Property Investment in Leeds

LAT Property Investments providing exciting property investment opportunities in YORKSHIRE with investment entry levels from £20,000+

Sourcing Property Opportunities Across England

Investment from £20,000 with various return options

Working with Experienced Investment Professionals and Novices

LEEDS Property Investment

Leeds anchors Yorkshire's economy as the region's financial and professional services capital, offering property investors exposure to Northern England's strongest employment fundamentals outside Manchester. The city combines major city economic diversity with more accessible pricing than Southern markets, creating balanced investment opportunities for those seeking professional tenant demographics and solid growth potential.

Property prices averaging £150,000-£200,000 for investment-grade properties require deposits of £38,000-£50,000, positioning Leeds between Midlands affordability and Manchester's premium pricing. These moderate entry costs deliver gross rental yields of 5.5-7% for standard buy-to-let, extending to 8-10% for well-positioned HMO conversions in student areas—returns balancing immediate income against sustainable capital appreciation.

Leeds' economic foundation rests predominantly on finance, legal services, professional services, and digital technology sectors. The city houses significant banking operations, major law firms, accounting practices, and growing technology companies. This white-collar employment concentration creates tenant demographics comprising primarily young professionals and established career workers—stable, employed individuals seeking quality accommodation near city center employment.

Two universities—University of Leeds and Leeds Beckett University—enroll approximately 70,000 students, providing substantial accommodation demand supporting HMO strategies in areas like Headingley, Hyde Park, and Burley. However, Leeds' investment appeal extends well beyond student markets, with professional rental demand across numerous neighborhoods supporting diverse strategies.

Transport infrastructure strengthens Leeds' fundamentals—direct rail services to London (under 2.5 hours), Manchester, York, and Newcastle, M1 and M62 motorway access, and Leeds Bradford Airport proximity. These connections support both current rental demand from professionals and businesses, plus reasonable capital growth prospects historically averaging 4-5% annually.

Leeds presents as Yorkshire's premier investment location, though it faces competition from investors recognizing the city's strengths. Quality properties in desirable neighborhoods often receive multiple offers, requiring decisive action when suitable opportunities arise. Leeds dominates Yorkshire as one of England's strongest professional rental markets, combining major city employment with property prices that remain substantially below London and southeastern levels.

Key Leeds Neighborhoods for Investment

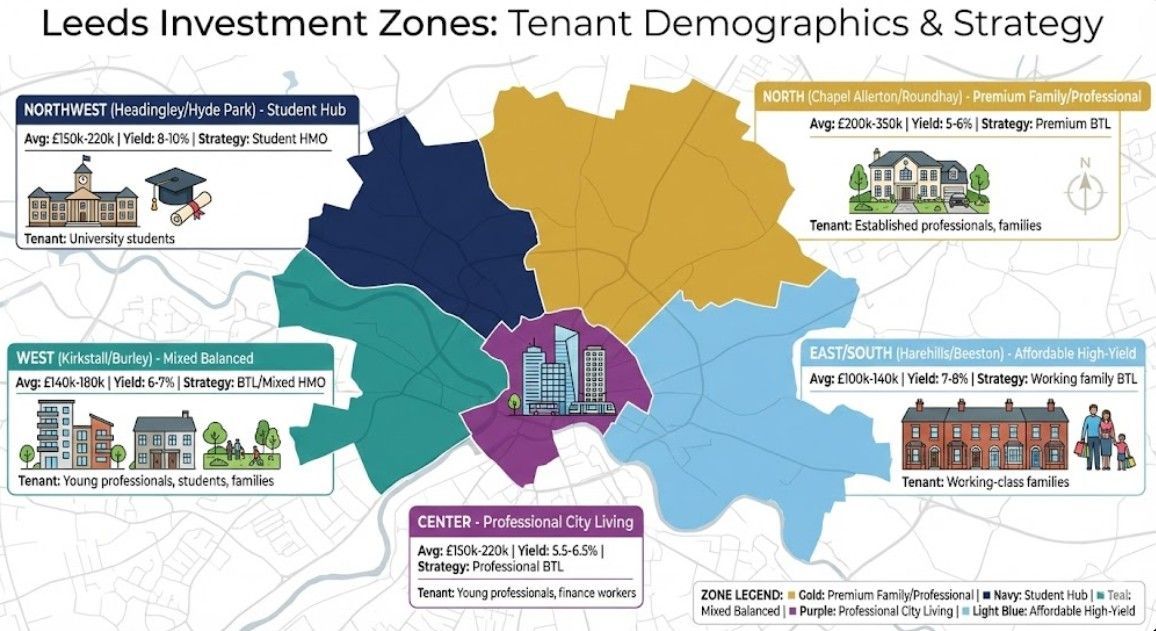

Leeds' substantial geographic spread creates distinct investment zones, each suited to particular strategies and tenant demographics.

Headingley and Hyde Park (Student Heartland)

Headingley represents Leeds' premier student accommodation area, with Victorian terraced houses dominating the landscape, many already operating as HMOs. Properties typically cost £160,000-£220,000, generating 8-10% gross yields when fully tenanted with 5-7 students paying £300-£400 monthly per room. The student market operates similarly to Sheffield's accommodation sector 35 miles south, though Leeds typically commands marginally higher rents reflecting university prestige differences.

Hyde Park sits adjacent, offering similar student appeal with marginally lower property prices (£150,000-£200,000) and established HMO infrastructure. Both areas benefit from proximity to University of Leeds main campus and reasonable city center connectivity via bus routes.

Competition for student tenants intensifies during peak letting seasons (January-March for September starts), and summer void management requires planning. However, established demand depth and limited new student accommodation supply in these traditional areas maintains HMO viability.

These neighborhoods suit experienced investors comfortable managing student properties or those using professional student letting specialists handling the operational complexities.

Chapel Allerton and Roundhay (North Leeds Premium)

North Leeds areas represent the city's most affluent residential neighborhoods, with properties ranging £200,000-£350,000 appealing to established professionals, families, and executives. Gross yields moderate to 5-6%, but tenant quality, extended tenancies, and minimal management often justify accepting lower immediate returns.

Chapel Allerton particularly attracts young professionals and couples valuing independent shops, restaurants, and community atmosphere whilst maintaining convenient city center access. Roundhay offers more family-oriented appeal with Roundhay Park proximity and excellent school catchments.

These areas suit investors prioritizing capital preservation, tenant stability, and minimal operational demands over maximum yields, accepting modest rental returns in exchange for premium tenant demographics and strong long-term value protection.

Kirkstall and Burley (Mixed Opportunities)

West Leeds neighborhoods provide balanced positioning—property prices £140,000-£180,000, yields 6-7%, and mixed tenant demographics including young professionals, students, and working families. Kirkstall particularly benefits from Abbey Road retail and leisure development improving local amenities.

Burley contains pockets of student accommodation alongside professional lets, creating portfolio diversification opportunities within single neighborhoods. The area's variety allows pursuing multiple strategies without geographic spread—some properties suit HMO conversion, others work better as professional single-lets.

These neighborhoods represent solid middle-market investment territory, avoiding extreme positions while delivering dependable performance across varied strategies.

Harehills and Beeston (Affordable Entry)

East and South Leeds areas offer most accessible entry points—properties from £100,000-£140,000—delivering gross yields potentially reaching 7-8% to diverse working-class tenant populations including families, couples, and some benefit recipients.

These areas require careful property and street-level selection. Some locations demonstrate stable demand and reasonable conditions; others face persistent challenges around property maintenance or neighborhood issues. Thorough due diligence prevents investing in superficially attractive high-yield properties in fundamentally problematic pockets.

Harehills and Beeston suit experienced investors comfortable with higher-yield, higher-management strategies rather than first-time investors seeking straightforward passive income.

City Center and Waterfront

Leeds city center contains modern apartment developments targeting young professionals working in finance, legal, and professional services sectors. Purchase prices typically range £150,000-£220,000 for one or two-bedroom units, generating 5.5-6.5% gross yields.

Waterfront developments along the River Aire and Leeds Dock areas offer newer stock with contemporary specifications and amenity access. However, service charges (often £1,500-£2,500 annually) and leasehold complications require thorough scrutiny impacting net returns.

City center investment suits investors wanting urban professional market exposure and convenient tenant demographics—employed individuals seeking city living convenience paying reliable rents through employment income.

Why Leeds Attracts Investment

Leeds' investment appeal rests on several economic fundamentals distinguishing it within Northern England property markets.

Financial Services Concentration

Leeds ranks as the UK's largest financial center outside London, housing major banking operations, insurance companies, and asset management firms. This concentration creates substantial professional employment supporting quality tenant demand—employed individuals with stable incomes seeking accommodation near city center workplaces.

The financial sector's presence provides economic resilience—unlike cities dependent on single employers or vulnerable sectors, Leeds' diverse financial services base demonstrates stability through economic cycles. Professional employment continues attracting graduates and career professionals relocating from other UK regions.

Legal and Professional Services Hub

Leeds hosts major legal practices, accounting firms, consultancies, and professional services businesses serving Yorkshire and broader Northern England. This professional ecosystem creates employment depth supporting rental demand across various price points and neighborhoods.Leeds' professional services concentration—legal, financial, digital—creates exceptional tenant demand among young professionals and established career progressors. This employment profile closely resembles Manchester's diverse professional base, both cities attracting graduates who remain after university.

Professional workers typically seek quality accommodation, maintain stable tenancies, and pay rents reliably through employment income rather than benefits. These tenant characteristics reduce management intensity and void risks compared to more volatile tenant demographics.

Digital and Technology Growth

Leeds demonstrates growing technology sector presence, with digital agencies, software companies, and tech startups establishing operations attracted by lower costs than London whilst maintaining talent access from universities and professional workforce.

This diversification beyond traditional finance and legal sectors provides additional economic resilience and attracts younger professional demographics seeking modern city living—ideal rental tenant profiles for city center and trendy neighborhood properties.

Transport and Connectivity

Leeds' position as Yorkshire's transport hub strengthens its economic fundamentals. Direct rail services to London make day-commuting viable for some roles, whilst connections to Manchester, York, and Newcastle support regional business connectivity.

HS2's eventual northern extension (despite ongoing uncertainties) would further strengthen Leeds' positioning, though investment decisions should rest on current fundamentals rather than speculative infrastructure benefits that may materialize differently than currently envisaged.

Leeds Investment Performance

Professional Buy-to-Let Returns

Typical Leeds professional rental (£165,000 in Kirkstall):

- Monthly rent: £900-£1,050

- Gross yield: 6-7%

- Net yield: 3.5-4.5%

- Tenancy duration: 18-24 months average

- Tenant profile: Young professionals, stable employment

Student HMO Performance

Headingley HMO (£180,000, 6 rooms):

- Monthly rent: £1,800-£2,200 (£300-£370 per room)

- Gross yield: 9-10%

- Net yield: 6-7.5%

- Management: Moderate to high intensity

- Academic year considerations: September-July primary demand

Premium North Leeds

Chapel Allerton family home (£240,000):

- Monthly rent: £1,200-£1,500

- Gross yield: 5-6%

- Net yield: 3-4%

- Tenancy duration: 24-36+ months

- Tenant quality: Exceptional stability

Capital Growth Trends

Leeds historically demonstrates solid capital appreciation averaging 4-5% annually over extended periods, occasionally higher during strong market conditions. Growth reflects genuine economic fundamentals—employment strength, population growth, infrastructure investment—rather than speculative excess. This balanced performance mirrors Birmingham's yield and growth combination, both cities offering major employment centers at accessible pricing.

Properties in established neighborhoods near city center or premium North Leeds areas show most consistent appreciation. Student areas demonstrate steadier yields but more modest capital growth reflecting their operational rather than capital appreciation focus.

Leeds Within Regional PROPERTY Portfolios

Leeds functions as Yorkshire's premier investment location, though Sheffield offers complementary opportunities at lower price points creating balanced regional portfolio potential. This versatility exceeds Nottingham's primary HMO focus, allowing investors to pivot strategies without changing geographic markets.

Leeds vs Sheffield

Leeds provides superior professional employment concentration, stronger financial sector presence, and more diverse high-quality neighborhoods. Sheffield offers better affordability (properties £20,000-£40,000 cheaper on average) and solid student markets.

Many Yorkshire-focused investors maintain properties in both cities—Leeds for professional markets and capital growth, Sheffield for affordability and student yields—creating diversified regional exposure.

Northern Powerhouse Positioning

Leeds sits alongside Manchester as Northern England's dual economic powerhouses. While Manchester receives more regeneration attention and media focus, Leeds maintains comparable economic substance with arguably superior financial sector depth.

Investors building Northern England portfolios often include both cities, benefiting from their different characters and market dynamics whilst maintaining regional concentration allowing efficient management.

Excellent rail connections place Leeds within two hours of London, under one hour to Manchester. This connectivity supports professional tenant demand whilst keeping property prices below capital levels, with even Derby's more modest connectivity delivers similar benefits at considerably lower entry costs.

Invest in Leeds Property

Leeds' combination of professional employment strength, diverse neighborhood options, and balanced return characteristics creates compelling investment opportunities for various investor profiles.

Our Yorkshire sourcing network identifies optimal Leeds opportunities across student, professional, and family rental sectors before they reach major portals.

FAQs ABOUT leeds property investment

Is Leeds better than Manchester for property investment?

Leeds and Manchester serve similar investor profiles seeking Northern England exposure but demonstrate different characteristics. Manchester offers slightly stronger capital growth (5-7% versus Leeds' 4-5% historically) and more intensive regeneration activity creating higher-profile opportunities. Leeds provides comparable professional employment depth, marginally better affordability (properties £10,000-£30,000 cheaper on average), and arguably stronger financial services concentration. Both cities face similar apartment oversupply considerations in specific developments. Choose Manchester for maximum growth focus and major regeneration exposure. Choose Leeds for balanced professional market strength with slightly superior affordability. Many investors maintain properties in both cities, benefiting from their complementary Northern England positioning.

Are Leeds student HMOs a good investment?

Leeds student HMO investments in established areas like Headingley and Hyde Park consistently deliver 8-10% gross yields with proven demand from University of Leeds and Leeds Beckett students. However, success requires understanding student market dynamics—September-focused letting cycles, summer void management, higher turnover than professional lets, and licensing compliance. Competition for student tenants intensifies during peak seasons (January-March), requiring quality properties and competitive pricing. The market demonstrates resilience given limited new purpose-built student accommodation in traditional areas, maintaining HMO viability. Student HMOs suit experienced investors comfortable with operational intensity or those using professional student letting specialists. First-time investors might find professional buy-to-let in areas like Kirkstall more straightforward initial strategies.

What are Leeds city center apartment investment risks?

Leeds city center apartments face several considerations requiring careful evaluation. Service charges ranging £1,500-£2,500 annually significantly impact net yields, sometimes consuming 15-20% of gross rental income. Leasehold complications and ground rents add further costs and complexity. Some developments show oversupply signs with extended void periods or rental discounting needed to secure tenants. Building quality varies considerably—some developments deliver promised specifications, others reveal construction issues or management problems. However, quality apartments in established buildings near major employment centers continue letting successfully to finance and professional services workers. Success requires development-specific due diligence, realistic service charge assessment, and understanding which micro-locations within city center demonstrate sustained demand versus those facing tenant absorption challenges.

Should I invest in North Leeds or student areas for better returns?

This depends entirely on your investment priorities and circumstances. North Leeds areas like Chapel Allerton deliver 5-6% gross yields with exceptional tenant stability (24-36+ month tenancies), minimal management, premium demographics, and strongest capital appreciation prospects. Student areas like Headingley generate 8-10% gross yields but require managing academic letting cycles, accepting higher turnover, and handling operational complexities. North Leeds suits investors prioritizing capital preservation, tenant quality, and passive management accepting lower immediate income. Student areas work for those prioritizing maximum current yields comfortable with active management or using professional operators. Many sophisticated investors pursue both strategies within Leeds portfolios—premium properties for stability and growth, student HMOs for income—creating balanced exposure to different return characteristics.