnership agreements. Partners who prove incompatible, unresponsive, or dishonest create situations where capital partners' funds are tied up in underperforming assets they cannot easily exit.

Potential capital partners must conduct thorough due diligence including: verified references from working partners' previous collaborators or clients; evidence of completed successful projects with documented outcomes; clear understanding of working partners' property experience, qualifications, and market knowledge; professional indemnity insurance and appropriate business structures demonstrating serious professional approach; and crucially, personal compatibility and communication styles suggesting sustainable long-term working relationships. Never commit capital to joint ventures with individuals lacking verified track records, regardless of proposal attractiveness or claimed expertise.

Working Partner Perspective

For investors with property expertise, sourcing capability, and available time but insufficient capital building substantial portfolios, joint ventures theoretically offer portfolio growth without full financial burden.

Potential benefits include property portfolio building without requiring personal capital for every acquisition—working partners might contribute £10,000-20,000 toward deals whilst capital partners fund majority costs, allowing working partners building £500,000-1,000,000 portfolios from £50,000-100,000 personal capital. Equity accumulation through sweat equity means working partners earn ownership stakes through effort rather than cash, building wealth through property appreciation and profit shares. Income generation during projects through management fees or profit distributions provides ongoing revenue streams whilst building long-term equity positions. Learning opportunities working with experienced capital partners sometimes provide business mentorship, professional networks, and strategic guidance beyond simple capital provision.

Reality proves considerably more challenging than promotional JV materials suggest. Finding suitable capital partners represents working partners' greatest obstacle—most high-net-worth individuals capable of providing £75,000-150,000 per property deal either invest directly themselves, use established institutional channels, or already have trusted property relationships. Cold approaches to potential capital partners typically yield nothing regardless of working partner credentials. Capital partners understandably prove extremely selective, requiring extensive working partner verification before committing substantial funds—one or two successful projects provide insufficient track record generating confidence for most serious capital sources.

Value proposition requirements for working partners prove demanding. Capital partners need genuine value beyond simple property identification—anyone can find properties on Rightmove, so working partners must demonstrate access to off-market opportunities, negotiation skills securing below-market pricing, specialist knowledge in specific strategies (HMOs, commercial conversions, development projects), or established operational systems delivering superior returns through excellent management. Without clear differentiation from what capital partners could achieve independently or through established agents, working partners struggle attracting partnership interest.

Realistic pathways to working partner success typically involve: building proven track records through personal investments first, demonstrating capability before seeking partners; developing specialist expertise in specific niches (specific locations, property types, or strategies) creating genuine competitive advantages; building professional reputations through industry networks, property associations, or educational content establishing credibility; partnering initially with friends, family, or professional contacts where existing relationships provide trust foundations; or accepting asymmetric profit splits initially (perhaps 60/40 or 70/30 favoring capital partners) reflecting working partners' unproven status, with rebalancing opportunities after successful projects demonstrate capability.

Working partners must recognise that capital partners assume substantial risk entrusting funds to relative strangers, justifying careful partner selection and extensive due diligence. Approaching capital partner searches with patience, professionalism, and realistic expectations about relationship building timescales proves essential.

Legal Structures and Agreements

Joint venture partnerships require formal legal structures and comprehensive written agreements protecting all parties' interests—informal handshake arrangements or inadequate documentation create expensive conflicts when circumstances change or partners disagree.

Special Purpose Vehicle (SPV) companies represent the most common professional JV structure. Partners establish limited companies specifically to hold property investments, with each partner becoming shareholder holding percentages reflecting their agreed equity stakes. SPVs provide limited liability protection—partners' personal assets remain protected from property-related claims beyond their company shareholdings. Corporate governance through shareholder agreements establishes clear decision-making processes, voting rights, profit distribution mechanisms, and dispute resolution procedures. SPVs facilitate cleaner exits through share transfers—partners selling shareholdings to remaining partners or third parties without triggering property transfer taxes or complications. Company structures require proper administration including annual accounts, corporation tax compliance, and Companies House filings, creating ongoing costs (£1,500-3,000+ annually) but providing professional frameworks for substantial investments.

Shareholder agreements governing SPV operations must address multiple critical provisions. Profit distribution mechanisms specify how and when company profits distribute to shareholders—quarterly dividends, annual distributions, or retained within company for reinvestment. Decision-making authorities clarify which decisions require unanimous consent (major acquisitions, significant borrowing, director appointments) versus simple majority votes (routine operational matters). Capital contribution requirements establish whether partners can be required providing additional funding if needed, consequences for failing to contribute, and procedures for maintaining equity percentage integrity. Exit provisions including buyout rights, valuation methodologies (independent surveyor valuations, formula-based calculations, or market-tested approaches), and compulsory sale triggers (deadlock situations, partner bankruptcy, or fixed term expiry) prove absolutely essential preventing indefinite forced partnerships when relationships deteriorate.

Partnership agreements for direct property co-ownership prove less common than SPV structures but occasionally suit specific circumstances. Traditional partnerships create unlimited liability exposing all partners' personal assets to partnership debts and obligations—this substantial risk makes partnerships unsuitable for most property investments beyond between family members or very trusted long-term relationships. Limited Liability Partnerships (LLPs) provide middle ground combining partnership tax treatment with limited liability protection, though administrative requirements and complex tax treatments often favor SPV structures instead.

Critical agreement clauses regardless of structure must include: explicit profit split percentages and distribution timing; comprehensive decision-making authorities specifying approval requirements for all major decisions; partner obligations defining expected contributions (capital, time, expertise) with consequences for non-performance; exit mechanisms including buyout rights, valuation procedures, and forced sale provisions; dispute resolution processes including mediation requirements before litigation and arbitration provisions; deadlock provisions specifying outcomes when partners cannot agree on fundamental decisions (common in 50/50 structures); and death or incapacity provisions addressing what happens if partners die, become incapacitated, or face bankruptcy.

Specialist legal advice proves mandatory—partnership and shareholder agreements demand solicitors experienced specifically in property joint ventures, not general commercial lawyers lacking sector expertise. Expect legal costs of £2,000-5,000+ per partnership depending on complexity, parties involved, and property values. Attempting DIY agreements using internet templates or inadequate legal input creates far greater eventual costs when conflicts arise and poorly drafted agreements prove unenforceable or ambiguous.

Significant Risks and Challenges

Joint venture partnerships carry substantial risks frequently underestimated by investors attracted to collaborative structures' theoretical benefits without appreciating relationship complexity and failure modes.

Partnership relationship breakdown represents the most common and serious JV failure cause. Partners entering arrangements with aligned objectives and positive relationships sometimes discover fundamental incompatibilities emerging through working together—different risk tolerances, communication styles, work ethics, or long-term vision creating constant friction. What begins as minor irritations compound into significant conflicts affecting decision quality and project outcomes. Even well-intentioned partners can develop irreconcilable differences making continued collaboration untenable, requiring expensive buyouts or forced property sales during potentially unfavorable market conditions.

Misaligned expectations and objectives frequently cause partnership difficulties. Capital partners expecting genuinely passive investments discover working partners require frequent approvals, opinions, or additional capital contributions. Working partners anticipating autonomy executing strategies discover capital partners demanding detailed involvement in decisions supposedly delegated to working partners. Partners entering arrangements with different exit timeframes—one wanting 3-5 year holds whilst the other envisions 10-15 year ownership—face conflicts when initial term conclusions approach. Thorough upfront discussions explicitly addressing expectations prove essential but cannot eliminate all future misalignment risks.

Decision-making conflicts and deadlock scenarios plague partnerships lacking clear governance structures. 50/50 partnerships without specified tiebreaking mechanisms face paralysis when partners disagree fundamentally on major decisions—whether to sell properties, undertake major refurbishments, refinance borrowing, or respond to tenant issues. Neither partner can proceed over the other's objection, whilst compromise proves elusive when positions reflect genuinely different strategic visions. Deadlock provisions triggering buyouts, mediation, or forced sales prove essential in partnership agreements but still create expensive disruptions.

Partner non-performance occurs when partners fail delivering agreed contributions. Capital partners might struggle providing additional funding when properties require unexpected capital, or delay payment transfers affecting project timelines. Working partners might prove less competent than claimed, deliver poor property management, fail securing projected returns, or simply lose motivation after receiving capital. Partnership agreements specifying performance expectations and non-performance consequences help but cannot guarantee partner delivery.

Exit complications arise when partners want different outcomes simultaneously. One partner wanting to sell properties whilst the other wants continued holding creates conflicts resolved through buyout provisions—but valuation disagreements, financing availability for buyouts, and forced sale timing frequently prove problematic. Partners wanting to exit partnerships entirely during market downturns might face situations where neither partner can afford buying the other out nor can properties be sold without crystallizing substantial losses.

Legal disputes between partners prove exceptionally expensive and time-consuming. Even with comprehensive partnership agreements, disagreements requiring legal resolution can consume £20,000-100,000+ in legal costs over 12-24+ months before reaching conclusions. Litigation damages or destroys partnerships regardless of legal outcomes, and properties typically suffer from neglect and declining management quality during dispute periods.

Trust represents absolutely fundamental requirement—joint ventures with partners lacking complete mutual trust should not proceed regardless of opportunity quality or financial structuring attractiveness. Without trust, even minor disagreements escalate into major conflicts, communication breaks down, and partnerships become untenable. Most successful joint ventures involve partners with pre-existing relationships, shared values, and proven reliability through other contexts before formalizing property partnerships.

LAT's Approach to Joint Ventures

Our involvement in joint venture facilitation remains deliberately limited and selective, reflecting realistic assessment of our role and recognition that successful partnerships require foundations we cannot create through simple introductions.

We occasionally facilitate joint venture introductions when specific circumstances align appropriately. Existing clients with proven track records seeking capital partners for particular opportunities where we can credibly vouch for their capability and integrity might receive introductions to suitable capital sources. Established investors within our network expressing genuine interest in passive property exposure whilst possessing substantial available capital might receive vetted opportunities from working partners we know professionally. These situations occur several times annually rather than representing regular ongoing activity.

We do not operate active joint venture matchmaking platforms, maintain databases of investors seeking partners, or actively coordinate partnership formations. Multiple specialist platforms and property investment networks exist specifically for JV matchmaking—these organizations possess systems, processes, and track records facilitating partnerships far beyond our occasional ad-hoc facilitation. Investors seriously pursuing joint venture strategies should engage these specialist platforms rather than expecting LAT to provide regular JV opportunities or systematic partner matching.

Our strict criteria for any JV facilitations we undertake include: verified track records from working partners demonstrating successful completed projects with documented outcomes; professional references from previous partners, clients, or industry connections confirming competence and reliability; appropriate professional structures including companies, insurance, and legal frameworks indicating serious professional approach rather than amateur dabbling; clear value propositions explaining specifically what working partners provide beyond simple property identification; and crucially, personal character and communication qualities suggesting sustainable partnership relationships rather than potential conflicts.

For capital partner introductions, we require: substantial available capital (minimum £75,000-100,000 per opportunity); realistic return expectations understanding JV returns will be lower than direct investment; appropriate risk tolerance for property investment and partnership structures; and professional approach including commitment to proper legal documentation and specialist advice rather than informal arrangements.

We strongly emphasize that all parties must obtain independent specialist legal advice before finalizing any joint venture arrangements. We provide commercial introductions between potentially compatible parties, not legal advice, tax guidance, or partnership structure recommendations. Solicitors experienced in property joint ventures must draft appropriate agreements, accountants must advise on tax implications and optimal structures, and financial advisors should assess whether JV investments suit overall financial circumstances and objectives.

Most successful joint ventures we've observed involve partners with pre-existing relationships—business associates, professional connections, or personal relationships where trust foundations exist before commercial arrangements formalize. Partnerships between strangers, regardless of how attractive opportunities appear, carry substantially higher risks and failure rates. Investors without existing networks of potential partners should invest time building genuine professional relationships through property investment associations, educational events, and industry engagement before expecting successful partnership formations.

Larger commercial acquisitions requiring substantial capital sometimes suit JV structures, though commercial property's additional complexity makes partnership relationships even more critical. For most investors, focusing on direct property investment strategies through personal capital deployment delivers clearer outcomes without partnership relationship complexities and risks.

Frequently Asked Questions About Property Joint Venture Partnerships

What profit split should I expect in a property joint venture partnership?

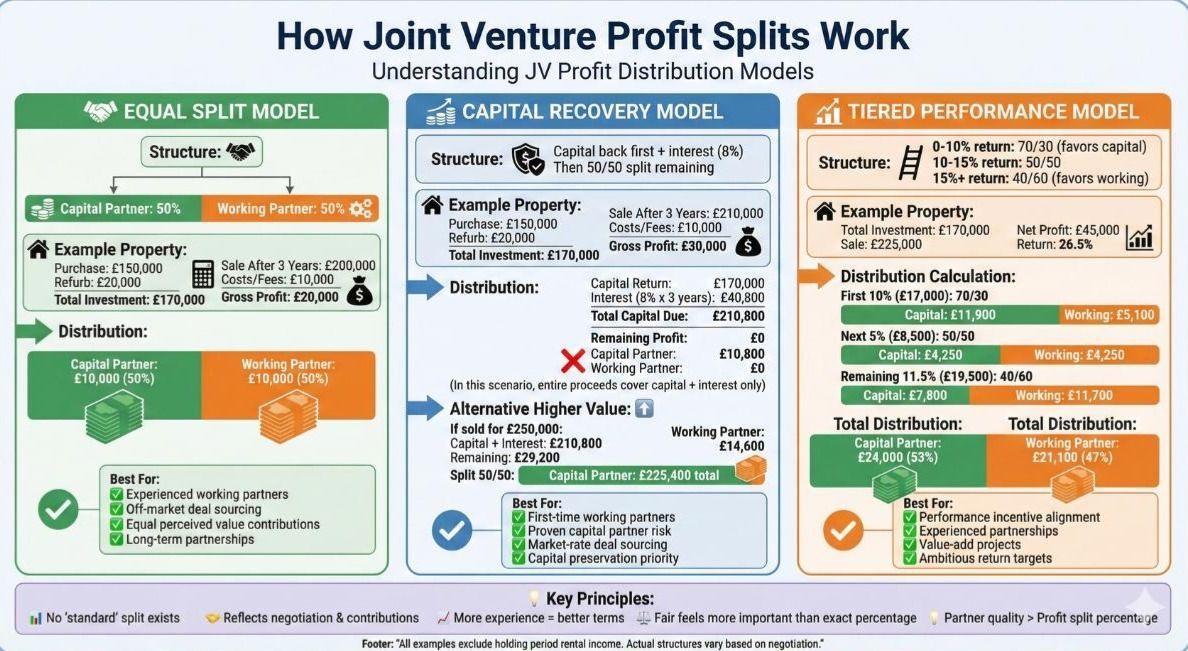

Profit splits vary considerably depending on partners' respective contributions, experience levels, market conditions, and negotiation outcomes—there's no universal "standard" split. The commonly cited 50/50 split represents a starting point for negotiations rather than an industry standard applying universally. In practice, profit distributions reflect several factors: capital partner contribution amounts (£50,000 versus £150,000 might influence splits), working partner track record and experience (proven successful investors command more favorable terms than those with limited history), deal quality and exclusivity (off-market opportunities securing 20% discounts might justify working partners taking larger shares than properties sourced from Rightmove), and ongoing management intensity (hands-off FRI commercial properties might split differently than intensive HMO management). Common split structures include: straightforward percentage splits where all profits divide per agreed percentages (50/50, 60/40, 70/30 being most common); capital recovery models where capital partners receive initial investment return plus modest interest (perhaps 5-8% annually) before profit splitting begins—for example, capital partner receives first £60,000 returning their £50,000 investment plus £10,000 interest, then subsequent profits split 50/50; tiered structures where initial returns favor capital partners but subsequent returns rebalance—perhaps first £20,000 profits split 70/30 favoring capital, next £20,000 splits 50/50, profits beyond £40,000 split 40/60 favoring working partner; or performance-based arrangements where working partner shares increase if projects exceed agreed return targets. First-time working partners should expect accepting less favorable splits (40% or less) reflecting unproven status, whilst established working partners with strong track records might command 50-60% depending on opportunity quality. Capital partners providing £100,000+ might expect more favorable terms than those contributing £50,000 given larger risk exposure. Crucially, profit splits prove less important than overall partnership dynamics and project execution quality—50/50 split with excellent working partner delivering 12% total returns provides better outcomes than 70/30 split with mediocre partner achieving 7% returns. Never base partnership decisions primarily on profit split percentages without thoroughly evaluating partner quality, project fundamentals, and relationship compatibility.

How do I find reliable joint venture partners for property investment?

Finding trustworthy joint venture partners represents property investment's greatest challenge, with no shortcuts or guaranteed approaches. The most successful partnerships typically arise through existing professional or personal relationships rather than cold searches—business associates, professional network connections, property education course participants, or personal friends with complementary investment interests and verified trustworthiness. Building these relationships takes considerable time, often 12-24+ months of regular interaction, collaboration on smaller projects, and demonstrated reliability before formalizing substantial financial partnerships. For working partners seeking capital, effective strategies include: demonstrating competence through personal investment successes first—own 2-3 successful properties before seeking partners, providing proof of capability; building professional reputations through property networking events, investment associations, property education teaching, or industry content creation establishing credibility and visibility; leveraging professional networks through accountants, solicitors, mortgage brokers, or estate agents who encounter high-net-worth individuals seeking property exposure; and accepting initially asymmetric terms (60/40 or 70/30 favoring capital partners) for first 1-2 deals demonstrating reliability, with rebalancing opportunities after proving capability. For capital partners seeking working partners, strategies include: attending property investment education events and networking groups where serious investors congregate; engaging with property professionals (letting agents, property sourcers, developers) with established track records and client references; approaching property management companies whose principals might consider JV partnerships beyond pure management services; and critically, conducting exhaustive due diligence including multiple verified references from previous partners or clients, evidence of successful completed projects with documented outcomes, professional indemnity insurance confirming serious professional approach, and extensive personal meetings assessing communication, integrity, and compatibility before any commitments. Warning signs demanding immediate disengagement include: unwillingness providing detailed references or financial history; pressure for rapid decisions without proper due diligence periods; reluctance to use proper legal agreements or specialist solicitors; lack of verifiable track record or documented previous successes; evasive answers about previous partnerships or projects; and incompatible communication styles or values suggesting inevitable conflicts. Several specialist platforms exist facilitating property JV matchmaking—Property Investors Network, Progressive Property, Property Tribes—though even these require exceptional caution and thorough verification before proceeding. Remember that most JV failures stem from partner selection mistakes rather than deal structure issues—invest far more effort evaluating potential partners than analyzing property opportunities, as poor partners destroy even excellent opportunities whilst strong partners deliver acceptable outcomes despite mediocre properties.

What legal documents do I need for a property joint venture?

Proper property joint venture documentation requires comprehensive legal agreements drafted by solicitors specializing in property partnerships—informal arrangements or inadequate documentation create expensive conflicts when circumstances change or disagreements arise. Essential documentation includes: Shareholder Agreement (for SPV company structures)—this governs partner relationships, decision-making, profit distribution, exit provisions, deadlock resolution, and all operational aspects. Critical clauses must address: profit split percentages and distribution timing/frequency; decision-making authorities specifying which decisions require unanimous consent (major acquisitions, significant borrowing, director appointments) versus majority votes (routine operations); capital contribution requirements and procedures if additional funding needed; exit mechanisms including buyout rights, valuation methodologies, and forced sale triggers; dispute resolution processes including mediation requirements before litigation; deadlock provisions for 50/50 partnerships when partners cannot agree; death, incapacity, or bankruptcy provisions addressing what happens if partners die or face financial difficulties. Company Articles of Association establishing corporate governance framework, though these typically follow standard formats with shareholder agreement providing detailed specific provisions. Property Purchase Documentation including mortgage arrangements, property title transfers, and all standard conveyancing documents—ensure legal ownership clearly reflects agreed structure (company ownership versus personal co-ownership). Management Services Agreement (if working partner providing ongoing management)—specifies management responsibilities, fees or profit share arrangements, performance standards, and termination provisions. Side Letter Agreements sometimes documenting private arrangements between partners not suitable for shareholder agreements—though extensive reliance on side letters suggests inadequate main documentation. Personal Guarantees for commercial mortgages or other borrowing where lenders require partner guarantees beyond company obligations. Insurance Documentation including landlord insurance, professional indemnity insurance (working partners), and potentially key person insurance on working partners whose death would significantly impact ventures. Tax Structure Documentation including corporation tax registrations, VAT registrations if applicable, and any tax elections or planning arrangements. Legal costs for comprehensive JV documentation typically range £2,000-5,000+ depending on complexity, property values, number of partners, and specific circumstances—these costs should be shared between partners or borne by the partnership entity. Using inadequate documentation or attempting DIY agreements using internet templates proves dramatically more expensive long-term—poorly drafted agreements create ambiguity generating disputes consuming £20,000-100,000+ legal costs resolving through litigation or forced dissolutions. Both partners must obtain independent legal advice from different solicitors—shared solicitors create conflicts of interest potentially invalidating agreements if disputes arise. Accountants should also advise on optimal tax structures (company versus partnership, profit distribution timing, capital versus revenue treatment) before finalizing agreements, as restructuring after establishment proves expensive or impossible. Never proceed with property joint ventures without comprehensive specialist legal documentation regardless of how trusted partners are or how simple arrangements seem—circumstances change, relationships deteriorate, and memories of verbal agreements differ, making written documentation absolutely essential protecting all parties.

Can I exit a joint venture early if the partnership isn't working?

Exiting joint ventures early when partnerships deteriorate proves considerably more complex and expensive than investors anticipate, with outcomes depending entirely on exit provisions within partnership agreements and partners' willingness negotiating reasonable solutions. If comprehensive shareholder or partnership agreements exist containing proper exit provisions, several mechanisms might apply: Buyout rights allowing one partner purchasing the other's equity stake at valuations determined per agreement methodologies—typically independent RICS surveyor valuations or formula-based calculations using property values minus outstanding debts. However, buyouts require purchasing partners possessing available funds or securing financing covering buyout amounts, which proves problematic if property values declined or partners' financial circumstances changed. Put and call options giving either partner rights to force sales or purchases at specific times or under defined circumstances—though exercising these rights requires financial capability completing transactions. Deadlock provisions triggering when partners cannot agree on fundamental decisions, potentially requiring mediation, arbitration, or ultimately forcing property sales with proceeds distributed per equity percentages—though forced sales during unfavorable markets crystalize losses neither partner wants. If agreements lack proper exit provisions or partnerships deteriorated such that cooperation proves impossible, options become extremely limited and expensive: negotiated buyouts where partners agree terms independent of agreement provisions, typically requiring significant compromise and potentially professional mediation facilitation at £2,000-5,000+ costs; mutual agreement to sell properties with proceeds distributed per ownership percentages, though this requires both partners accepting sale timing and proceeds allocation; or legal action seeking partnership dissolution, buyout orders, or property sales through courts—extraordinarily expensive (£30,000-100,000+ legal costs), time-consuming (12-24+ months), and damaging to all parties regardless of outcomes. Partners in SPV company structures face additional complexity—minority shareholders (owning less than 50%) possess extremely limited ability forcing outcomes, whilst majority shareholders face unfair prejudice claims if they attempt forcing minority partners out on unreasonable terms. Partnerships holding multiple properties face challenges around whether all properties must be addressed simultaneously or if individual property exits prove possible—this depends entirely on agreement provisions and properties' ownership structures. Prevention proves far superior to cure—before entering joint ventures, ensure: comprehensive exit provisions covering all foreseeable exit scenarios within shareholder agreements; clear valuation methodologies avoiding valuation disputes; practical buyout financing arrangements or property sale triggers when buyouts prove unaffordable; mediation and dispute resolution processes addressing conflicts before irreparable relationship breakdown; and realistic understanding that early exits typically prove expensive and disruptive regardless of agreement quality. The harsh reality is that joint ventures represent medium-to-long-term commitments of 5-10+ years optimally—partners entering arrangements expecting easy early exits if situations deteriorate fundamentally misunderstand joint venture nature and should reconsider partnership appropriateness for their circumstances.

Should I form a joint venture with someone I don't know well?

Forming property joint ventures with people you don't know well represents exceptionally high-risk proposition strongly discouraged regardless of opportunity attractiveness or professional credentials partners present. Successful joint ventures require extraordinary levels of trust, communication compatibility, aligned values, and proven reliability—qualities impossible to verify through brief interactions or surface-level due diligence. The statistics prove sobering: property industry estimates suggest 60-70% of joint ventures between strangers fail within 3-5 years, typically through partnership relationship breakdown rather than property performance issues. Even ventures involving seemingly competent professionals with strong track records frequently deteriorate when working together reveals incompatibilities, different work ethics, miscommunication patterns, or fundamentally different values and objectives partners didn't recognize during initial courtship phases. Trust proves absolutely fundamental—partners must trust each other's competence executing responsibilities, integrity handling funds and making decisions, commitment maintaining effort through difficult periods, communication providing honest information even when uncomfortable, and judgment prioritizing partnership interests alongside personal objectives. These trust foundations require substantial time building through multiple interactions across various contexts—business dealings, social settings, challenging situations revealing character—before sufficient confidence develops justifying £50,000-200,000+ financial commitments. Minimum relationship building period before considering property JV partnerships should span 12-24+ months including: regular face-to-face meetings in various settings assessing personality, communication style, and reliability; smaller collaborative projects or business interactions demonstrating ability working together productively; verified references from multiple previous partners, clients, or business associates confirming claimed capabilities and character; observation through challenging situations revealing how partners handle stress, disagreement, or adversity; and extensive discussions addressing values, risk tolerance, conflict resolution approaches, and long-term objectives ensuring genuine alignment. Even after 12-24 months interaction, proceed cautiously with proper legal protection, modest initial commitments, and continuing vigilance for concerning behaviors. Alternative approaches for investors without existing trusted relationships include: starting solo with direct property investment building portfolios independently without partnership risks; engaging professional property management companies or investment firms providing passive exposure through formal commercial arrangements rather than partnerships; investing through established property funds or REITs offering liquidity and professional management without personal partnership relationships; or investing extended time building genuine professional networks and relationships before pursuing JV opportunities rather than rushing partnerships with strangers. If you find yourself considering joint ventures with people you've known less than 12 months, lack verified references from previous partners, or don't completely trust handling your family's financial wellbeing, the partnership should not proceed regardless of opportunity quality. Excellent properties with unsuitable partners deliver disappointing outcomes, whilst moderate properties with outstanding partners typically exceed expectations—partner quality determines success far more than deal quality, making partner selection the absolute critical success factor in joint venture investing.