Property Investment in Sheffield

LAT Property Investments providing exciting property investment opportunities in SOUTH YORKSHIRE with investment entry levels from £20,000+

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

sheffield Property Investment

Sheffield offers property investors Yorkshire's most accessible entry point, combining genuinely affordable property prices with solid rental yields and established student market depth. For investors seeking value positioning—maximum returns from modest capital—or those building Yorkshire portfolios without Leeds' premium pricing, Sheffield consistently delivers viable opportunities.

Property prices averaging £110,000-£150,000 for investment-grade houses require deposits of just £28,000-£38,000, positioning Sheffield alongside Derby as England's most affordable major city investment markets. These budget-friendly entry costs deliver respectable gross rental yields of 6-8% for standard buy-to-let, extending to 9-11% for well-positioned HMO conversions in student areas - returns balancing immediate income against sustainable operational viability.

Sheffield's economic foundation has evolved from steel manufacturing heritage toward more diverse sectors including advanced manufacturing, healthcare (Sheffield Teaching Hospitals employing over 19,000), retail, and higher education. Two universities - University of Sheffield and Sheffield Hallam University - enroll approximately 65,000 students, creating substantial accommodation demand supporting HMO strategies across multiple neighborhoods.

The city's geographic character differs markedly from flat Midlands cities - Sheffield sits within South Yorkshire hills and Peak District proximity, creating varied topography affecting neighborhood desirability and property characteristics. Areas with challenging hills or limited transport access sometimes struggle despite superficially attractive pricing, requiring location-specific knowledge beyond simple postcode analysis.

Transport infrastructure provides reasonable connectivity - direct rail services to London (2 hours), Leeds, Manchester, and Nottingham, M1 motorway running through the city, and Sheffield-Rotherham tram network connecting various districts. These fundamentals support current rental demand whilst capital appreciation historically averages modest 3-4% annually - respectable without being exceptional.

Sheffield presents as Yorkshire's value proposition - investors accepting slightly lower growth prospects and less prestigious city profile than Leeds access significantly superior affordability creating faster portfolio building opportunities and higher immediate yields. It stands out among England's property investment locations for combining university city rental demand with genuinely affordable entry prices that suit budget-conscious investors

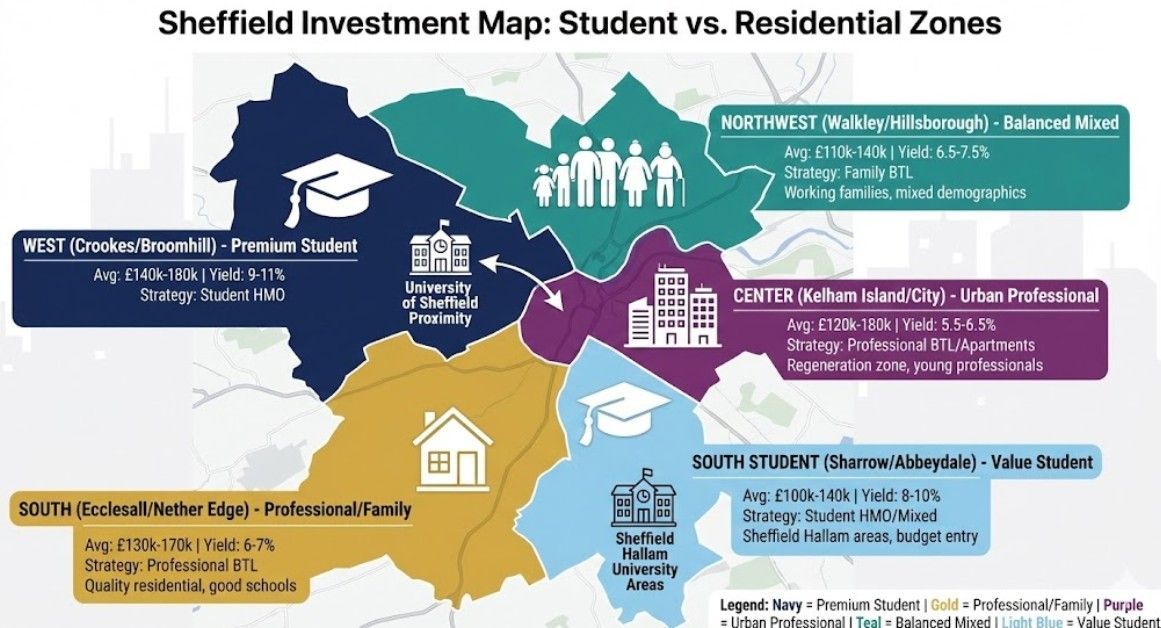

Key Sheffield Neighborhoods for Investment

Sheffield's topography and university locations create distinct investment zones requiring understanding beyond simple price-point analysis.

Crookes and Broomhill (Premium Student Areas)

These areas adjacent to University of Sheffield represent the city's premier student accommodation zones. Victorian terraced houses typically cost £140,000-£180,000, generating 9-11% gross yields when fully tenanted with 5-7 students paying £280-£350 monthly per room.

Crookes particularly benefits from hilltop position offering city views whilst maintaining convenient campus proximity. Broomhill sits closer to university main campus with excellent amenities including independent shops and cafes creating vibrant student community atmosphere.

These areas demonstrate strongest student demand and most established HMO infrastructure, though competition from purpose-built student accommodation has intensified in recent years. Properties in prime locations near campus maintaining quality standards continue letting successfully, whilst peripheral properties or those in poor condition face increased tenant acquisition challenges. The HMO market operates at similar scale to Nottingham's established student sector, though Sheffield's lower property prices deliver comparable yields with reduced capital requirements.

Ecclesall and Nether Edge (South Sheffield Residential)

South Sheffield neighborhoods provide family-oriented and young professional rental markets with properties ranging £130,000-£170,000 delivering 6-7% gross yields to stable tenant demographics.

Ecclesall Road corridor particularly attracts professionals and postgraduate students seeking quality accommodation outside pure undergraduate student zones. The area benefits from excellent local amenities, decent schools, and reasonable city center connectivity.

Nether Edge offers similar appeal with marginally better affordability and Victorian/Edwardian properties attracting families and established professionals. These neighborhoods suit straightforward buy-to-let strategies avoiding student market complexities whilst maintaining respectable yields.

Kelham Island and City Center (Urban Regeneration)

Kelham Island represents Sheffield's primary regeneration success story, transforming from industrial dereliction into trendy neighborhood with converted warehouse apartments, independent businesses, and creative sector appeal. Modern apartments typically cost £120,000-£180,000, generating 5.5-6.5% gross yields to young professionals.

City center proper contains various apartment developments with mixed success—some demonstrate strong demand and letting performance, others struggle with oversupply or management issues. Sheffield's city center hasn't experienced regeneration intensity matching Leeds or Manchester, creating more modest apartment market depth and appreciation potential.

These areas suit investors wanting urban professional market exposure at Yorkshire price points, though opportunities lack the growth dynamism of larger cities' regeneration zones.

Walkley and Hillsborough (Northwest Sheffield)

Northwest areas provide balanced opportunities—property prices £110,000-£140,000, yields 6.5-7.5%, and mixed tenant demographics including working families, young professionals, and some students attending Sheffield Hallam's nearby campuses.

Hillsborough particularly benefits from tram connectivity and local amenities including Wednesday football ground proximity. The area demonstrates solid working-class residential character with stable tenant demand at accessible price points.

These neighborhoods represent dependable middle-market territory suitable for investors seeking Sheffield exposure without premium student area pricing or requiring city center positioning.

Sharrow and Abbeydale (South Student Zones)

Areas south of city center near Sheffield Hallam campuses provide additional student accommodation opportunities at more accessible price points than University of Sheffield zones. Properties cost £100,000-£140,000, potentially delivering 8-10% gross yields.

However, these areas face stronger competition from purpose-built student accommodation and sometimes struggle with neighborhood perception issues affecting student appeal. Success requires understanding which specific streets maintain demand versus those experiencing tenant acquisition challenges as purpose-built accommodation diverts students from traditional HMO markets.

Areas Requiring Caution

Certain Sheffield neighborhoods—parts of Page Hall, some Manor streets, pockets of Firth Park—face persistent challenges around deprivation, property condition, or limited tenant demand. Properties might offer superficially attractive yields (8-9%+) but often generate returns through necessity rather than genuine investment quality.

First-time investors particularly should focus on established areas with proven tenant demand rather than chasing maximum theoretical yields in neighborhoods requiring extensive local knowledge and higher management tolerance.

Why Sheffield Works for Investors

Sheffield's investment appeal centers on accessibility and value rather than prestige or maximum growth—understanding this positioning prevents unrealistic expectations whilst recognizing genuine opportunities.

Exceptional Affordability

Sheffield ranks among England's most affordable major cities for property investment, with entry costs comparable only to Derby and certain Northern towns. This affordability allows building substantial portfolios quickly - investors with £100,000 available capital could potentially acquire 3-4 Sheffield properties versus perhaps two Leeds properties or one Manchester investment.

Multiple property ownership provides both diversification and accelerated learning. Managing several Sheffield properties builds operational experience faster than single-property ownership whilst affordable pricing reduces catastrophic risk if mistakes occur during initial investments. Sheffield's property prices typically run 15-25% below Leeds' equivalent neighborhoods despite both cities serving similar tenant demographics. This pricing differential creates exceptional value for investors prioritising immediate yield over maximum capital growth.

Established Student Market Infrastructure

Sheffield's dual universities and 65,000+ student population create proven accommodation demand spanning multiple neighborhoods. Unlike cities where student markets concentrate in single areas creating extreme competition, Sheffield distributes student housing across various zones providing strategy flexibility.

The market demonstrates resilience despite purpose-built student accommodation growth—traditional HMO areas near University of Sheffield maintain demand for quality properties, whilst Sheffield Hallam zones offer more budget-conscious opportunities. This diversity allows targeting different student demographics and rent points within single city.

Faster Portfolio Velocity

Sheffield's affordability enables faster portfolio building through both cash flow and equity release. Properties generating 7-8% gross yields on modest purchase prices create surplus income funding additional deposits more quickly than expensive properties with lower percentage returns.

Similarly, properties purchased at £120,000 appreciating modestly to £140,000 still release £20,000 equity through refinancing—meaningful capital for next deposits despite modest percentage appreciation. Lower absolute values mean smaller percentage gains translate into deposit-sized equity releases.

Yorkshire Regional Diversification

Sheffield complements Leeds within Yorkshire-focused portfolios, providing geographic spread and different market exposures. Leeds offers professional employment concentration and premium neighborhoods; Sheffield delivers student market depth and affordability.

Many Yorkshire investors maintain properties in both cities, benefiting from their different characteristics whilst keeping geographic scope manageable for operational efficiency.

Sheffield Investment Performance

Student HMO Returns

Crookes/Broomhill HMO (£155,000, 6 rooms):

- Monthly rent: £1,800-£2,100

- Gross yield: 10-11%

- Net yield: 6.5-8%

- Management: Moderate to high

- Competition: Purpose-built accommodation

These returns rival Derby's yield-focused profile, Sheffield offering similar immediate income whilst adding university market advantages.

Family/Professional BTL

Ecclesall area (£145,000):

- Monthly rent: £850-£1,000

- Gross yield: 6.5-7.5%

- Net yield: 4-5%

- Tenancy duration: 18-24 months

- Tenant stability: Good

Value Entry Areas

Walkley property (£120,000):

- Monthly rent: £750-£850

- Gross yield: 7-8%

- Net yield: 4.5-5.5%

- Management: Moderate

- Appreciation: Modest

Capital Growth Reality

Sheffield demonstrates modest capital appreciation historically averaging 3-4% annually—respectable inflation protection without exceptional value increases. This measured growth reflects Sheffield's economic transition challenges and competition from other Northern cities receiving more regeneration investment. Whilst substantially below Manchester's 5-7% growth rates. Investors prioritizing wealth accumulation often prefer Manchester despite higher entry costs; yield-focused investors favor Sheffield's superior immediate returns

Investors prioritizing primarily capital appreciation often prefer Leeds, Manchester, or Birmingham despite higher entry costs. Those valuing immediate income and portfolio building velocity find Sheffield's modest appreciation acceptable trade-off for superior affordability and yields. These returns rival Derby's yield-focused profile, Sheffield offering similar immediate income whilst adding university market advantages.

Purpose-Built Student Accommodation Impact

Sheffield has experienced substantial purpose-built student accommodation development, creating genuine competition for traditional HMO properties particularly in certain price points and locations. Quality HMOs in prime locations near campus continue letting successfully, but peripheral properties or those unable to compete on quality/price face increased challenges.

This competitive pressure requires realistic rent expectations and quality property standards - student tenants now compare traditional HMOs against modern purpose-built alternatives offering ensuite facilities and inclusive bills. This student dominance differs from Leicester's more balanced tenant mix, where students represent just one segment within diverse rental demand.

Choosing Your Sheffield Approach

For Maximum Affordability

Sheffield provides England's most accessible major city entry alongside Derby. First-time investors with limited capital (£25,000-£35,000 deposits) can acquire quality investment properties impossible to access in Leeds, Manchester, or Birmingham.

Focus on straightforward buy-to-let in areas like Walkley or Hillsborough, avoiding student market complexities whilst building confidence and operational experience.

For Student Market Exposure

Investors comfortable with student HMO management or using professional student letting specialists find Sheffield's established student infrastructure and dual university presence creating viable opportunities despite purpose-built competition.

Target prime locations near University of Sheffield campus, maintain quality standards competing effectively with modern alternatives, and price realistically acknowledging competitive landscape.

For Portfolio Building

Sheffield's affordability enables rapid portfolio expansion—acquire multiple properties generating combined income and equity growth accelerating toward larger portfolios faster than expensive markets allow.

Combine different Sheffield strategies and areas within portfolios—perhaps student HMOs for yields, family properties for stability—creating diversified exposure within manageable geographic scope.

For Yorkshire Regional Balance

Sheffield functions excellently complementing Leeds holdings—Sheffield provides affordability and student yields, Leeds delivers professional markets and superior growth. This combination balances portfolio across different Yorkshire characteristics.

Invest in Sheffield Property

Sheffield's value positioning—accessible pricing, solid yields, established student markets—creates compelling opportunities for investors prioritizing affordability and portfolio building velocity over maximum prestige or growth.

Our Sheffield market knowledge spanning student letting dynamics, neighborhood-specific characteristics, and topography considerations delivers advantages navigating the city's unique landscape. Our established Yorkshire deal sourcing relationships identify Sheffield properties before widespread marketing, screening for optimal student locations and genuine below-market pricing.

FAQs ABOUT Sheffield property investment

How does Sheffield compare to Leeds for property investment?

Sheffield and Leeds serve different investor priorities within Yorkshire. Sheffield offers superior affordability (properties £30,000-£50,000 cheaper on average), higher gross yields (6-8% versus Leeds' 5.5-7%), and faster portfolio building potential. Leeds provides stronger professional employment concentration, more prestigious neighborhoods, better capital appreciation (4-5% versus Sheffield's 3-4%), and superior city center regeneration momentum. Choose Sheffield for maximum affordability, immediate yields, and rapid portfolio expansion accepting modest growth. Choose Leeds for professional tenant focus, capital appreciation priority, and major city fundamentals. Many Yorkshire investors maintain properties in both cities, benefiting from Sheffield's affordability and student yields alongside Leeds' growth and professional markets.

Is Sheffield's student accommodation market oversaturated?

Sheffield has experienced substantial purpose-built student accommodation development creating genuine competition for traditional HMO properties. However, "oversaturation" isn't universal—quality HMOs in prime locations near University of Sheffield campus continue letting successfully to students preferring traditional housing character, larger rooms, or specific neighborhood appeal. Peripheral locations, properties in poor condition, or those unable to compete on price face increased challenges. Success requires realistic expectations—acknowledge competitive landscape, maintain quality standards matching or exceeding purpose-built alternatives where possible, price competitively, and target prime locations demonstrating sustained demand. Our sourcing service explicitly evaluates area-specific student demand dynamics, screening out locations facing genuine oversupply before presenting opportunities.

Why is Sheffield property so affordable compared to other cities?

Sheffield's affordability reflects several factors: the city's economic transition from steel manufacturing hasn't generated explosive growth matching Leeds or Manchester; competition from other Northern cities receiving more regeneration investment and business relocation; purpose-built student accommodation impacting some traditional investment areas; and general Northern England property price moderation compared to Southern markets. However, affordability also creates genuine investment opportunities—lower entry costs enable portfolio building impossible in expensive markets, whilst yields remain solid compensating for modest appreciation. Sheffield works for investors recognizing value positioning advantages rather than expecting explosive growth or prestige comparable to larger cities.

Should I invest in Sheffield student areas or family neighborhoods?

This depends on your capital, management tolerance, and return priorities. Student areas like Crookes deliver 9-11% gross yields but require managing academic letting cycles, summer voids, higher turnover, and competing with purpose-built accommodation. Family/professional areas like Ecclesall generate 6-7% yields with longer tenancies (18-24+ months), minimal voids, and straightforward management. Student HMOs suit investors prioritizing maximum current income comfortable with operational intensity or using professional student letting specialists. Family BTL works for those valuing stability, simplicity, and passive management accepting lower yields. Many Sheffield investors pursue both strategies—student properties for income, family homes for stability—creating balanced portfolios within affordable entry costs allowing multiple property acquisition.