Commercial Property Investment

LAT Property Investments providing exciting Commercial property investment opportunities

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

Commercial Property Investment opportunities

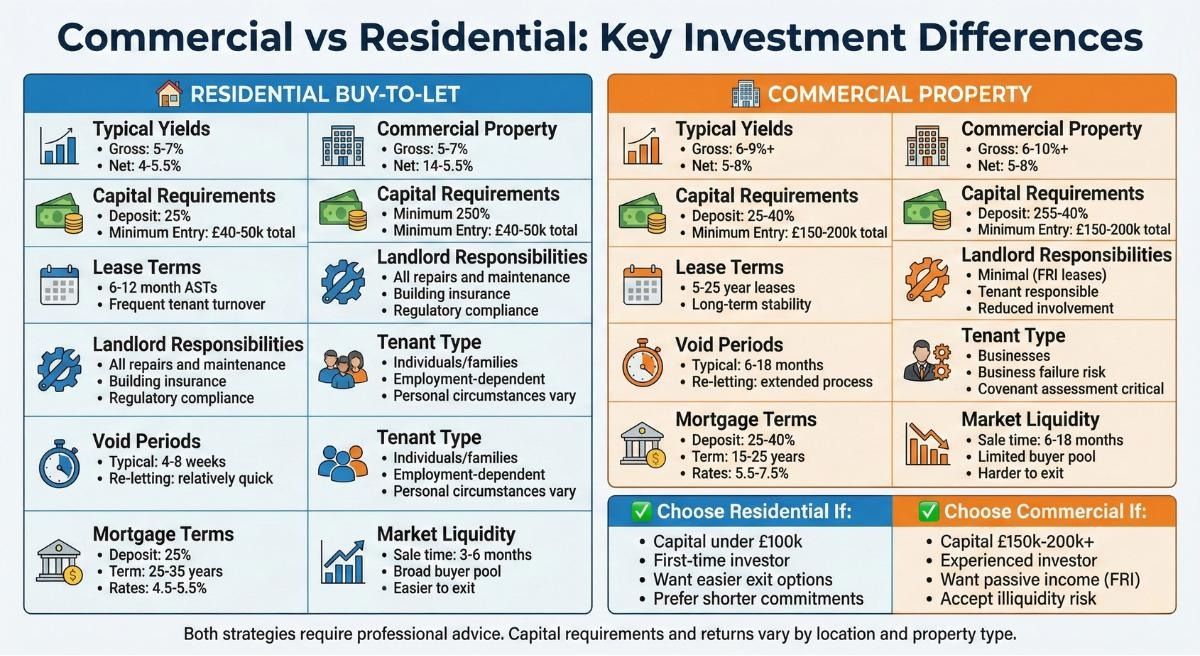

Commercial property investment involves acquiring premises occupied by businesses rather than residential tenants—offices, retail units, industrial warehouses, leisure facilities, and mixed-use developments. These assets typically deliver higher rental yields than residential properties, often reaching 6-9% or more, whilst providing longer lease terms creating income stability and predictability absent from residential investments where tenants change frequently.

However, commercial property demands substantially higher capital requirements, more sophisticated market knowledge, and tolerance for significantly different risk profiles than residential investment. Entry-level commercial opportunities typically require £100,000-300,000 minimum capital, with many viable investments demanding £200,000-500,000 or more. Commercial mortgages require 25-40% deposits versus 25% for residential buy-to-let, whilst valuations, lease negotiations, and asset management require specialist expertise beyond typical residential landlord capabilities.

We occasionally identify commercial property opportunities when they align with specific client circumstances—experienced investors with substantial available capital seeking portfolio diversification, or business owners considering premises ownership rather than leasing. However, commercial property does not represent our primary expertise or focus area. Our core residential property sourcing service and residential buy-to-let investment strategies remain our principal specializations where we maintain deepest market knowledge and strongest sourcing capabilities.

Investors seriously considering commercial property should engage specialist commercial property advisors—commercial estate agents, chartered surveyors specializing in commercial valuations, solicitors experienced in commercial leases, and accountants understanding commercial property taxation. We provide introductions to appropriate specialists when clients express genuine commercial investment intentions backed by adequate capital and experience.

Commercial vs Residential Property Investment

Commercial and residential property investments differ fundamentally across multiple dimensions affecting returns, risks, and operational requirements.

Tenant types create the most obvious distinction. Commercial properties house businesses—retail shops, professional offices, manufacturing operations, restaurants, gyms—whilst residential properties accommodate individuals and families. Business tenants bring different priorities, behaviors, and risks than residential occupants. Businesses evaluate premises primarily on commercial viability—location suitability for customer access or employee recruitment, premises configuration supporting operational requirements, rental costs as percentage of revenue. Residential tenants prioritize personal preferences—commute convenience, school quality, neighborhood character, property size and condition.

Lease structures differ dramatically. Commercial leases typically run 5-25 years with longer terms common for substantial premises or significant tenant fit-out investments. Many commercial leases include break clauses allowing earlier termination at specified points (typically after 3 or 5 years), but even with break options, commercial tenancies provide far greater security than residential tenancies' 6-12 month arrangements. This stability benefits landlords through predictable long-term income but creates challenges when properties become vacant—finding replacement commercial tenants takes considerably longer than residential re-letting.

Tenant responsibilities represent crucial differences. Most commercial leases are structured as "Full Repairing and Insuring" (FRI) agreements where tenants assume all repair obligations, insurance costs, and often service charges. Landlords' operational involvement proves minimal beyond rent collection and lease renewals. This contrasts sharply with residential investment where landlords remain responsible for structural repairs, building insurance, and regulatory compliance. FRI structures reduce landlord operational burdens but create risks when tenants fail maintaining properties adequately or vacate leaving substantial dilapidations requiring expensive remediation.

Valuation methodologies follow different principles. Commercial properties are valued primarily through income capitalization—annual rent divided by yield reflecting market expectations produces capital values. A property generating £30,000 annual rent in a market where 7% yields prevail values at approximately £428,000 (£30,000 ÷ 0.07). This income-focused approach means rental values directly determine capital values far more than with residential property where comparable sales dominate valuations. Commercial property capital values can decline substantially if rental markets weaken, even without physical deterioration.

Financing arrangements prove more restrictive for commercial property. Commercial mortgages typically require 25-40% deposits depending on property type and borrower profile—retail and leisure properties often demand 35-40% deposits reflecting higher perceived risks, whilst offices and industrial units might accept 25-30% for strong covenant tenants. Mortgage terms run shorter, typically 15-25 years versus 25-35 years for residential mortgages, creating higher monthly payments. Lenders assess viability primarily on rental income coverage, typically requiring rent covering 125-130% of mortgage interest costs. Personal guarantees are standard, exposing borrowers' personal assets to commercial mortgage defaults.

Regulatory environments differ substantially. Commercial properties face business rates rather than council tax—rates calculated on properties' rateable values can prove considerably higher than residential equivalents. Energy Performance Certificate (EPC) requirements prove more stringent, with regulations requiring commercial properties achieve minimum 'C' ratings by April 2028, potentially necessitating expensive energy efficiency improvements. Planning use classes govern permitted commercial activities—converting retail units to offices, restaurants to gyms, or any other use changes often requires planning permission creating complications absent from residential property.

Commercial Property Sectors

Commercial property encompasses diverse sectors with distinct characteristics, tenant profiles, and investment dynamics.

Office space ranges from prestigious city center towers housing financial services and corporate headquarters, to suburban business parks accommodating smaller professional services firms, to small individual units serving local businesses. London, Manchester, Birmingham, and Leeds provide the UK's strongest office markets. Office investment success depends heavily on location quality—proximity to transport hubs, availability of amenities for employees, and building specifications meeting modern occupier requirements including air conditioning, raised floors for cabling, and increasingly, strong environmental credentials. Post-pandemic working pattern changes have created divergence between prime Grade A offices commanding strong rents and secondary stock suffering higher vacancy rates.

Retail property includes high street shops, shopping centers, retail warehouses, and supermarkets. Retail investment has faced substantial challenges from e-commerce growth reducing physical retail demand, particularly affecting traditional high streets and secondary shopping centers. However, convenience retail, supermarkets, and retail warehouses serving "click and collect" functions maintain relatively robust fundamentals. Retail investment demands careful assessment of specific location footfall, competing retail provision, and tenant covenant strength. Retail yields vary enormously—prime supermarket investments might yield 4-5% reflecting low risk, whilst secondary high street shops can offer 8-10% yields reflecting substantial risk.

Industrial and logistics properties encompass warehouses, distribution centers, light industrial units, and increasingly, last-mile delivery hubs supporting e-commerce. This sector has performed exceptionally strongly recent years, driven by e-commerce growth creating insatiable demand for logistics space. Properties with good motorway access, adequate loading facilities, and modern specifications command premium rents and attract institutional investor demand. Smaller industrial estates providing units for local businesses offer opportunities for private investors, typically yielding 7-9% with strong tenant demand from businesses requiring affordable operational space.

Leisure properties include hotels, restaurants, gyms, cinemas, and entertainment venues. Leisure investment carries higher risks than other commercial sectors due to business model vulnerabilities—leisure businesses often operate on tight margins making them susceptible to economic downturns, changing consumer preferences, or operational challenges. However, well-located leisure properties with strong operator covenants can deliver attractive returns, typically yielding 7-10%. Leisure investment demands thorough understanding of specific business viability and location sustainability.

Mixed-use developments combining residential apartments with ground-floor commercial units (typically retail or restaurants) offer diversification within single assets. These investments spread risk across residential and commercial income streams whilst often benefiting from planning policies encouraging mixed-use development. However, mixed-use properties prove more complex to manage, finance, and value than single-use assets.

Current market dynamics vary significantly by sector. Industrial/logistics remains exceptionally strong with limited supply and robust demand. Offices show divergence between prime and secondary stock. Retail continues restructuring with convenience formats outperforming traditional high street. Leisure faces ongoing uncertainty though showing recovery from pandemic impacts.

Commercial Investment Benefits

Commercial property offers distinctive advantages attracting experienced investors seeking alternatives to residential investment.

Higher rental yields represent commercial property's primary appeal. Typical commercial yields range 6-9% across most sectors, with some higher-risk opportunities reaching 10%+ gross yields. This compares favorably with residential buy-to-let yields of 5-7% in most markets. The yield premium reflects both higher risks and different valuation dynamics—commercial property values more directly reflect income streams, whilst residential values incorporate substantial owner-occupier demand creating capital appreciation often exceeding rental yields.

Longer lease terms provide income security impossible with residential tenancies. Five-year leases represent minimum commercial standards, with 10-15 year terms common and 20-25 year leases occurring for substantial properties. Even accounting for break clauses, commercial tenancies provide multi-year income certainty. This stability facilitates accurate financial planning, reduces void-related income disruption, and minimises tenant turnover costs. However, this benefit converts to disadvantage when markets strengthen—landlords cannot increase rents until lease reviews or renewals, potentially missing years of rental growth.

Tenant-responsible repairs through Full Repairing and Insuring lease structures substantially reduce landlord operational involvement and costs compared to residential property. Commercial landlords typically avoid the constant maintenance requests, emergency repairs, compliance inspections, and regulatory obligations consuming residential landlords' time and money. Annual commercial landlord involvement might comprise simply processing rent payments and conducting occasional lease administration. This operational simplicity proves particularly attractive for investors seeking genuinely passive income.

Upward-only rent reviews in many commercial leases protect landlords from rental declines whilst capturing growth. Traditional lease structures include rent reviews every 5 years adjusting rent to current market levels, but crucially specifying rents cannot decrease below previous levels. This mechanism means landlords benefit fully from rental market improvements whilst suffering no reduction during market weakening. However, upward-only reviews have become less universal in recent years, with some landlords accepting open market reviews to attract tenants.

Business tenant reliability often exceeds residential tenant consistency. Established businesses with multi-year premises commitments typically prioritize rent payment maintaining operational continuity. Business failures obviously create exceptions, but functioning businesses generally prove more financially reliable than individual residential tenants whose employment, relationships, or personal circumstances change unpredictably.

Capital appreciation potential exists substantially for well-selected commercial property, particularly when rental growth drives yield compression. Properties acquired when sectors face temporary challenges but possess strong underlying fundamentals can deliver exceptional capital returns as markets recover. Industrial property investors purchasing during 2010-2015 before e-commerce logistics boom achieved extraordinary capital appreciation alongside solid rental yields.

Significant Challenges and Risks

Commercial property's benefits accompany substantial challenges and risks frequently underestimated by investors experienced only in residential property.

Capital requirements prove prohibitive for many investors. Entry-level commercial investments typically require £100,000-150,000 minimum capital covering deposits, transaction costs, refurbishment allowances, and contingency reserves. Viable commercial opportunities more commonly demand £200,000-300,000, with many strong investments requiring £300,000-500,000+. A £400,000 commercial property purchase requires £120,000-160,000 deposit (30-40%), approximately £16,000-20,000 stamp duty and transaction costs, £10,000-30,000 potential refurbishment, and £20,000-40,000 contingency reserves—total capital requirement £170,000-250,000. These capital levels exclude most residential investors regardless of commercial strategy interest.

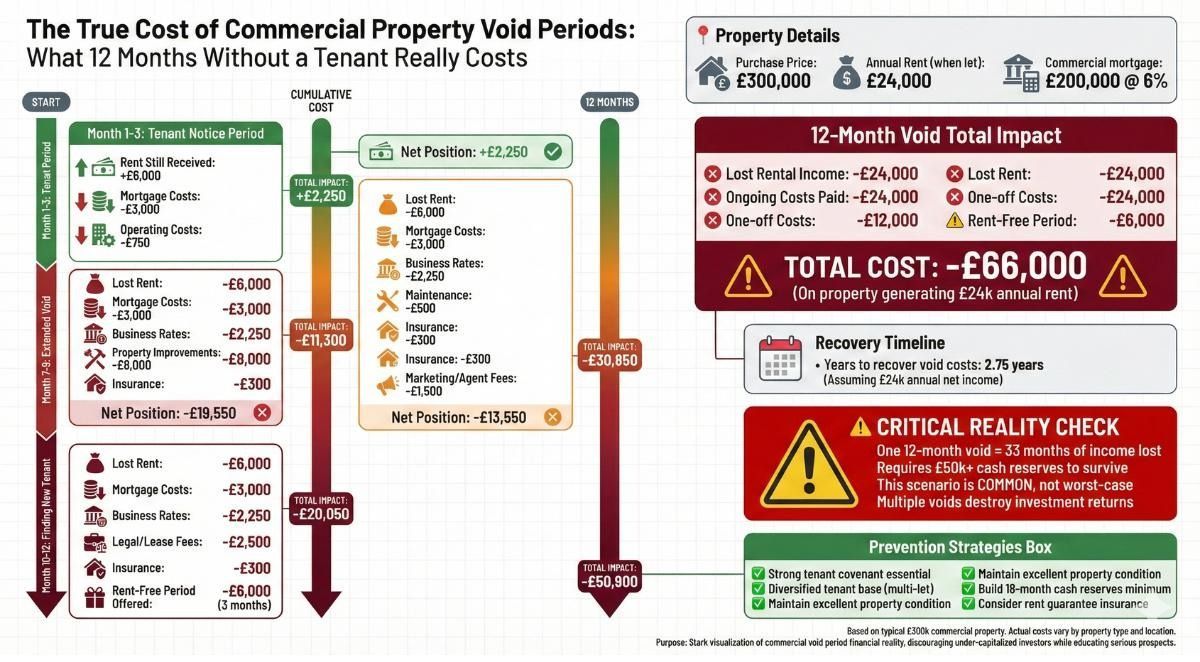

Extended void periods create substantial income disruption when commercial tenants vacate. Finding replacement commercial tenants commonly takes 6-12 months, occasionally 18-24 months for specialized properties or challenging locations. During voids, landlords face ongoing mortgage costs, business rates (unless vacant property relief applies), insurance, and minimal maintenance whilst generating zero income. A £30,000 annual rent property vacant 12 months costs approximately £40,000-45,000 in lost income plus ongoing costs—financial impact far exceeding typical residential void periods of 4-8 weeks.

Tenant insolvency risks prove substantially higher than residential tenancy failures. Business failures occur regularly, particularly during economic downturns, leaving landlords with vacant properties, unpaid rent arrears, and potentially substantial dilapidations if tenants failed maintaining premises. Company liquidations frequently leave landlords as unsecured creditors recovering minimal percentages of owed amounts. Tenant covenant strength assessment proves crucial but imperfect—even apparently strong businesses can fail unexpectedly.

Economic sensitivity affects commercial property far more severely than residential. During recessions, businesses close, downsize, or renegotiate leases downward, whilst new business formation slows reducing tenant demand. Commercial rental markets weaken substantially during economic difficulties whilst residential rental demand often strengthens as people delay or avoid homeownership. Commercial property capital values can decline 30-50% during severe downturns as yields expand reflecting increased risk perceptions.

Specialist knowledge requirements exceed most residential investors' expertise. Understanding lease structures, rent review mechanisms, service charge calculations, dilapidations assessments, use class planning restrictions, and sector-specific dynamics requires professional expertise. Investors lacking commercial property knowledge frequently make expensive mistakes—overpaying for properties, accepting unfavorable lease terms, or failing to identify latent risks. Professional advisors prove essential but add substantial costs to investment processes.

Illiquidity characterizes commercial property markets. Commercial properties typically take 6-18 months to sell, compared to 3-6 months for residential property. Fewer potential purchasers exist for commercial assets, particularly specialized properties. Forced sales due to financial pressure or changing circumstances often realize disappointing prices as buyers exploit distressed sellers' limited negotiating positions.

Business rates and operating costs exceed residential equivalents substantially. Business rates can reach £10,000-50,000+ annually depending on rateable values. During void periods, empty property rates might apply at 100% rateable value or potentially qualify for relief depending on circumstances and duration. Building insurance costs more for commercial property than residential equivalents. These costs continue regardless of occupancy, creating ongoing financial drains during void periods.

Commercial Mortgages and Financing

Commercial property financing follows different principles and requirements than residential mortgages, with less favorable terms reflecting lenders' perception of increased commercial property risks.

Deposit requirements typically range 25-40% of purchase prices, significantly higher than residential buy-to-let's 25% standard. Retail and leisure properties often demand 35-40% deposits reflecting higher perceived risks from sector challenges. Offices and industrial properties might accept 25-30% deposits for properties with strong tenant covenants and favorable locations. First-time commercial property investors sometimes face 40% deposit requirements regardless of property quality, with subsequent purchases allowing reduced deposits as investors demonstrate commercial property experience.

Mortgage terms run shorter than residential equivalents, typically 15-25 years versus 25-35 years for buy-to-let mortgages. Shorter terms create higher monthly payments reducing cash flow despite commercial property's typically higher yields. Interest-only commercial mortgages exist but prove less common than residential equivalents, with many lenders requiring partial or full capital repayment over mortgage terms.

Rental coverage requirements prove more stringent than residential criteria. Commercial mortgage lenders typically require rental income covering 125-130% of mortgage interest costs when calculated at stress test rates (often 6-7% regardless of actual mortgage rate). These requirements mean £30,000 annual rent supports maximum £230,000-240,000 borrowing at typical coverage ratios—substantially constraining loan-to-value ratios when combined with deposit requirements.

Interest rates exceed residential mortgage rates by 1-2 percentage points, reflecting commercial property's higher risk profile. Residential buy-to-let mortgages might achieve 4.5-5.5% interest rates, whilst commercial mortgages typically charge 5.5-7.5% depending on property type, tenant covenant, and borrower profile. These higher rates significantly impact investment returns, particularly on highly leveraged acquisitions.

Personal guarantees are standard requirements for commercial mortgages, exposing borrowers' personal assets to mortgage defaults. Unlike some residential buy-to-let mortgages potentially confined to property assets alone, commercial mortgage defaults can trigger personal liability claims against all borrower assets including primary residences and investment portfolios.

Alternative financing options exist for specific circumstances. Bridging finance provides short-term funding (typically 12-24 months) at higher interest rates (7-12%+ annually) allowing rapid property acquisition or holding assets during refurbishment before securing longer-term commercial mortgages. Development finance supports property conversion or substantial refurbishment projects. Mezzanine finance bridges gaps between primary mortgage amounts and required purchase prices, though at premium interest rates reflecting subordinated security positions.

LAT's Approach to Commercial Property

Our relationship with commercial property investment remains deliberately limited, reflecting honest assessment of our expertise boundaries and recognition that specialized commercial property advisors better serve investors' interests in this sector.

We occasionally identify commercial property opportunities arising through our residential property sourcing networks—small retail units with residential accommodation above, mixed-use developments, or straightforward light industrial properties. When such opportunities align with specific client circumstances and represent genuinely viable investments, we facilitate introductions and provide appropriate context. However, these instances occur rarely, perhaps several times annually rather than forming regular deal flow.

Commercial property does not represent our core competence or primary market focus. Our team's expertise, relationships, and market knowledge center firmly on residential investment—buy-to-let properties, HMO opportunities, and occasionally residential development projects. Attempting to position ourselves as commercial property specialists would disserve clients by providing inferior guidance compared to genuine commercial property professionals who operate exclusively in commercial markets.

When clients express serious commercial property investment intentions, we typically recommend engagement with specialist commercial property agents, chartered surveyors specializing in commercial valuations, solicitors experienced in commercial lease negotiations, and accountants understanding commercial property taxation intricacies. These professionals possess sector-specific knowledge, market intelligence, and technical capabilities we cannot replicate through our residential focus.

We maintain selective criteria for any commercial opportunities we do facilitate. Investors must demonstrate substantial available capital—minimum £150,000-200,000 liquid funds beyond existing commitments. They should possess prior property investment experience, ideally having successfully operated residential portfolios providing foundational landlord knowledge. Clear investment strategies explaining why commercial property suits their objectives and how specific opportunities align with portfolio goals prove essential. Most importantly, investors must commit to engaging appropriate professional advisors rather than attempting commercial investment through residential investment knowledge alone.

For most investors, residential buy-to-let investment strategies deliver superior risk-adjusted returns given accessible capital requirements, more liquid markets, and operational simplicity compared to commercial property's substantial capital demands and complexity. Investors comfortable with increased complexity and possessing adequate capital might also consider joint venture structures for larger commercial acquisitions, potentially providing commercial property exposure without bearing full capital requirements or management responsibilities individually.

We maintain our focus where we deliver greatest value—identifying, evaluating, and facilitating excellent residential property investment opportunities across England's strongest markets. Commercial property remains peripheral activity we acknowledge exists but recommend clients pursue through specialist channels better positioned to serve their commercial investment requirements.

Frequently Asked Questions About Commercial Property Investment

How much money do I realistically need to invest in commercial property?

Minimum viable commercial property investment typically requires £150,000-200,000 total available capital, though many worthwhile opportunities demand £250,000-400,000+. These figures include deposits (25-40% of purchase prices), stamp duty on commercial property (typically 2-5% of purchase price depending on value), legal fees and surveys (£3,000-8,000 for commercial transactions given additional complexity), potential refurbishment costs (£10,000-50,000 depending on property condition and tenant fit-out requirements), and crucially, substantial contingency reserves covering 12-24 months of mortgage payments and operating costs during potential void periods. For example, purchasing a £300,000 retail unit requires approximately £90,000-120,000 deposit (30-40%), £10,000-13,000 stamp duty, £5,000-8,000 transaction costs, £15,000-25,000 refurbishment allowance, and £30,000-50,000 contingency reserves—total capital requirement £150,000-216,000. These capital levels exclude most investors regardless of commercial property interest. Additionally, unlike residential property where £50,000 capital allows viable entry-level investments, commercial property's minimum viable opportunities rarely exist below £200,000-250,000 purchase prices—smaller commercial units often suffer poor locations, limited tenant appeal, or problematic lease situations making them unsuitable regardless of affordable pricing. We generally advise investors require £200,000+ liquid capital beyond existing commitments before seriously considering commercial property investment. Lower capital levels should focus on residential buy-to-let strategies where viable opportunities exist at accessible price points with substantially lower deposit requirements and transaction costs.

What are the main differences between commercial and residential property mortgages?

Commercial mortgages differ substantially from residential buy-to-let mortgages across multiple dimensions, generally providing less favorable terms reflecting lenders' perception of higher commercial property risks. Deposit requirements reach 25-40% for commercial mortgages versus 25% standard for residential buy-to-let—retail and leisure properties often demanding 35-40% deposits, whilst offices and industrial units might accept 25-30% for strong situations. Mortgage terms run shorter, typically 15-25 years versus 25-35 years residential, creating higher monthly payments despite commercial property's superior yields. Interest rates exceed residential equivalents by 1-2 percentage points—residential buy-to-let mortgages achieving 4.5-5.5% whilst commercial mortgages charge 5.5-7.5% depending on property type and borrower profile. Rental coverage requirements prove more stringent, typically demanding rent covering 125-130% of mortgage interest versus 125% residential standard, calculated at higher stress test rates (6-7% versus 5.5% residential). Lender assessment focuses heavily on tenant covenant strength and lease terms—properties with strong, creditworthy tenants on long leases secure better mortgage terms than those with weak tenants or short remaining lease periods. Personal guarantees prove universal requirements for commercial mortgages, exposing all borrower assets to default claims, whereas some residential mortgages confine liability to property assets alone. Product availability proves limited compared to residential mortgages—fewer lenders offer commercial mortgages, with limited competition often resulting in less favorable terms. Additionally, commercial mortgage applications require substantially more documentation including full business plans, detailed property valuations from RICS-qualified commercial surveyors, comprehensive lease documentation, and often tenant financial information verifying covenant strength. Processing times extend 8-12 weeks typically versus 6-8 weeks for residential mortgages. These differences mean commercial mortgage availability and terms significantly impact investment viability—opportunities appearing attractive based on purchase prices and rents sometimes prove unworkable when actual available mortgage terms reduce returns below acceptable levels.

How long does it typically take to find tenants for vacant commercial properties?

Commercial property void periods substantially exceed residential equivalents, typically ranging 6-18 months depending on property type, location quality, lease terms offered, and prevailing market conditions. Office space in strong locations with good specifications might find tenants within 6-9 months, whilst secondary retail units in challenging high street locations can remain vacant 12-24 months or longer. Industrial units demonstrate variable void periods—modern warehouses with good motorway access often let within 6-12 months, whilst older secondary industrial estates might struggle 12-18+ months. Leisure properties prove particularly unpredictable, as finding operators for restaurants, gyms, or entertainment venues depends on identifying businesses specifically seeking premises, securing any necessary licenses or planning consents, and negotiating fit-out contributions or rent-free periods allowing tenant establishment. These extended void periods create severe financial pressure—a property generating £30,000 annual rent sitting vacant 12 months costs approximately £40,000-50,000 in combined lost income, ongoing mortgage costs, business rates (unless vacant property relief applies, which has specific qualifying criteria and time limitations), insurance, and minimal maintenance. During void periods, landlords cannot simply reduce operational involvement as with tenanted properties—active marketing requires engaging commercial letting agents (typically charging 10-15% of first year's rent as letting fees), maintaining properties in presentable condition, potentially offering inducements like initial rent-free periods (3-6 months common) or tenant fit-out contributions (£10,000-50,000+ for retail/leisure), and conducting viewings with prospective tenants. Extended voids often force landlords accepting lower rents than originally anticipated, longer rent-free periods than preferred, or less favorable lease terms than intended, further impacting investment returns. Void period risk represents one of commercial property investment's most significant challenges, explaining why commercial properties trade at higher yields than residential equivalents—the yield premium partly compensates for extended income disruption when tenancies end. Investors must maintain substantial cash reserves covering 12-18 months of mortgage payments and operating costs before purchasing commercial property, as void periods of this duration occur commonly rather than representing worst-case scenarios.

What happens if my commercial tenant's business fails during the lease?

Tenant business failure represents one of commercial property investment's most serious risks, potentially resulting in substantial financial losses beyond simply lost rental income. When commercial tenants enter administration, liquidation, or bankruptcy, lease obligations typically pass to insolvency practitioners who assess whether continuing lease commitments serves creditors' interests. In most cases, administrators disclaim leases, returning properties to landlords whilst leaving rent arrears and dilapidations as unsecured debts in the insolvency process. As unsecured creditors, landlords typically recover 0-10 pence per pound of owed amounts—essentially receiving nothing. Lost rental income during insolvency processes and subsequent void periods creates immediate financial impact—6-12 months of unpaid rent before formal insolvency plus 6-18 months void period finding replacement tenants means 12-30 months without rental income whilst mortgage and operating costs continue. Properties returned in poor condition require expensive remediation before remarketing—failed businesses often cease maintenance during financial difficulties, leaving properties with deferred repairs, damage from removed fixtures and fittings, and general dilapidation. Dilapidations claims against insolvent tenants prove worthless, meaning landlords absorb £10,000-100,000+ remediation costs depending on property size and condition. Former tenant fit-outs might prove unsuitable for different business types, requiring removal and reinstallation of alternative configurations at landlord expense. Additionally, properties associated with failed businesses sometimes suffer reputational damage or local perception problems making re-letting more difficult. Some protection mechanisms exist but prove imperfect. Rent deposits (typically 3-6 months' rent held as security) provide limited cushion but rarely cover full exposure. Guarantor requirements where parent companies or directors personally guarantee lease obligations offer protection if guarantors possess adequate assets, though many small business owners lack sufficient personal wealth to honor substantial guarantee claims. Landlord insurance policies sometimes include rent guarantee coverage, but exclusions, limitations, and claim processes often reduce effective protection. The fundamental reality is that commercial property investment places significant reliance on tenant business success—when tenants fail, landlords suffer substantial financial consequences largely beyond their control. This risk explains why tenant covenant strength assessment proves crucial in commercial property investment, and why properties let to financially weak tenants trade at higher yields reflecting increased risk.

Should I invest in commercial property through a limited company or personally?

Commercial property ownership structure decisions prove more complex than residential property equivalents, requiring professional tax and legal advice tailored to individual circumstances rather than following general recommendations. However, several considerations typically influence these decisions. Limited company ownership offers potential tax advantages—corporation tax at 19-25% versus income tax at 20-45% on rental profits, though this advantage diminishes for basic-rate taxpayers. Companies allow flexible profit extraction timing through salary/dividend combinations potentially optimizing overall tax positions. Capital gains tax upon eventual sale faces 19-25% corporation tax rates versus 18-28% personal CGT rates, though extracting proceeds from companies to personal use triggers additional dividend taxation potentially eliminating advantages. Companies facilitate cleaner succession planning and potential transfers to family members through share gifting rather than property transfers triggering substantial tax charges. However, commercial mortgages through limited companies typically carry 0.5-1% higher interest rates than personal borrowing, significantly impacting investment returns over time. Company administration costs £1,500-3,000+ annually for accounting, Corporation Tax returns, and Companies House filings. Extracting profits or sale proceeds from companies to personal use triggers dividend tax at 8.75-39.35% depending on personal tax positions, potentially creating double taxation eliminating corporation tax advantages. Commercial mortgage lenders often require personal guarantees even for company borrowing, meaning limited liability protection proves illusory for financed acquisitions—directors remain personally liable for mortgage defaults regardless of company structure. For investors purchasing single commercial properties without complex estate planning requirements, personal ownership often proves simpler and potentially cheaper overall despite higher headline tax rates. For investors building substantial commercial portfolios or with specific inheritance tax planning objectives, company structures might provide genuine advantages. Professional advice from accountants specializing in commercial property taxation and solicitors experienced in commercial property ownership structures proves essential—the wrong structure decision can cost tens of thousands in unnecessary taxation or create complications during eventual disposal. We strongly recommend investors obtain this specialist advice before completing commercial property purchases, as restructuring after acquisition proves expensive or impossible.